Product Partnerships in Tech: A PM’s Guide to Value Capture

Hi, I’m Kyle Kelly . Each week Line of Sight breaks down how AI, strategy, and revenue growth architecture turn complexity into leverage.

I spent over a decade doing partnerships of every kind. Product partnerships are my favorite. They’re technical, challenging, very strategic, and when executed right, they drive customer acquisition, brand elevation, revenue expansion, and stickiness. They help a business run a faster race.

Product partnerships rarely fail in the announcement. They fail in measurement, ownership, and resourcing. We call this “value leakage,” but it’s simpler than that: it’s a failure of accountability. We treat partnerships like lottery tickets when we should treat them like systems.

This week, I’m breaking down where that value goes and what you can do about it. In my next post, I’ll share a 90-day playbook to reclaim it.

What you’ll get in the article

How partnership value leaks before it ever hits the P&L (and the 5 failure modes to audit)

A simple spectrum and matrix to pick the right partnerships, not just the exciting ones

The 5 guardrails to lock before engineering starts: economics, data rights, ownership, attribution, and exit

Product managers are measured on impact.

We ship product, drive metrics, and grow the business. But one of the most powerful levers for impact often remains underutilized or misunderstood: product partnerships. Too often, we approach partnerships with a value capture mindset, asking, “What can we get?” This is a mistake. The most successful partnerships start by asking, “What can we create, together?”

Marty Cagan of the Silicon Valley Product Group puts it best: “focus on value and always create more value than you capture.” [1] This is the fundamental principle that separates partnerships that merely extract value from those that create exponential growth.

Value creation is the strategy. Guardrails are the mechanism that prevents value creation from turning into free labor.

Create First, But Protect Capture

Focusing on value creation first does not mean ignoring the economics. It gives you permission to focus on building a bigger pie, but it doesn’t give you permission to accept weak terms. As an operator, you must establish guardrails to protect your ability to capture value later. Before any significant engineering work begins, ensure you have alignment on these five non-negotiable terms:

Minimum viable economics: “What is the smallest paid commitment on Day 1?”

Data rights: “Who can store, reuse, and market from shared data?”

Customer ownership: “Who supports, who renews, who can upsell?”

Attribution: “What is the source of truth and the event definition?”

Exit: “What happens to customers, data, and the integration on unwind?”

Securing these terms upfront prevents costly renegotiations and ensures that when you do create value, you have a clear path to capturing your fair share.

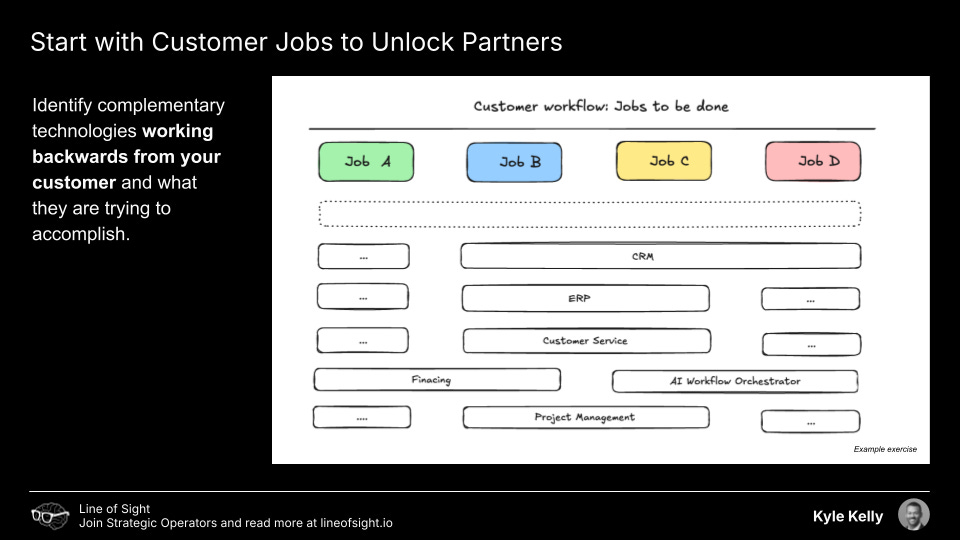

Start with Customer Jobs, Not Integration Features

Before diving into frameworks and playbooks, we need to establish the foundational principle: partnerships exist to solve customer problems, not to create technical integrations.

The most successful product partnerships work backwards from the customer. Identify complementary technologies working backwards from your customer and what they are trying to accomplish. Map the customer workflow and the jobs to be done, then identify where your product and your partner’s product can work together to eliminate friction.

This customer-first approach ensures you’re building integrations that solve real problems, not just technical exercises that look impressive on a partnership announcement but deliver no measurable value.

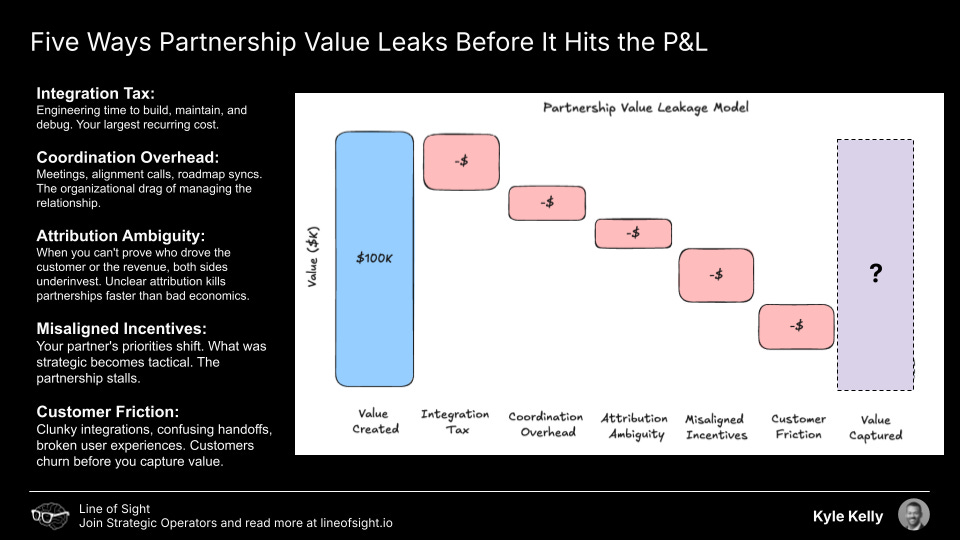

Where Partnership Value Can Miss the P&L

The reality is that most of the value created in a partnership is never realized. It leaks away. Let’s be clear: ‘friction’ and ‘misalignment’ are polite terms for unbudgeted costs that kill your ROI. The Integration Tax isn’t a metaphor; it’s a real, recurring expense that hits your engineering budget every quarter.(Note: the %s and timelines below are heuristics from my experience, used to help you size the problem.)

Based on my experience, I’ve developed a heuristic to visualize this: The Partnership Value Leakage Model. Imagine a partnership creates $100K in potential value. A significant portion of that value can be lost before it ever reaches the customer or the bottom line.

Integration Tax: ongoing engineering build, maintenance, and debugging.

Coordination Overhead: recurring meetings, roadmap syncs, and cross-team drag.

Attribution Ambiguity: unclear source of truth, so both sides underinvest.

Misaligned Incentives: priorities shift, commitments decay, execution stalls.

Customer Friction: clunky handoffs and broken flows that drive churn.

As this illustrative chart shows, the majority of potential value can be lost to various forms of friction. The “Integration Tax” and “Misaligned Incentives” are often the biggest culprits. This is why a myopic focus on capturing a bigger slice of the pie is so dangerous. A bigger slice of a tiny, shrunken pie is still a tiny slice.

The Transactional Trap

The great trap for most organizations is getting stuck in transactional partnerships. They offer predictable, measurable, but linear returns. Leaders become addicted to the comfort of a simple rev-share model, and they lack the strategic patience to invest in the less-defined, but exponential, returns of deeper integrations. Most companies should earn the right to transformative partnerships through repeatable integrative wins.

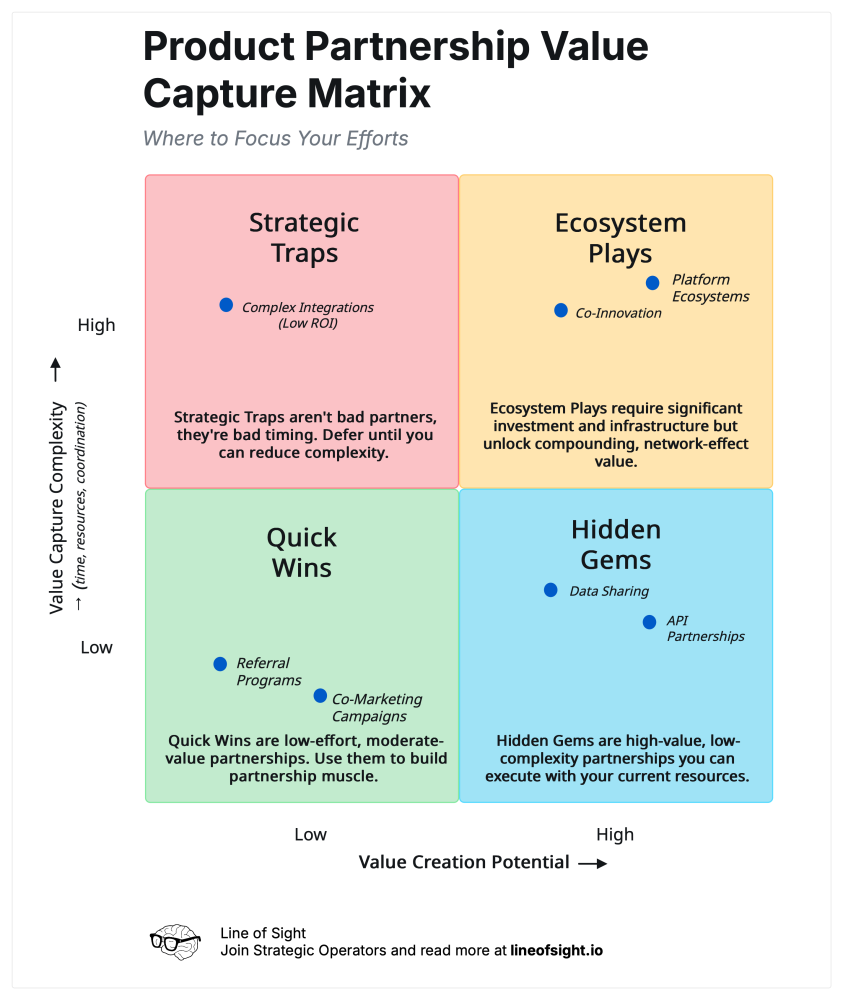

Where to Focus: The Partnership Value Capture Matrix

Not all partnerships deserve equal investment. Use the Partnership Value Capture Matrix to decide where to focus your efforts. This 2x2 evaluates partnerships based on their value creation potential and the complexity of capturing that value.

Your goal is to spend most of your time on “Hidden Gems”, partnerships with high value creation potential and low capture complexity, like API and data-sharing agreements. “Ecosystem Plays” are your big bets, requiring significant investment but offering massive returns. Avoid “Strategic Traps” at all costs. These look impressive on paper but drain resources without delivering proportional value.

Hidden Gems are high-value, low-complexity partnerships you can execute with your current resources.

Ecosystem Plays require significant investment and infrastructure but unlock compounding, network-effect value.

Strategic Traps aren’t bad partners, they’re bad timing. If you can’t capture the value yet, defer them until you have the infrastructure to make them Hidden Gems.

The Pull Forward: From Frameworks to Action

The frameworks in this article are not just theoretical exercises. They are diagnostic tools. Use the Value Leakage Model this week to audit your most important partnership. Use the Value Capture Matrix to start a conversation with your team about where you are placing your bets.

The hard truth is that most partnerships fail quietly from neglect, not spectacularly in a press release. They die from a thousand small cuts of misalignment, friction, and ambiguity. But by shifting your mindset from pure extraction to value creation, and by using these frameworks to systematically de-risk your initiatives, you move from playing the lottery to building a system.

This is the foundational work. It’s the diagnosis before the treatment. In a future post, I will lay out a concrete, 90-day playbook to operationalize this strategy and build a high-ROI partnership engine. But the work of value capture begins now, with the questions you ask and the systems you build.

About Line of Sight

Line of Sight breaks down how AI, strategy, and revenue growth architecture turn complexity into leverage. Written by Kyle Kelly for VP and C-suite GTM, product, and partnership leaders. Join Strategic Operators and read more at lineofsight.io

References

Cagan, Marty. “Value Creation vs. Value Capture.” Silicon Valley Product Group, 21 Apr. 2013.