The Best Acquisition Targets Are Already Your Partners

How operators turn strategic partnerships into M&A intelligence

Hi, I’m Kyle Kelly. Welcome to Line of Sight, a weekly newsletter decoding how AI, capital, and strategy create durable advantage.

TLDR: Your best acquisition target may already be in your partner ecosystem. The integrations, joint customers, and roadmap overlap you see every day are not just partnership signals. They are M&A intelligence hiding in plain sight.

The Blind Spot in Corporate Development

Your next acquisition target is not buried in a banker’s pitch. It is already inside your ecosystem.

Snowflake underscored this at its 2025 Summit. The company highlighted how partner integrations now drive the bulk of usage across its Data Cloud. Partners are not just feature extensions — they are revenue engines. And when Snowflake acquired Streamlit (data apps) and Neeva (AI search), it wasn’t a surprise. Both had already been battle-tested inside the ecosystem.

Most corporate development teams miss this. They spend months scanning banker decks, attending demo days, and waiting for processes to start. Meanwhile, the highest-signal targets are already embedded in their product stack, serving joint customers, and quietly proving value every quarter.

The blind spot is not a lack of capital or vision. It is treating partnerships only as distribution, instead of what they truly are: live diligence processes.

Partnerships as Diligence

Partnerships have evolved. They are not just about co-marketing or channel reach. They are the ultimate diligence process.

Through a strong partner integration, operators can see:

Real usage data

Joint customer outcomes

Cultural alignment in working teams

Roadmap fit against strategic priorities

That is intelligence you will never find in a CIM.

Partnerships as Due Diligence

The strategic shift is simple. Partnerships are not just about distribution anymore. They are the ultimate diligence process.

Through a strong partner integration you can see:

Real usage data

Joint customer outcomes

Cultural alignment in working teams

Roadmap fit against your strategic priorities

This is intelligence that no banker deck will provide.

Case Studies: When Partnerships Became Acquisitions

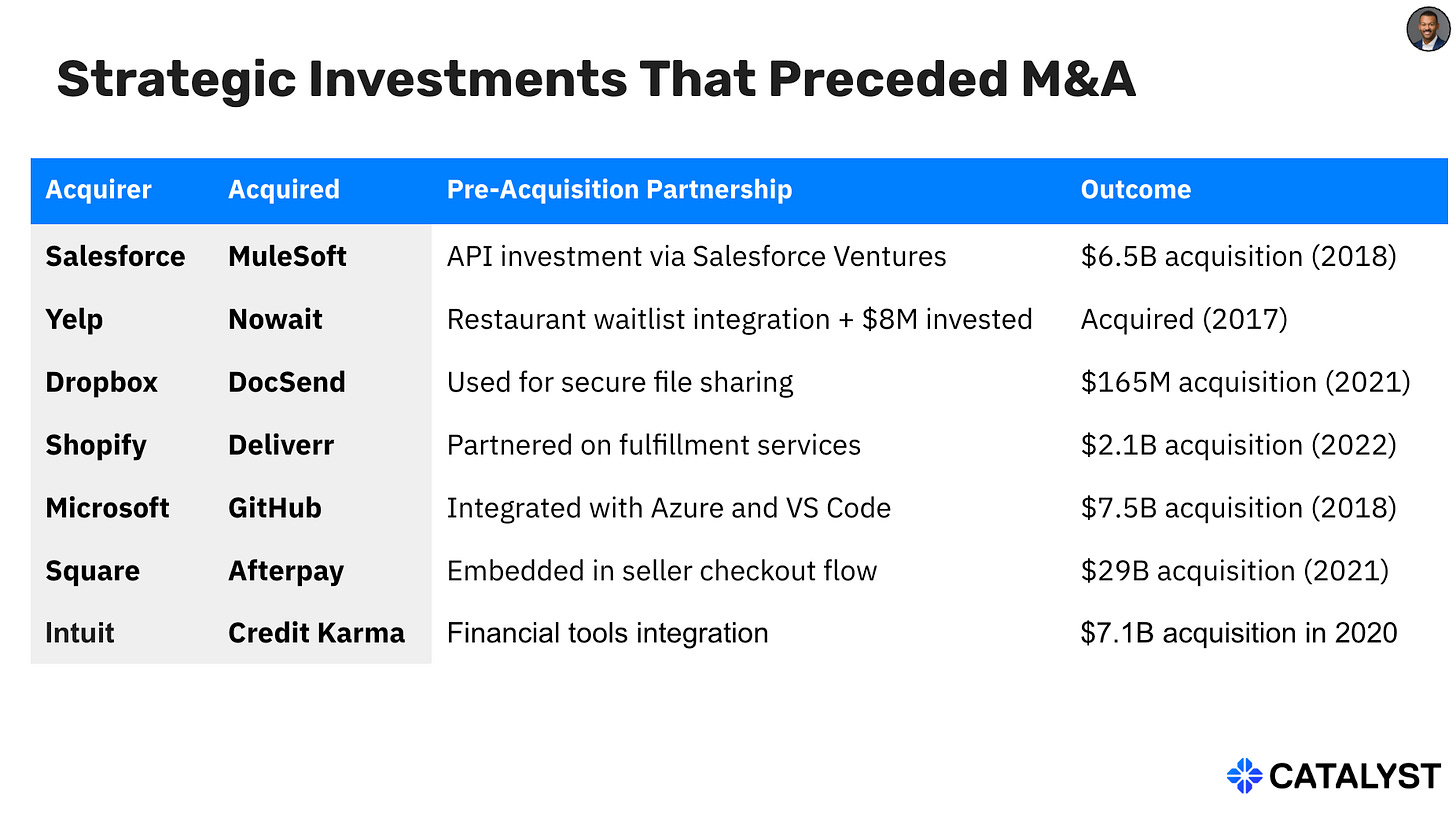

Salesforce + MuleSoft ($6.5B, 2018)

Three years of partnership powering 1,000+ integrations. Premium of 36 percent, but de-risked by usage data.Dropbox + DocSend ($165M, 2021)

Two years of API integration with 65 percent customer overlap. Integration complexity solved before the deal closed.Square + Afterpay ($29B, 2021)

Eighteen months of payments integration with thousands of merchants. The partnership created a moat competitors could not cross.

These weren’t speculative bets. They were validated partnerships upgraded into acquisitions.

The Operator’s Take

Think of partnerships as extended job interviews. You would never hire a VP without observing performance. Why would you acquire a company without testing how it integrates with your systems, your customers, and your culture?

Traditional M&A relies on projections and promises. Partnership-first M&A relies on performance data. The difference is dramatic.

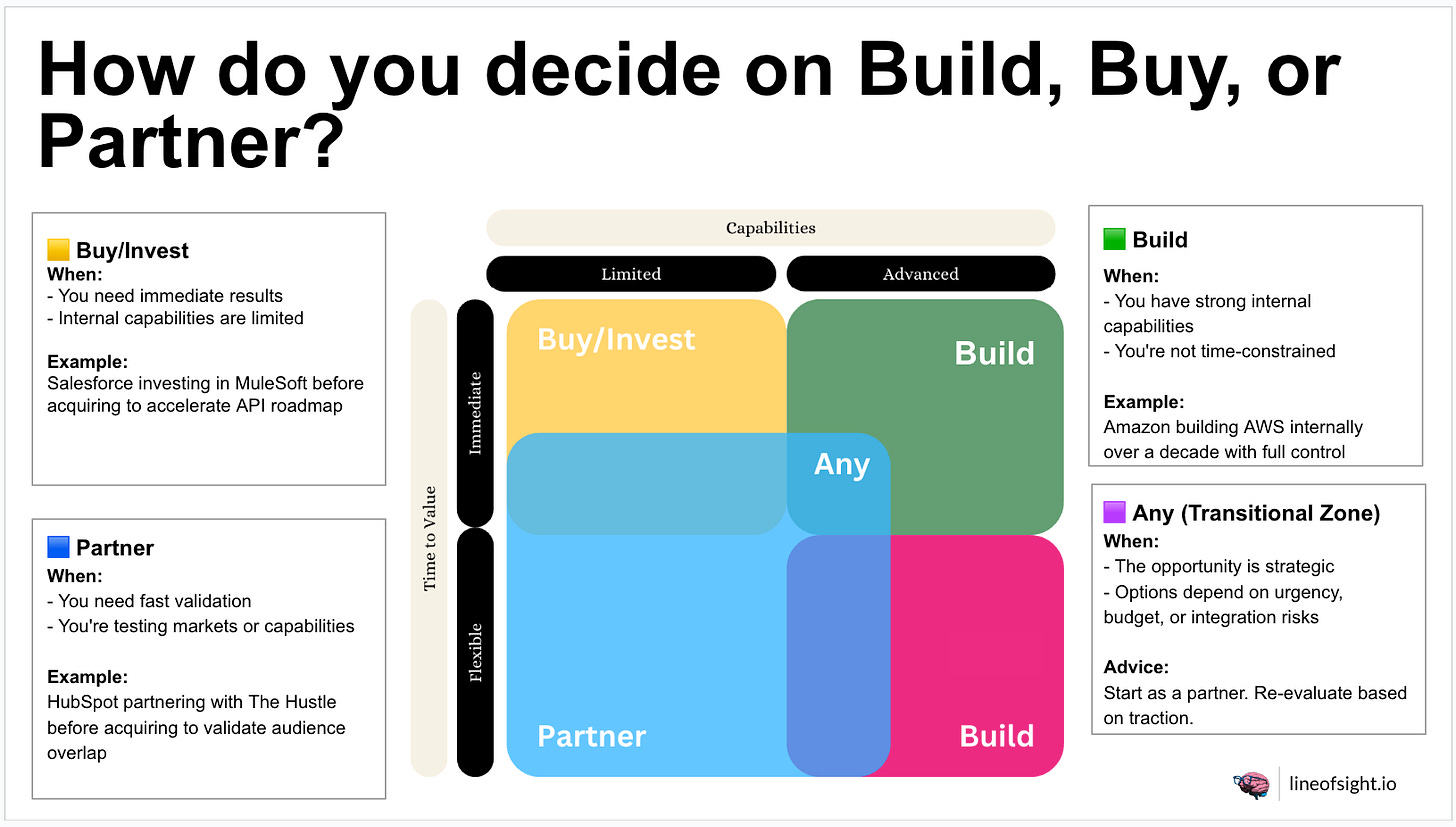

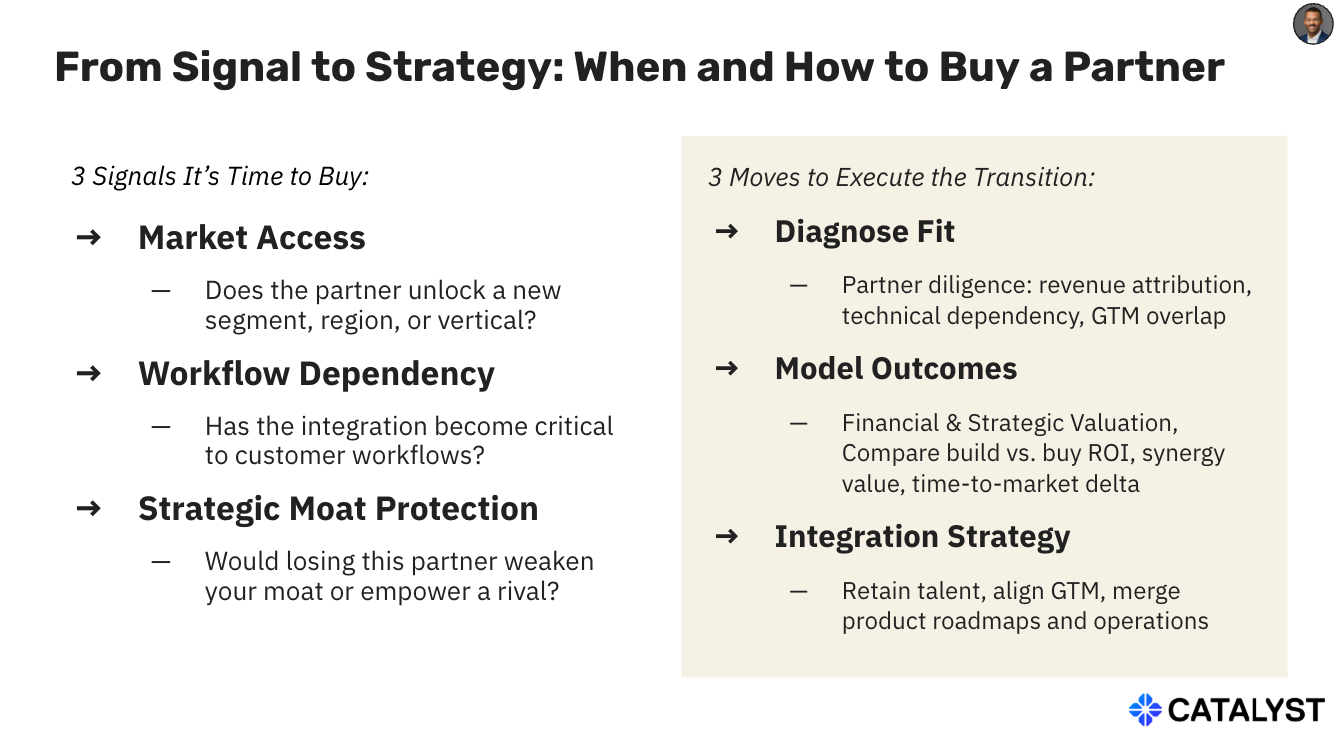

The Partnership-to-Acquisition Signal Framework

Green Light (Consider Acquisition):

Partner drives more than 20% of new customer pipeline

Joint solution is mission critical for shared customers

Roadmaps align with your 3-year strategy

Integration costs declining while value creation rises

Retention rates improve for joint solutions

Yellow Light (Deepen Partnership):

Strong technical fit but limited market traction

Cultural alignment but unclear strategic value

High customer satisfaction but low revenue attribution

Integration works but monetization not clear

Red Light (Keep at Arm’s Length):

Strategic priorities diverge

Integration complexity rising

Partner’s wins do not translate to your success

Cultural friction shows up in collaboration

What Strategic Operators Can Track

You do not need to understand APIs or financial modeling to spot potential acquisitions. Track three business metrics:

Customer retention: Joint solution retention vs standalone products

Revenue attribution: Growth from partner-sourced deals and upsells

Support volume: Tickets on integrated features (declining = good)

If these trend positively, you are looking at an acquisition candidate.

Every Partnership Is M&A Intelligence

Traditional process:

Identify targets through banker outreach

Run 60–90 days of diligence

Decide on projections

Hope integration works

Partnership-first process:

Partner first to test fit

Gather 12–24 months of data

Decide based on proven performance

Integrate along an already tested path

The Operator’s Checklist

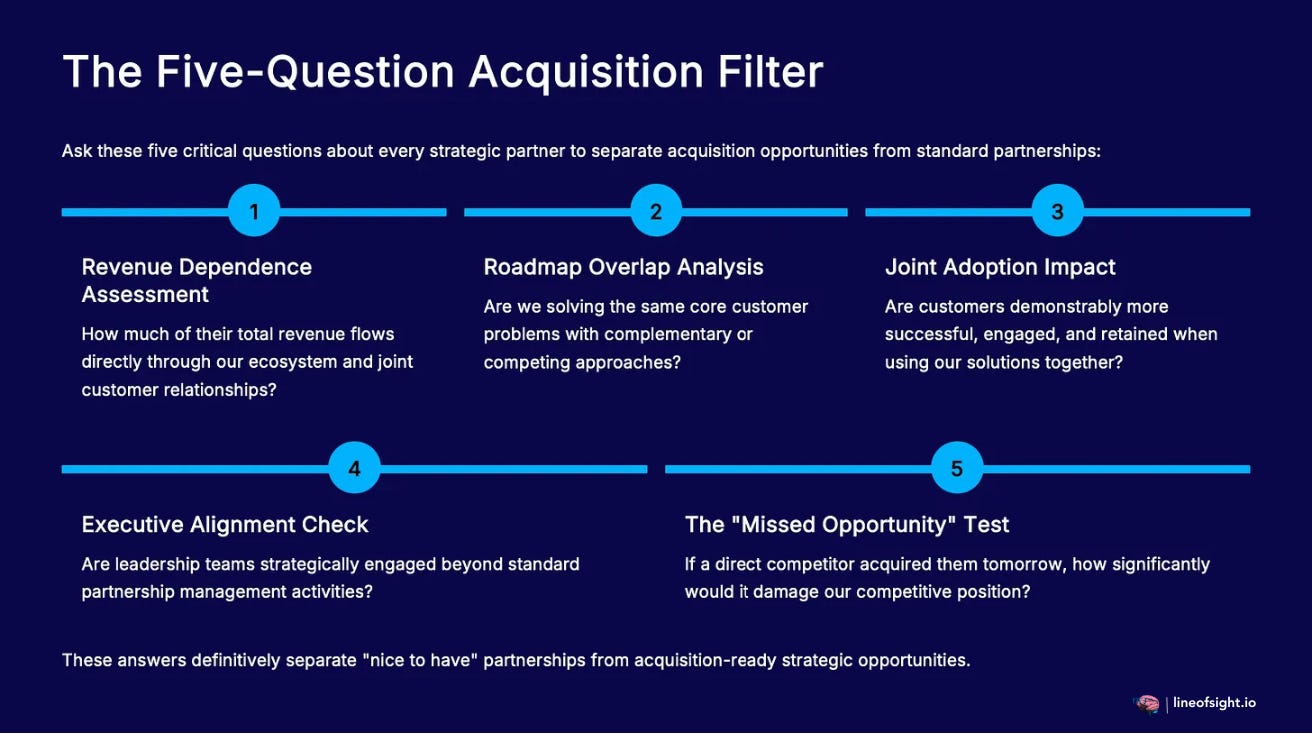

Ask these five questions of every strategic partner:

How much of their revenue flows through our ecosystem?

Are we solving the same customer problems?

Are customers clearly more successful using us together?

Are our leadership teams strategically engaged?

If a competitor acquired them tomorrow, how badly would it hurt?

These separate “nice to have” partners from acquisition-ready opportunities.

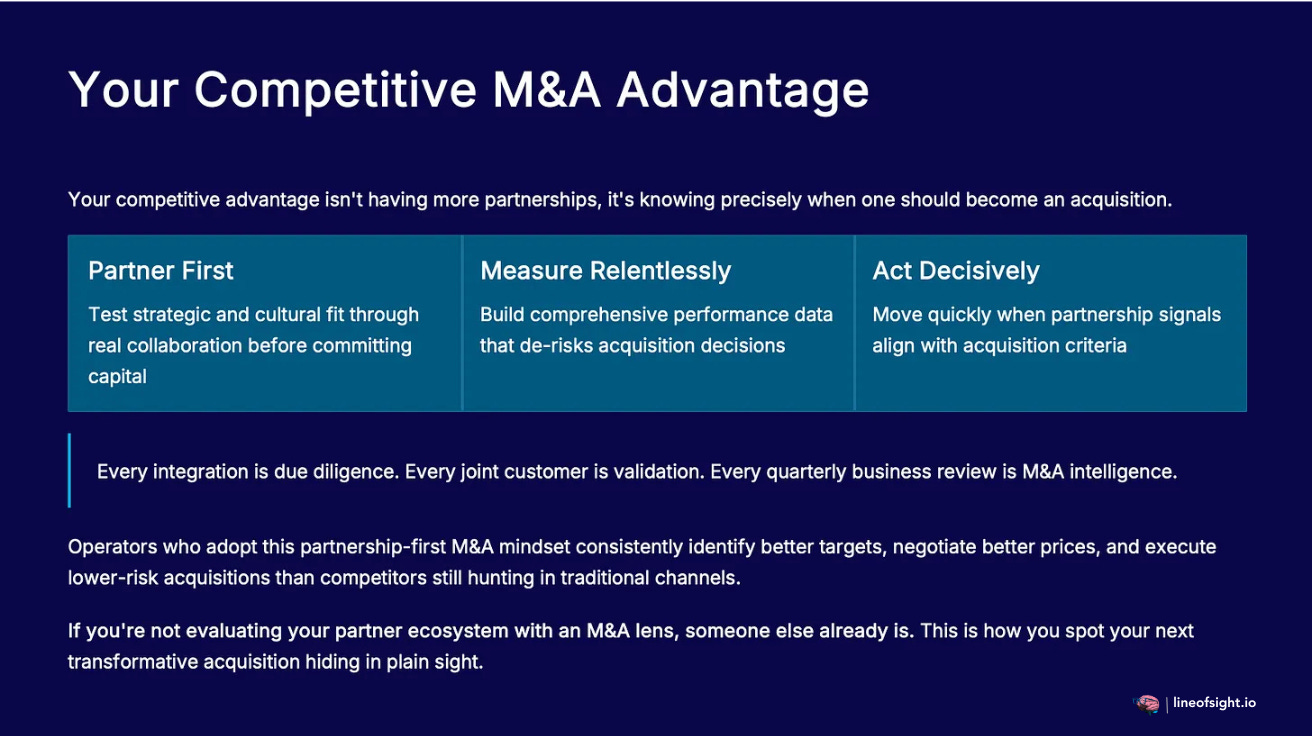

Your Competitive Advantage

The edge is not having more partnerships. It is knowing when one should become an acquisition.

The playbook is straightforward:

Partner first to test strategic and cultural fit

Measure relentlessly to build performance data

Act decisively when the signals align

Every integration is due diligence. Every joint customer is validation. Every quarterly business review is M&A intelligence.

Operators who adopt this mindset consistently find better targets, at better prices, with lower risk. If you are not evaluating your partner ecosystem with an M&A lens, someone else already is.

This is how you find your next acquisition hiding in plain sight.

This is what I write about at Line of Sight: operator frameworks and playbooks that turn hidden signals into strategic advantage. Subscribe to get them directly.