Apple Just Blinked: And It Might Be Their Smartest $1 Trillion Move Yet

Hi, I’m Kyle Kelly. Each week Line of Sight breaks down how AI, strategy, and revenue growth architecture turn complexity into leverage.

Apple’s partnership with Google’s Gemini isn’t a headline about AI. It’s a masterclass in sequencing strategy.

When a company this dominant changes its build-buy-partner calculus, it signals a platform shift big enough to rewrite market structure. Here’s what I see in the data, and why it could be the smartest trillion-dollar decision Apple’s ever made.

Apple’s AI strategy isn’t about catching up. It’s about controlling the curve.

As an operator who builds commercial systems, I see this not as a sign of weakness, but as a calculated portfolio decision that reveals everything about how they weigh risk and opportunity. But the way they choose to build, buy, or partner may define the next trillion dollars of market value. How does Apple, a company known for its closed ecosystem and obsession with vertical integration, decide when to build internally, acquire externally, or partner strategically? The answer lies in a disciplined, multi-layered approach that prioritizes differentiation over speed, and capability over scale.

With 2.4B active devices and 1.5B iPhones in circulation, Apple’s advantage isn’t speed, it’s control. The curve they’re managing is adoption, not innovation.

The Build Doctrine: Differentiation at a Deliberate Pace

Apple’s history is a testament to the power of vertical integration. From designing its own silicon (the M-series chips that have redefined performance and efficiency in personal computing to building privacy-first data systems, Apple’s DNA is coded with a preference for internal development. This approach gives the company unparalleled control over the user experience, allowing for the seamless hardware-software integration that has become its hallmark. However, in the specific domain of large-scale AI models, where Apple started later than its cloud-native competitors, building from scratch limits velocity. This is a notable exception to Apple’s usual hardware strategy, where vertical integration has historically accelerated its pace.

While Google’s open platforms and Microsoft’s Azure-powered AI services have enabled rapid, broad-based innovation, Apple has chosen a more deliberate path. The company’s emphasis is on differentiation through product experience and system control. Building in-house allows Apple to create deeply integrated features that are difficult for competitors to replicate, even if it means sacrificing the velocity that comes with open collaboration. The key insight is this: building gives Apple differentiation, but it limits velocity.

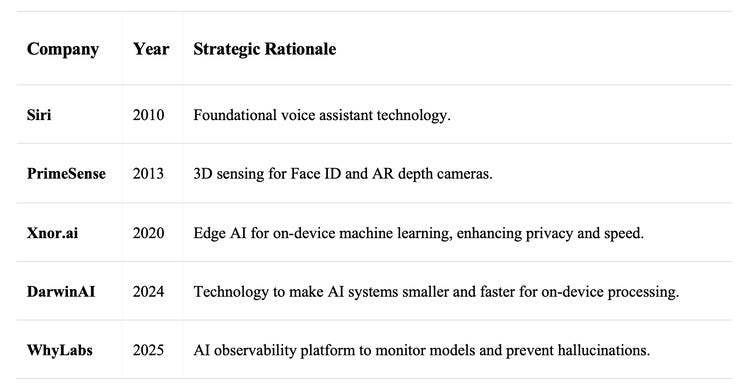

The Buy Doctrine: Acquiring Capability, Not Scale

With a staggering $162 billion in cash and marketable securities and over $100 billion in annual free cash flow [3], Apple has the financial firepower to acquire almost any company it desires. Yet, its M&A record is surprisingly conservative. Unlike its tech giant peers who often make headline-grabbing, multi-billion dollar acquisitions to enter new markets, Apple’s strategy is one of surgical precision. The company acquires small, technically-focused teams to gain specific capabilities and accelerate its internal roadmap. As one corp dev leader observed, Apple rarely buys scale; it buys technical acceleration.

Notable Apple AI acquisitions include:

This disciplined approach makes the acquisition of a large AI player like Anthropic, recently valued at over $183 billion [4], highly improbable. While a mega-deal for a player like Anthropic is out of reach, this doesn’t rule out a multi-billion dollar acquisition of a mid-tier AI company like Cohere or Mistral, which would still be a significant but more manageable acceleration play. However, for now, Apple seems to be sticking to its playbook of acquiring smaller, on-device AI firms that can be quietly integrated into its existing product lines, reinforcing its commitment to privacy and on-device processing.

The Partner Doctrine: Speed Through Strategic Alliance

The recent news that Apple is finalizing a deal to pay Google approximately $1 billion annually to use its powerful 1.2 trillion-parameter Gemini model is a masterclass in strategic pragmatism [5] [6]. This move signals a significant shift in Apple’s traditional isolationism, acknowledging that in the fast-moving world of AI, even Apple cannot afford to go it alone.

This partnership is not an admission of defeat, but a calculated move to gain speed while preserving its core strategic principles. It demonstrates a new willingness to collaborate when necessary to bridge a capability gap, without sacrificing its long-term vision of owning the entire technology stack. The key insight here is that partnering gives Apple speed, but it introduces strategic dependency.

Let’s look at the deal math. The $1 billion payment is basically an insurance policy on its 2.35 billion active devices [3]. More importantly, it protects the Services business, which generated $28.8 billion in revenue in Q4 2025 alone at a staggering 75.3% gross margin, more than double the 36.2% margin on hardware [3]. While the initial $1 billion fee is a rounding error (less than 1% of annual Services revenue), this manageable cost could escalate significantly at renewal, creating the very dependency Apple seeks to avoid.

The Principle: A Strategic Hierarchy

Apple’s build, buy, partner strategy can be summarized in a simple but powerful framework: a Strategic Hierarchy where the sequencing of these choices is paramount.

Partner for speed. Buy for capability. Build for differentiation.

Apple’s current AI strategy sits at the intersection of all three. It is partnering with Google for immediate speed, it continues to selectively buy smaller companies for specific capabilities, and it is relentlessly building its own proprietary models and silicon for long-term differentiation. The genius of this approach is not in choosing one path, but in skillfully navigating all three in the right sequence.

The Strategic Playbook: A Path to Owning the Stack

From an operator’s perspective, there is a clear strategic path for Apple to not just compete, but to dominate the next decade of AI-powered computing. This path follows a logical three-phase progression that leverages the company’s unique strengths.

Phase 1: Leverage and Acquire (Years 1-2)

The initial phase would focus on fully leveraging the partnership with Google to bring world-class AI features to market immediately. Simultaneously, this period would be used to accelerate the acquisition of on-device AI startups, focusing on talent and technology that can strengthen Apple Intelligence and be integrated into the core operating system.

Phase 2: Build and Integrate (Years 2-3)

With the immediate AI gap addressed, the focus would shift to internal development. The goal of this phase is to unify the ecosystem layers, from the model and interface to the device and silicon, into a single, seamless Apple experience. This involves building proprietary models that are deeply integrated with Apple’s hardware, creating a user experience that competitors cannot match.

Phase 3: Own the Stack (Year 3 and beyond)

The final phase would be to fully own the AI stack by developing proprietary models and frameworks that replace external dependencies. This remains a massive undertaking. Dedicating its entire current R&D budget of approximately $30 billion annually (according to their recent 10-K) for three years would represent a $90 billion investment. This is a massive undertaking, but one that is well within Apple’s financial capacity, representing less than one year of its free cash flow.

Apple can afford it. The question is whether Apple can execute this transition before the partnership becomes a permanent dependency, fundamentally altering its strategic position.

References

[1] Diverging AI Strategies and the Future of Open Source - AI reInvent VC

[2] Apple Inc. (AAPL) Valuation Measures & Financial Statistics - Yahoo Finance

[3] Anthropic raises $13B Series F at $183B post-money valuation - Anthropic

[4] Apple Plans to Use 1.2 Trillion Parameter Google Gemini Model to Power New Siri - Bloomberg

[5] Apple is planning to use a custom version of Google Gemini for Apple Intelligence - The Verge

Subscribe to Line of Sight for insights built for operators like us.