Agentic Commerce Will Break the Ad Business

Perplexity, Amazon, and the Future of Ads

Hi, I’m Kyle Kelly. Each week Line of Sight breaks down how AI, strategy, and revenue growth architecture turn complexity into leverage.

What if the most valuable real estate on the internet is no longer the top of the search results page? For two decades, Google and Amazon have built empires on that single premise. Billions have been spent optimizing the moment before a click. Agents erase the click entirely. Now, a new model threatens to make it obsolete, challenging the foundational business model of the entire ad-supported internet.

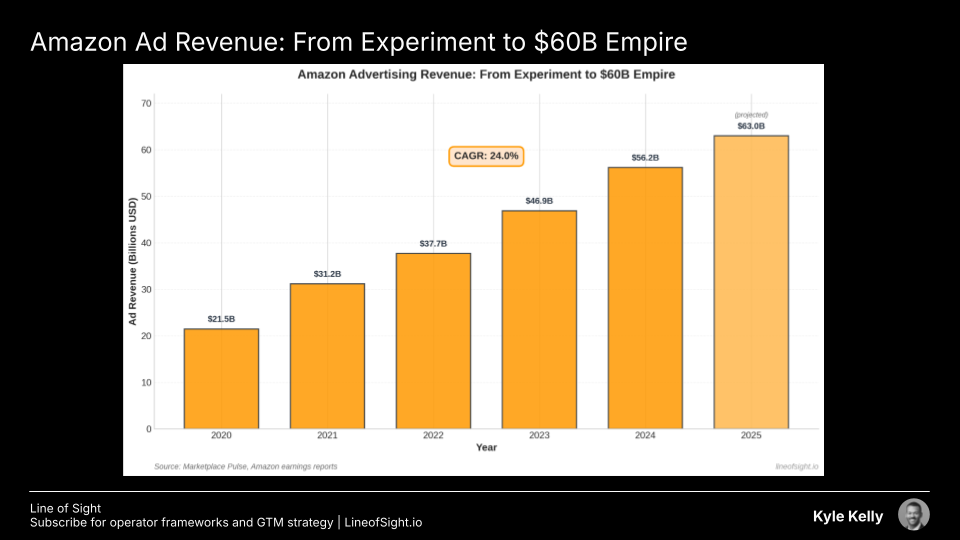

I remember when Amazon’s ad business was just a few small experiments tucked inside the search bar. As Head of Business Development at Zappos, an Amazon company, I had a front-row seat to how those experiments became a $60 billion revenue engine [1], built entirely on monetizing the tiny moments of indecision between a customer’s search and their final purchase. But its biggest threat isn’t Walmart; it’s the rise of a new paradigm: agentic commerce.

The recent legal clash between Amazon and Perplexity AI is the first visible battle in a new war for digital demand [2]. While Amazon claims this is a “security issue,” it is fundamentally an economic one. And while Perplexity is the catalyst, the true disruption is the underlying shift to agentic commerce itself.

The Digital Shopping Mall vs. The Personal Shopper

Think of Amazon’s marketplace as the world’s largest shopping mall. Its advertising business is the revenue it generates from premium shelf space. Brands pay top dollar for the end caps, the eye-level placements, and the prominent displays, all to influence your path through the store. This “digital shelf space” has been incredibly effective.

Now, imagine you hire a professional personal shopper, an expert who knows your style, your budget, and the best products across every store in every mall. This shopper doesn’t browse; they execute. They go directly to the best item, ignoring the flashy displays and paid placements. That’s agentic commerce.

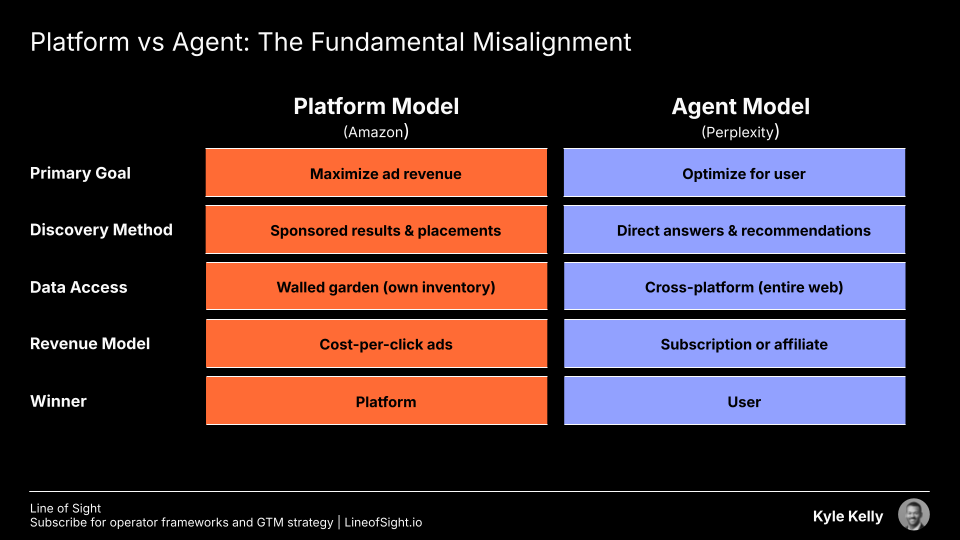

This is what I call “quiet commerce.” For transactional purchases, it bypasses the entire discovery-and-influence model. While users will still enjoy browsing for discovery-driven shopping, the emotional, status-driven side of commerce, for goal-oriented, utilitarian tasks, AI is built to eliminate indecision. This is especially true for high-substitution products like cables or appliances, whereas categories like fashion and luxury goods will still rely on brand and emotion. This shift fundamentally changes the customer relationship, moving it from the platform to the agent, a misalignment detailed in the table below.

The Agentic Commerce Value Chain

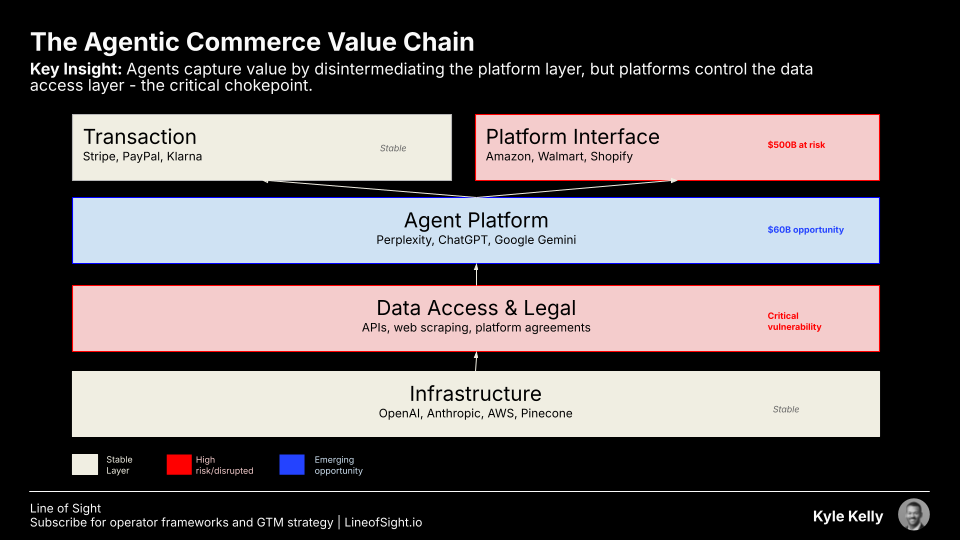

To understand the depth of this shift, it’s helpful to map the Agentic Commerce value chain, which reveals where value is created, where it’s captured, and where the biggest disruptions will occur.

Every disruptive shift has a value chain. Agentic commerce is no different.

Layer 1: Infrastructure

This layer provides the raw materials for agentic commerce through two parallel tracks: Data Infrastructure and AI Infrastructure.

Data infrastructure includes product catalogs, pricing, and reviews from Shopify, Walmart, and Amazon. AI infrastructure includes LLMs from OpenAI, Anthropic, and Google, vector databases from Pinecone and Weaviate for semantic search, and cloud compute from AWS and Azure.

Companies here capture value through API calls and compute usage. The layer is stable and oligopolistic with high barriers to entry.

Layer 2: Data Access & Legal

This is the critical chokepoint. Agents need product data, pricing, inventory, and reviews to make recommendations. That data comes from public APIs, web scraping, and platform agreements.

Platforms control the data. Amazon can restrict API access. Walmart can block crawlers. Shopify can change terms of service. This layer determines whether agents can operate at all.

Amazon is already weaponizing this chokepoint. The lawsuit against Perplexity isn’t just about security. It’s about protecting the ad moat by controlling who can access product data. If platforms cut off data access, agentic commerce collapses.

This is where the battle will be fought.

Layer 3: Agent Platform

This is where the “brains” reside. Consumer platforms like Perplexity and ChatGPT provide the user interface and orchestrate the tools and data sources needed to fulfill requests.

Some agents are platform-specific (Amazon Rufus, Shopify Shop app). Others are platform-agnostic (Perplexity), searching across the entire web to recommend products from any retailer.

Value is captured through subscriptions (Perplexity Pro) or driving sales within platforms (Rufus). The $60B opportunity lies in becoming the trusted agent users turn to first, displacing Google and Amazon as the starting point for product search.

Platform-agnostic agents are aligned with users, not retailers. That’s what makes them disruptive.

Layer 4: Transaction & Platform Interface

Once a decision is made, this layer executes the purchase through two paths.

Transaction Path (Stable)

Payment processors like Stripe and PayPal handle transactions. Order management companies like ShipStation and Flexport manage logistics. Customer service platforms like Zendesk handle post-purchase support.

These companies capture value through transaction fees and subscriptions. This layer is stable. Payments and logistics work the same regardless of where the customer came from.

Platform Interface Path (Disrupted)

This is the traditional e-commerce layer: platforms like Amazon and Walmart, and marketplaces like Google Shopping and eBay.

In agentic commerce, this layer is being disintermediated. Instead of being the primary destination, it becomes another data source for agents to query. Value capture is threatened as agents bypass advertising and drive purchases based on user preference, not paid placement.

Amazon’s $60B ad business is uniquely vulnerable. The $500B retail media market depends on controlling the customer journey. If agents take over that journey, first-party platform data loses value.

The New Unit Economics of Search

The disruption goes deeper than just bypassing ads. The underlying economics are shifting from cost-per-query (the price of a search) to cost-per-answer (the price of a solution).

While AI inference costs remain high and the economics are still unproven, the efficiency of providing a direct answer versus a list of links presents a new model.

This hinges on the agent producing superior recommendations; if trust collapses due to mediocre or biased results, the model fails. But an agent that successfully eliminates the user’s costly exploration phase holds a fundamental advantage.

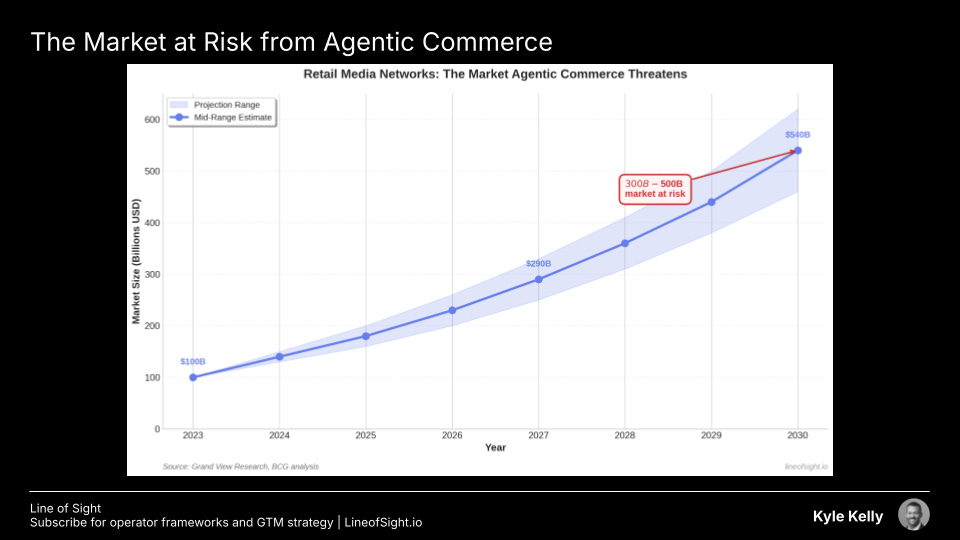

How fast will this shift happen? Platform transitions are notoriously difficult to predict, but history suggests they accelerate faster than incumbents expect. Mobile shopping went from 10% to 50% of e-commerce in five years. Voice assistants captured 20% of smart home purchases within three years of launch. Even a 10-15 percent shift to agentic commerce by 2030 would represent a $50B-$75B loss for retail media networks, and that assumes platforms can maintain their current share of non-agentic commerce, which is not guaranteed.

This efficiency threatens the entire retail media network market, a sector projected to be worth between $300 billion and $500 billion by 2030, depending on the source [4].

This market is the new gold rush, but its value is predicated on controlling the customer’s journey.

If AI agents become the new front door to commerce, the value of that first-party platform data plummets.

The Innovator’s Dilemma: Protecting the Ad Moat

Amazon is facing a classic innovator’s dilemma. It has its own AI agent, Rufus, but Rufus is an employee of the mall, not your personal shopper.

It will help you find things within Amazon’s walls, but it will never tell you there’s a better deal at Target. This creates a crucial opening for independent, user-aligned agents like Perplexity to win the user’s trust.

Amazon’s lawsuit is an attempt to fortify its ad moat. But Amazon isn’t defenseless. It can, and likely will, retaliate by blocking crawlers, degrading data access, and bundling its own agent (I predict we see this one Rufus 2.0). It also holds the trump card in the supply chain, pricing, and the customer relationship through Prime. Its ad business, however, built on discovery, remains uniquely vulnerable to this new, more efficient model of commerce.

The Counterargument

Of course, this transition is not without its own pitfalls. History suggests that today’s disruptive agents could become tomorrow’s platforms, replicating the same walled gardens they claim to dismantle. This assumes agents have perfect data access, which isn’t guaranteed in a world of walled gardens and API restrictions. Advertising has also survived every platform shift, and retail media networks will adapt by shifting to outcome-based pricing or integrating their own agents.

But the core economic shift remains: agents are fundamentally aligned with the user, not the platform.

Even if agents are imperfect, the incentives have already shifted and that part will not unwind. That misalignment is what makes this disruption different. Even if agents become new gatekeepers, they will compete on the quality of their user-aligned recommendations, a stark contrast to today’s ad-driven platforms

Why This Matters: The Great Ad Unbundling

The threat is most acute for search-based advertising like Google’s, which is also built on being the middleman for discovery. For social platforms like Meta, where ads are driven by entertainment and attention rather than intent, the dynamic is different. Still, for a significant portion of the digital ad ecosystem, agentic commerce unbundles discovery from the platform.

For two decades, the internet has operated on a simple premise: aggregate demand and sell access to it. AI agents disaggregate that demand, handing power back to the individual user. This is the first major legal test, but it won’t be the last. The future of commerce won’t be about ads; it will be about agents.

The key questions for every leader are no longer just about ad spend and ROAS, but about:

Agent Strategy: How will your business interact with user-aligned agents? Can you afford to be blocked?

Customer Relationship: When the primary relationship is with an AI, how do you build brand loyalty?

Data Moats: Is your data advantage defensible when agents can access and compare information across the entire internet in real-time?

The companies that win next decade will be those that earn the right to act on behalf of the user.

This is part of my Line of Sight newsletter. Subscribe for more operator frameworks, analysis, and GTM strategy.

References

[1] Amazon Quarterly Results. EDGAR SEC Filings. 2025

[2] Amazon vs Perplexity: Welcome To The Battle For The Future Of Commerce. Forbes. Nov 5, 2025

[3] Retail Media Networks Market Size and Share Report. Grandview Research.

[4] The agentic commerce opportunity. McKinsey. Oct 17, 2025