Energy is the AI Bottleneck

Hi, I’m Kyle Kelly. Each week Line of Sight breaks down how AI, strategy, and revenue growth architecture turn complexity into leverage.

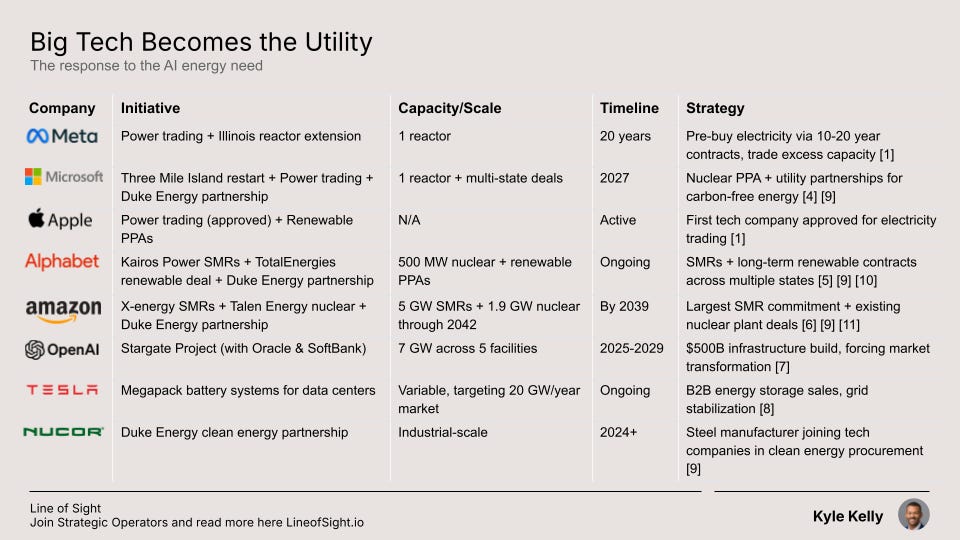

Meta is becoming a power trader. Microsoft is restarting nuclear reactors. Amazon is building its own energy infrastructure. These aren’t energy side projects. They’re GTM plays.

I spent the last three years at Aurora Solar (B2B SaaS) in the thick of the energy landscape leading partnerships & strategic growth. I built our financing partner ecosystem from zero to millions, scaled strategic partnerships that drove customer acquisition, and executed strategic acquisitions to expand marketplace capabilities.

When I see Big Tech vertically integrating into energy markets, I recognize the pattern: uncomfortable bets that expand into non-obvious categories. This is the same build, buy, partner playbook I ran scaling cross-functional teams across product, sales, marketing, and customer success.

By the end of the read, you will understand the energy bottleneck, the competitive gap with China, and why the Grid Wars are the new platform wars.

The AI race isn’t about models anymore. It’s about who can secure the power to run them.

The AI race is shifting.

Models are improving, but the constraint is no longer architecture. It is electricity.

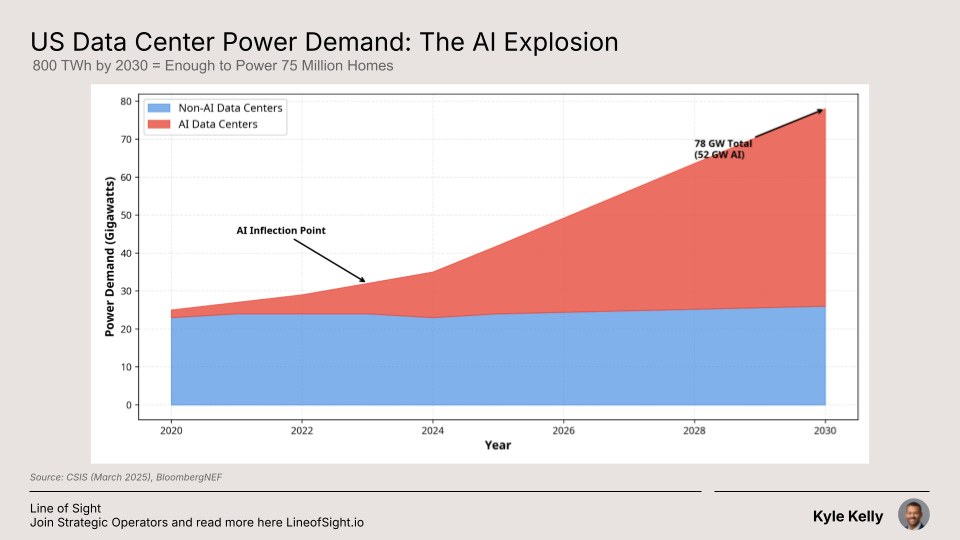

By 2030, US data centers will consume over 800 terawatt-hours (TWh) of electricity annually. That’s enough to power 75 million homes, more than half of all households in America [1].

For the first time in decades, the grid feels the strain. And the companies building the future of AI are discovering that the scarcest resource is not talent or GPUs. It is megawatts.

This isn’t a distant forecast. It’s a demand shock happening now. The US grid, after two decades of flat growth, is not ready.

For founders & investors, the AI bottleneck isn’t just compute. It’s power. And the companies that solve for energy will win the next decade.

1. The Consumer Impact is Already Here

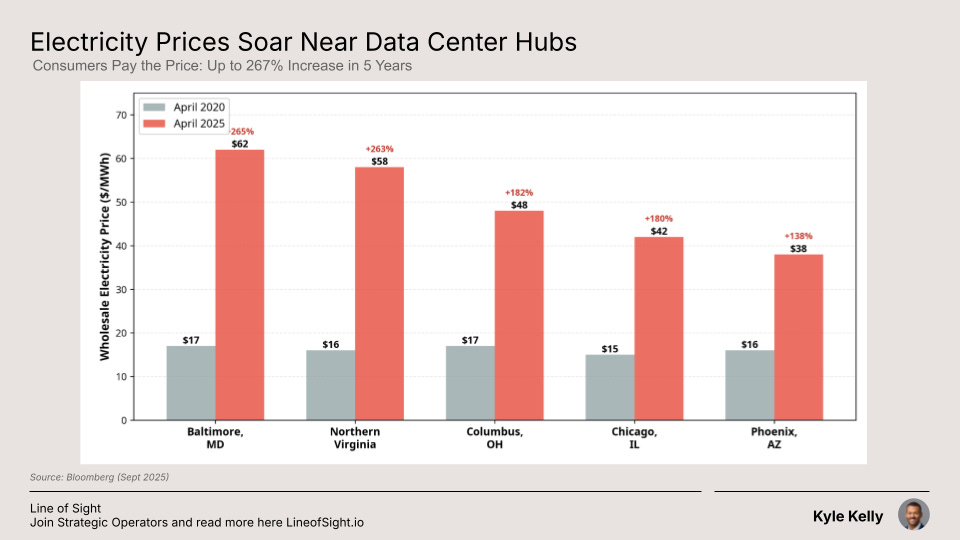

This isn’t an abstract problem for data center operators. It’s showing up on utility bills. Just ask your friends in Northern Virginia.

Wholesale electricity prices near data center hubs are up 138% to 267% in five years [2]. In Northern Virginia, the world’s largest data center market, residents face a $20/month rate hike explicitly tied to this new demand.

The market is sending a clear signal. The cost of power is becoming a material input for AI companies & a new tax on consumers.

2. The Demand Explosion

AI training runs consume as much electricity as 100 US homes use in a year. Inference at scale multiplies that exponentially.

The US grid added zero net capacity growth in the last two decades [1]. AI data centers are projected to 4x their electricity consumption by 2030. The math doesn’t work.

Wait times for new grid connections in Northern Virginia are seven years [1]. For AI companies racing to deploy models, that’s an eternity. Something has to give.

Big Tech isn’t waiting to find out what.

3. The US-China Infrastructure Gap

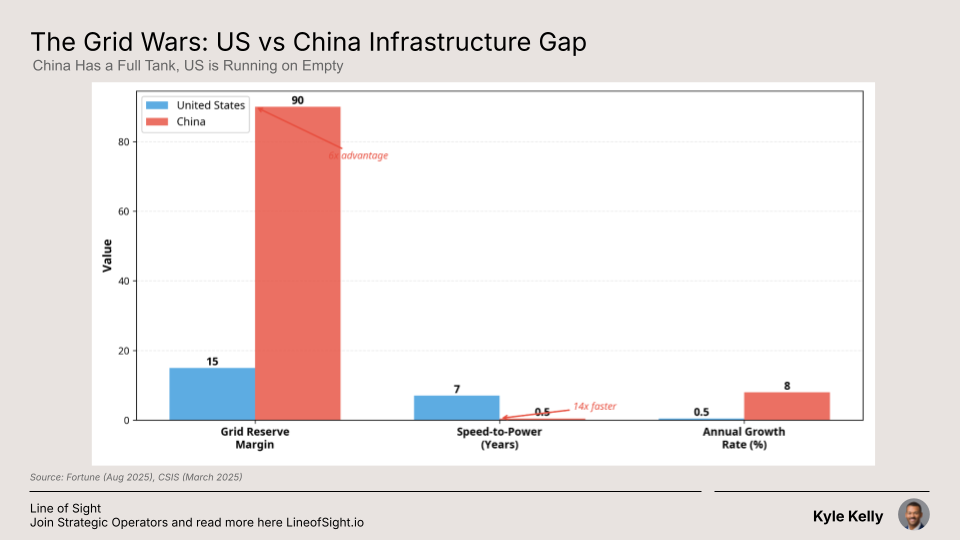

China operates with a 90% reserve margin on its grid. The US maintains 15% [3].

This is like driving. The US grid is running with the gas light on. China has a full tank & a spare jug in the trunk.

This structural difference creates a massive gap in speed-to-market. A new data center can get power in China in under 6 months. In Northern Virginia, the wait is seven years. For AI companies, that’s an insurmountable lead without private infrastructure.

Timelines vary by province and by state, but the directional gap is real.

4. Big Tech Becomes the Utility

A predictable hierarchy is forming.

When a resource becomes scarce

When timelines extend from quarters to years

And when the market cannot respond fast enough

Large platforms respond by integrating down the stack. Electricity is no exception.

Amazon, Google, Microsoft, and Meta are not just buying power. They are reshaping energy markets. Through multi decade PPAs, nuclear partnerships, SMR investments, and utility agreements, they are building private energy portfolios at a scale we have never seen.

Faced with a systemic bottleneck, Big Tech is executing a new strategy: becoming the energy market itself. They aren’t waiting for the grid.

They’re building their own.

The strategies fall into three categories:

Power Trading & Market Making: Meta, Microsoft, & Apple are becoming electricity traders [1]. This lets them sign 10-20 year contracts that unlock new power plant construction, then trade excess capacity as a hedge. It’s vertical integration into energy markets.

Direct Energy Infrastructure: Google & Amazon are building their own power sources. SMRs (Small Modular Reactors) are small, factory-built nuclear batteries installed onsite, bypassing the public grid entirely [5] [6]. Amazon also secured 1.9 GW from Talen Energy’s existing nuclear plant through 2042 [11].

Utility Partnerships: Microsoft, Google, Amazon, & even steel manufacturer Nucor have signed agreements with Duke Energy to accelerate carbon-free energy options across multiple states [9]. Google added a renewable deal with TotalEnergies for its Ohio data centers [10].

OpenAI’s Stargate Project is the most aggressive: $500 billion across five facilities requiring 7 gigawatts [7]. They’re not adapting to the bottleneck. They’re forcing the market to build around them.

Tesla is selling Megapack battery systems to data centers, targeting a 20 GW/year market [8].

5. The Takeaway

Energy is no longer a utility input. It is becoming a competitive moat.

Companies that secure dedicated power will ship faster, train larger models, and serve inference at lower cost. Those tied to the public grid will face delays measured in years.

We have seen this pattern before. AWS for compute. Azure for enterprise cloud. Meta for mobile. Infrastructure investments that looked unconventional at first and became foundational.

The grid wars will follow the same arc.

This is part of my Line of Sight substack. I write about AI strategy, GTM architecture, and the economics shaping the next decade. Subscribe for more.

References

The Electricity Supply Bottleneck on U.S. AI Dominance - CSIS, March 2025

How AI Data Centers Are Sending Your Power Bill Soaring - Bloomberg, September 2025

AI experts return from China stunned: The U.S. grid is so weak, the race may already be over - Fortune, August 2025

Constellation to restart Three Mile Island unit, powering Microsoft - World Nuclear News, September 2024

New nuclear clean energy agreement with Kairos Power - Google, October 2024

Amazon investing in SMRs to deploy 5 GW by 2039 - American Nuclear Society, October 2024

OpenAI’s Stargate Project Will Require Energy to Power a Small Country - Business Insider, October 2025

Tesla targets AI data centers with massive Megapack batteries - Tom’s Hardware, November 2025

Duke Energy, Amazon, Google, Microsoft execute agreements to accelerate clean energy options - Duke Energy, May 2024

TotalEnergies to Supply Renewable Power to Google’s Data Centers - TotalEnergies, November 2025

Amazon, Google, Meta and Microsoft go nuclear - Trellis, June 2025

Great article. That's quite an uptick for Northern Virginia. You would hope to see these big companies subsidizing power for their neighbors, not just sticking them with a higher bill due to the increased demand in the area.