Shopify's Trifecta: How 30%+ Growth, 18% FCF Margins, and AI are Defining Commerce's Next Era

A Deep Dive on the Ecommerce Company & Their AI Strategy

Hi, I’m Kyle Kelly. Each week Line of Sight breaks down how AI, strategy, and revenue growth architecture turn complexity into leverage.

Two weeks ago, Shopify reported Q3 results that deserve a closer look. When a company re-accelerates growth to 32% while posting 18% free cash flow margins, expands its addressable market 18-fold through product innovation, and reports 7x AI traffic growth in ten months: that’s not luck. That’s a playbook.

What struck me most was the strategic clarity: Shopify has evolved from “website builder for entrepreneurs” to “operating system for all commerce,” and they’re now laying the rails for agentic commerce while everyone else is still figuring out what that means.

I dug into their Q3 ‘25 investor deck and 10-Q, then discussed the findings with ecommerce colleagues I’ve worked alongside for over a decade. Here’s what the data reveals about three compounding flywheels that could define the next decade of commerce.

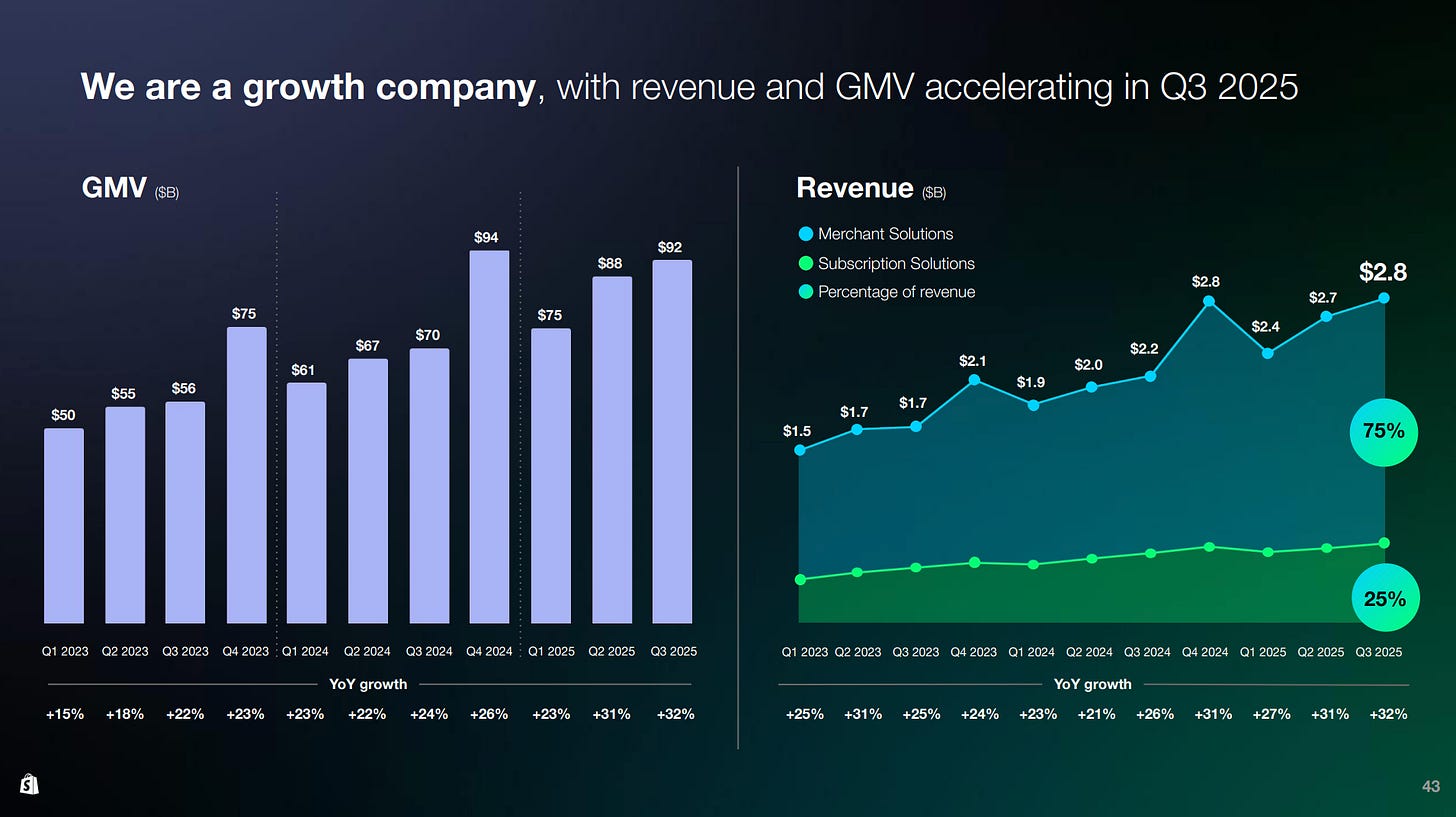

Shopify’s Q3 2025 results, announced on November 4th, paint a clear picture of a company hitting its stride with renewed vigor and discipline. In a quarter that saw both revenue and Gross Merchandise Volume (GMV) accelerate to 32% year-over-year growth, the e-commerce giant also posted an impressive 18% free cash flow (FCF) margin [1].

This isn’t just a story of post-pandemic normalization; it’s a narrative of deliberate, strategic execution transforming Shopify from a high-growth SaaS tool into a profitable, indispensable operating system for all of commerce.

After analyzing the company’s investor presentation and the market’s response over the past two weeks, a strong thesis emerges: Shopify’s current success and future trajectory are powered by three compounding flywheels. These are relentless product-led Total Addressable Market (TAM) expansion, deepening payment penetration that boosts take rates and margins, and a forward-looking pivot to become the essential infrastructure for the nascent world of AI-driven agentic commerce.

This combination is not just driving growth; it’s cementing Shopify’s position as the foundational layer for the next era of retail.

The Core Thesis: A Unified Platform for All Commerce

Before diving into the numbers, it’s crucial to understand Shopify’s core investment thesis, which they lay out with simple clarity. It’s a four-part statement that acts as the north star for their entire strategy.

This thesis is a powerful declaration of intent. Shopify is no longer just a tool for entrepreneurship, it aims to be the platform for all of commerce.

“As our merchants do better, Shopify does better.”

This final point is the fundamental principle of alignment that makes their business model so resilient and scalable. Every new feature, every integration, and every strategic decision can be traced back to this core idea of shared success.

The Re-acceleration Machine

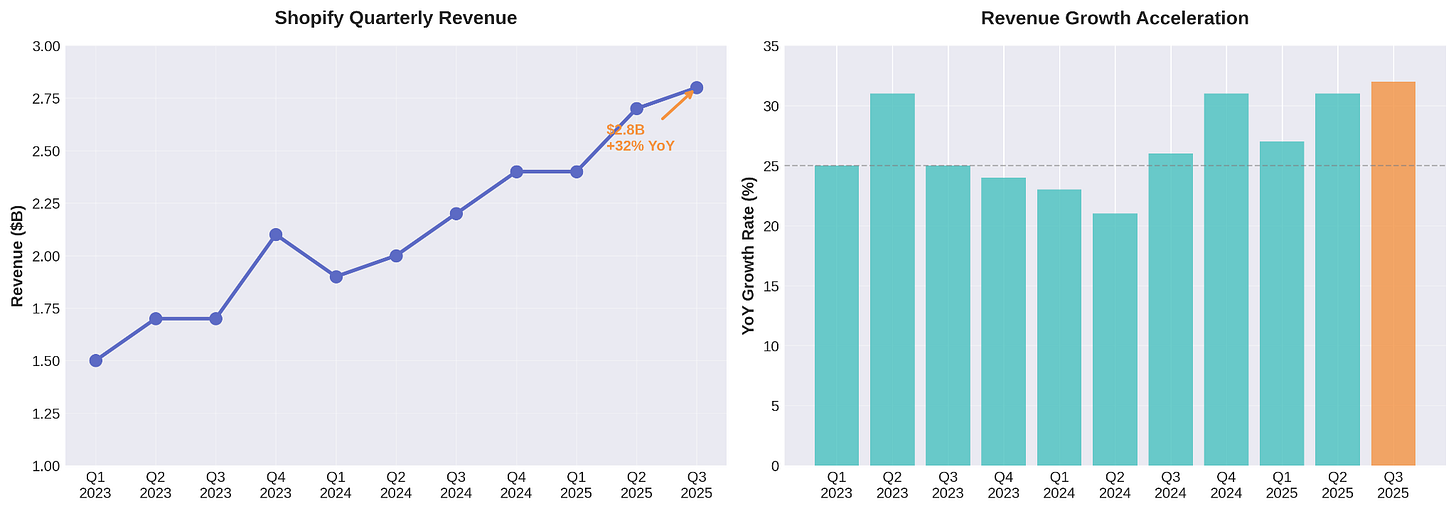

For years, the question for high-growth SaaS has been, “What happens when growth slows?” Shopify’s answer is to re-accelerate. The company’s Q3 performance marks a significant uptick, with revenue hitting $2.8 billion, the strongest growth rate in recent quarters.

This isn’t a single-quarter anomaly but the result of sustained momentum. As the chart below illustrates, the 32% YoY revenue growth demonstrates a clear acceleration from the low-to-mid-twenties growth rates of previous quarters.

The revenue mix, with 75% from Merchant Solutions (which includes payments, fulfillment, and capital) and 25% from high-margin Subscription Solutions, shows that Shopify is successfully capturing more value as its merchants grow. This is the “shared success” model in action.

The acceleration is particularly notable because it comes alongside improved unit economics. Every new merchant added to the platform has a higher lifetime value than those from previous cohorts, driven by increased adoption of Merchant Solutions and multi-channel selling. This is growth that compounds, not growth that burns capital.

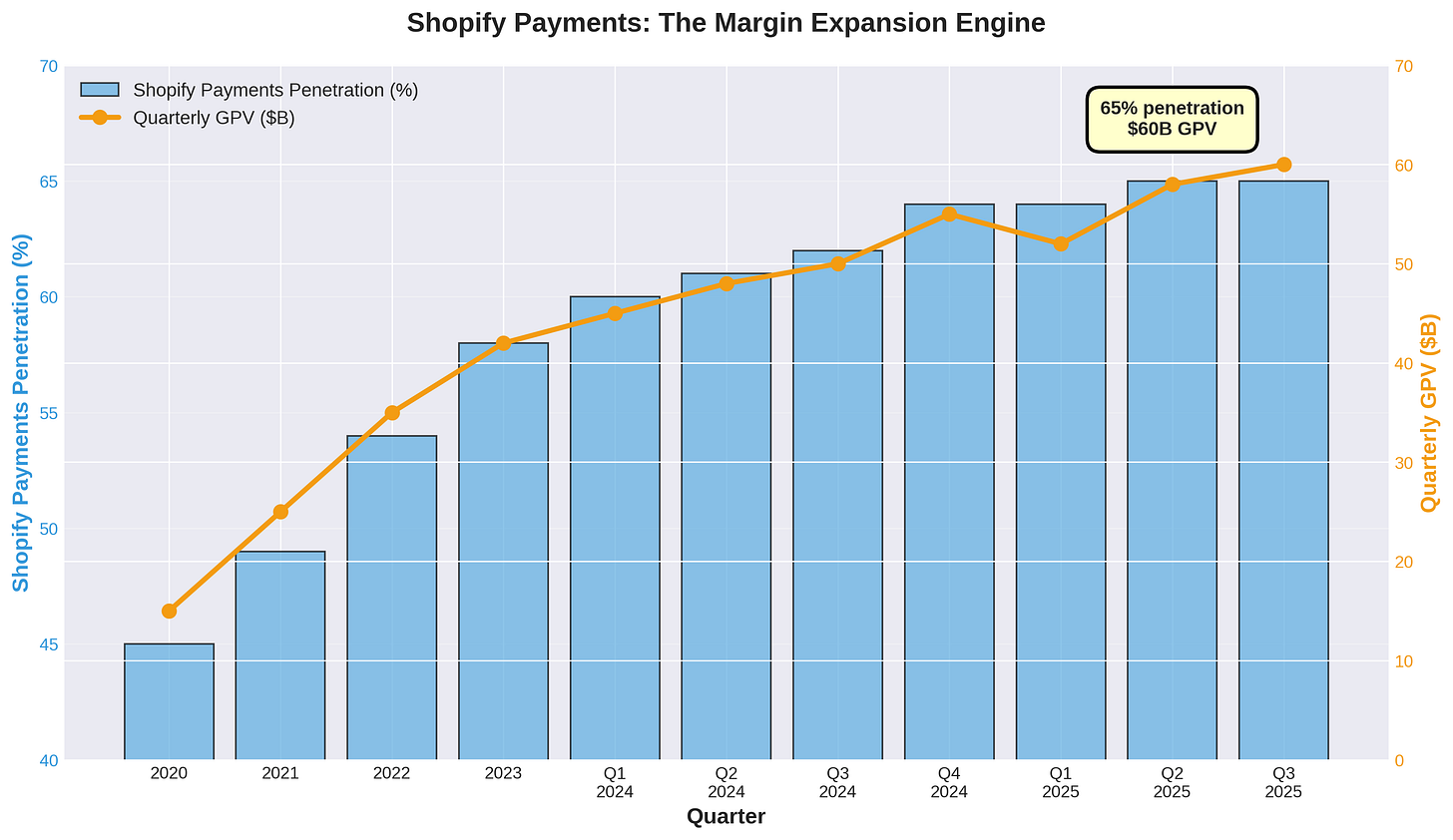

The Margin Expansion Engine: Payments Penetration

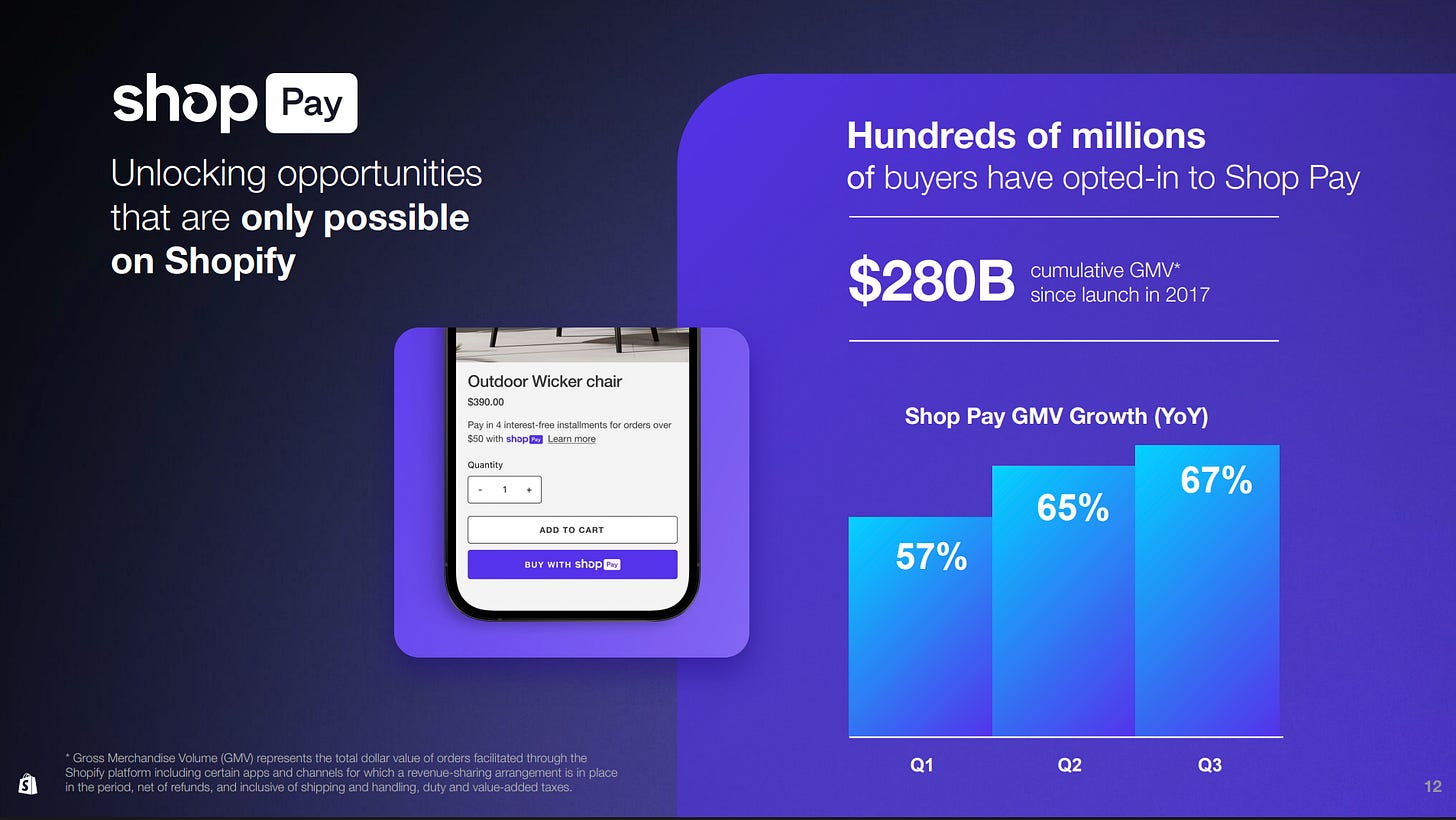

Perhaps the most critical lever for Shopify’s financial success is the continued adoption of Shopify Payments and its consumer-facing counterpart, Shop Pay. For a platform business, increasing the take rate, the percentage of GMV captured as revenue, is paramount. Shopify Payments is the primary vehicle for this.

The Numbers Tell the Story

In Q3 2025, Shopify Payments penetration reached 65% of GMV, up from 58% in 2023 and just 45% in 2020. This steady climb directly translates to higher-margin revenue and greater free cash flow. The Gross Payments Volume (GPV) for the quarter hit $60 billion, showcasing the immense scale of this operation.

With hundreds of millions of buyers opted-in and a staggering $280 billion in cumulative GMV since its launch, Shop Pay creates a frictionless checkout experience. The Q3 growth numbers tell the story: Shop Pay GMV grew 67% year-over-year, accelerating from 57% in Q1 and 65% in Q2.

This isn’t just adoption; it’s acceleration of adoption.

The Data Moat

The strategic brilliance here is that Shopify Payments isn’t just a revenue line item; it’s a data moat. Every transaction processed through Shopify Payments generates insights that feed back into:

Fraud detection

Credit underwriting for Shopify Capital

Personalized recommendations

This data advantage compounds over time, making the platform more valuable to merchants and harder for competitors to replicate.

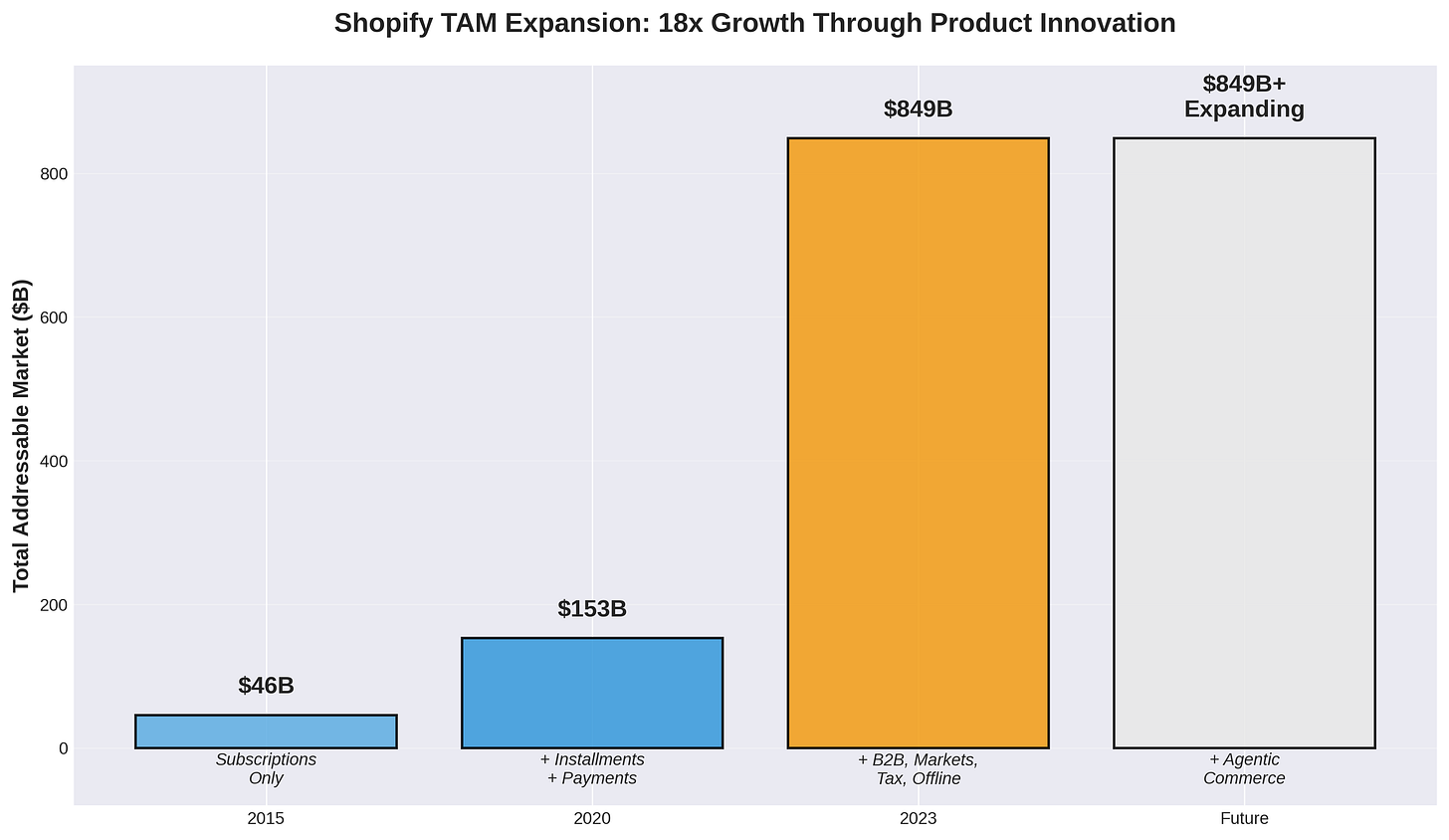

The 18x TAM Expansion Playbook

Shopify’s growth story is also one of remarkable market expansion, driven not by acquisitions but by relentless product innovation. The company has systematically expanded its TAM from $46 billion in 2015 to an estimated $849 billion today [2].

This was achieved by evolving from a simple website builder into a “unified operating system for commerce.”

This slide is the visual manifestation of their strategy. Shopify is the central hub connecting a merchant’s online store to physical retail, social media channels, marketplaces, and B2B operations.

Over 90% of merchants have installed two or more channels.

This isn’t theoretical strategy; it’s reality. This multi-channel integration makes the platform incredibly sticky. A merchant who sells online, in-store via POS, on Instagram, and through Amazon, all managed through Shopify, faces enormous switching costs. The unified inventory, customer data, and analytics across all these channels become mission-critical infrastructure.

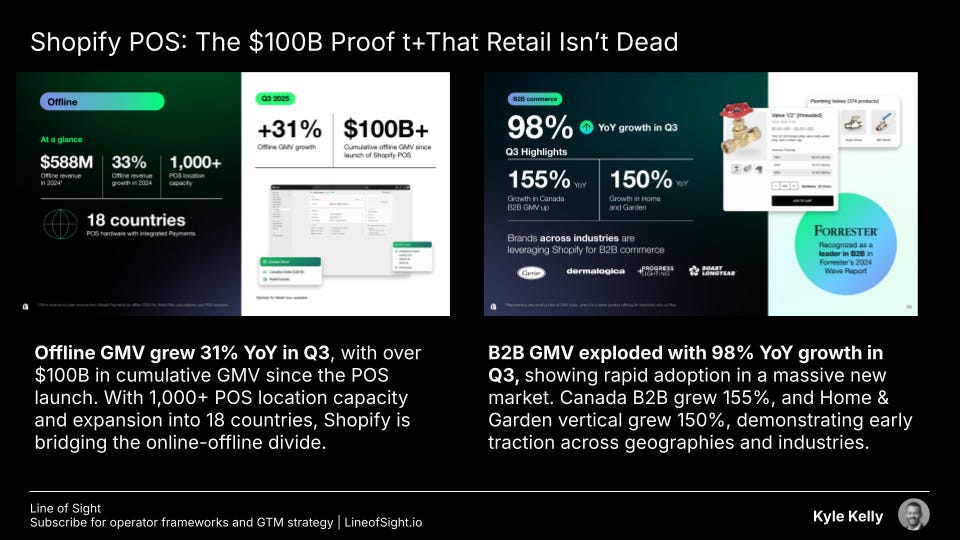

Two Growth Engines: Offline and B2B

Two key areas of this expansion are Offline and B2B commerce, which are now significant growth drivers and represent massive TAM expansion opportunities.

The offline story is particularly compelling because it represents a complete reversal of the traditional e-commerce narrative. Instead of physical retail dying, Shopify is enabling a unified commerce model where online and offline reinforce each other. A customer can browse online, buy in-store, and return via mail, all tracked in a single system.

This is the future of retail, and Shopify is building the infrastructure for it.

With only 2% penetration of its current Serviceable Addressable Market (SAM) of $404 billion, the runway remains incredibly long.

The New Frontier: Agentic Commerce

The most forward-looking element of Shopify’s strategy is its aggressive push into agentic commerce. The company recognizes that the next paradigm shift in online shopping will move from search bars and websites to conversations with AI agents.

Shopify is positioning itself to be the rails on which this new world runs.

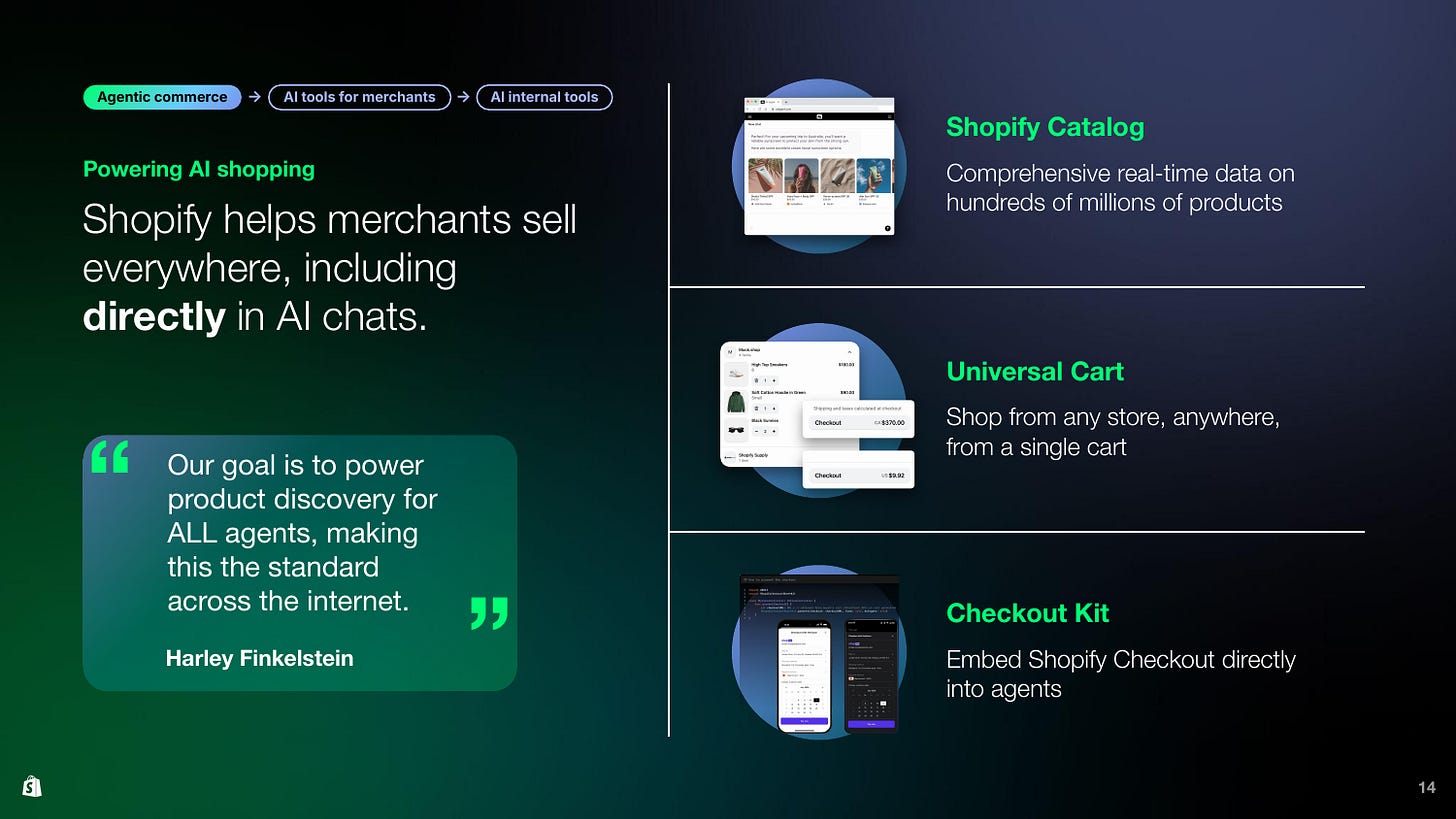

A Three-Layered AI Strategy

Shopify’s AI strategy is a comprehensive, three-layered approach that demonstrates unusual strategic clarity:

Layer 1: Agentic Commerce Infrastructure

Shopify has built three foundational products that allow any AI agent to sell products from Shopify merchants:

Shopify Catalog provides real-time data on hundreds of millions of products

Universal Cart allows shoppers to add items from multiple stores into a single cart

Checkout Kit embeds Shopify’s battle-tested checkout directly into AI agent experiences

This isn’t vaporware; Shopify has already partnered with OpenAI (ChatGPT), Microsoft Copilot, and Perplexity to enable in-chat shopping.

Layer 2: AI Tools for Merchants

Shopify is embedding AI throughout the merchant experience. Sidekick, their personalized AI assistant, helps merchants make smarter decisions, from product descriptions to marketing campaigns. The adoption here is impressive: 750,000+ merchants used Sidekick for the first time in Q3 alone.

This is legit because it demonstrates that AI isn’t just a feature for power users; it’s becoming table stakes for all merchants.

Layer 3: Internal AI Tools

Shopify is using AI to build better products. Scout, their internal AI assistant, has indexed hundreds of millions of merchant feedback points, allowing employees to quickly surface insights and make data-driven decisions.

This creates a flywheel: better products attract more merchants, which generates more data, which trains better AI models, which enables even better products.

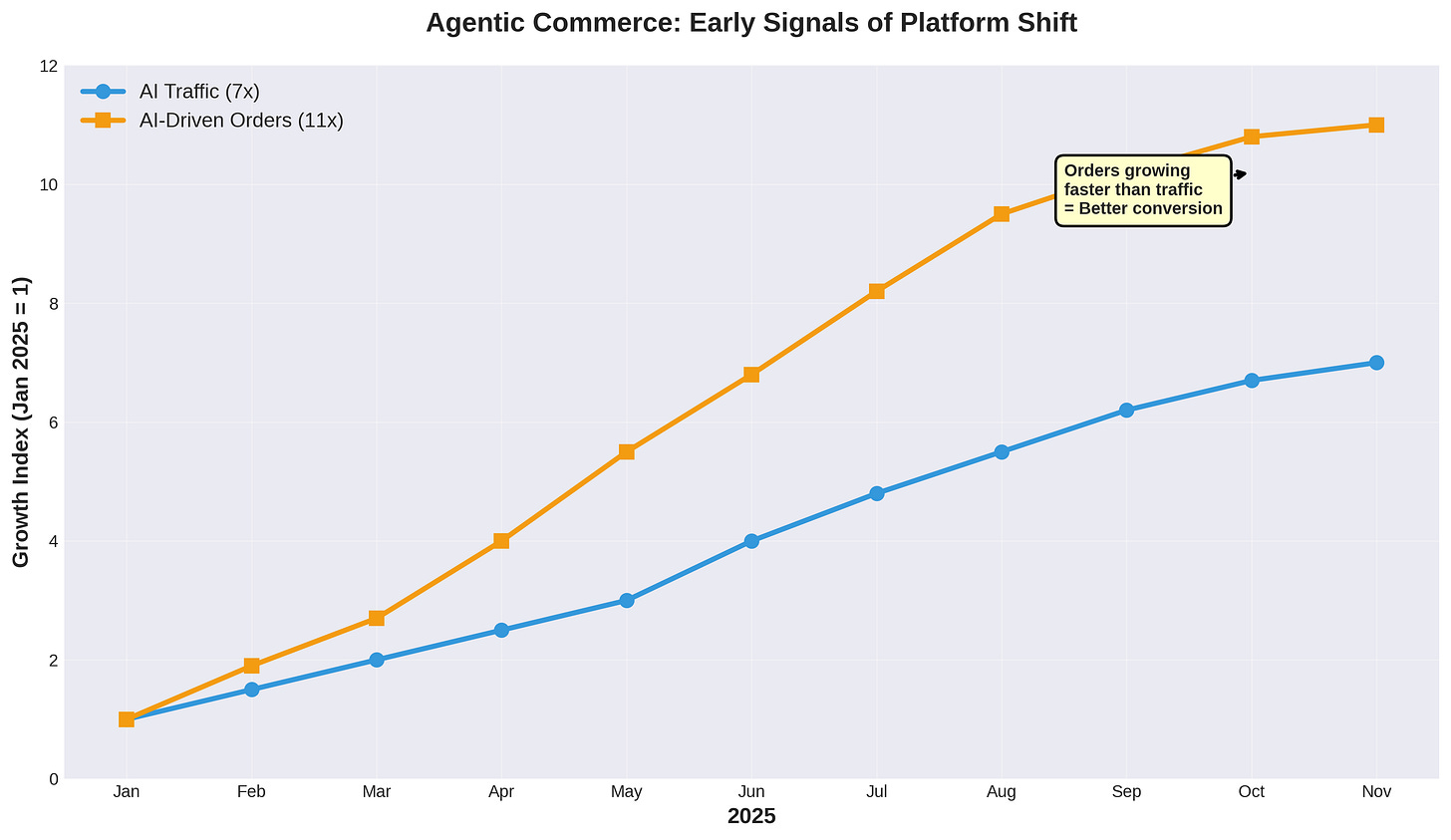

The Early Data is Striking

Shopify reported that traffic from AI tools to its merchants’ stores was up 7x since the start of the year, while purchases attributed to AI-powered search had exploded by 11x [3].

The fact that orders are growing significantly faster than traffic suggests that AI-driven recommendations are leading to higher conversion rates.

This is the critical insight: AI shopping isn’t just shifting existing demand; it’s creating better matches between buyers and products, which increases overall conversion and GMV.

As President Harley Finkelstein stated, “AI is not just a feature at Shopify. It is central to our engine that powers everything we build” [3]. More importantly, he noted that Shopify’s goal is to “power product discovery for ALL agents, making this the standard across the internet.”

This is an audacious bet, but it’s grounded in a real competitive advantage. Shopify has the product catalog, the checkout infrastructure, and the merchant relationships. If AI shopping takes off, and early data suggests it will, Shopify is positioned to be the Stripe of agentic commerce.

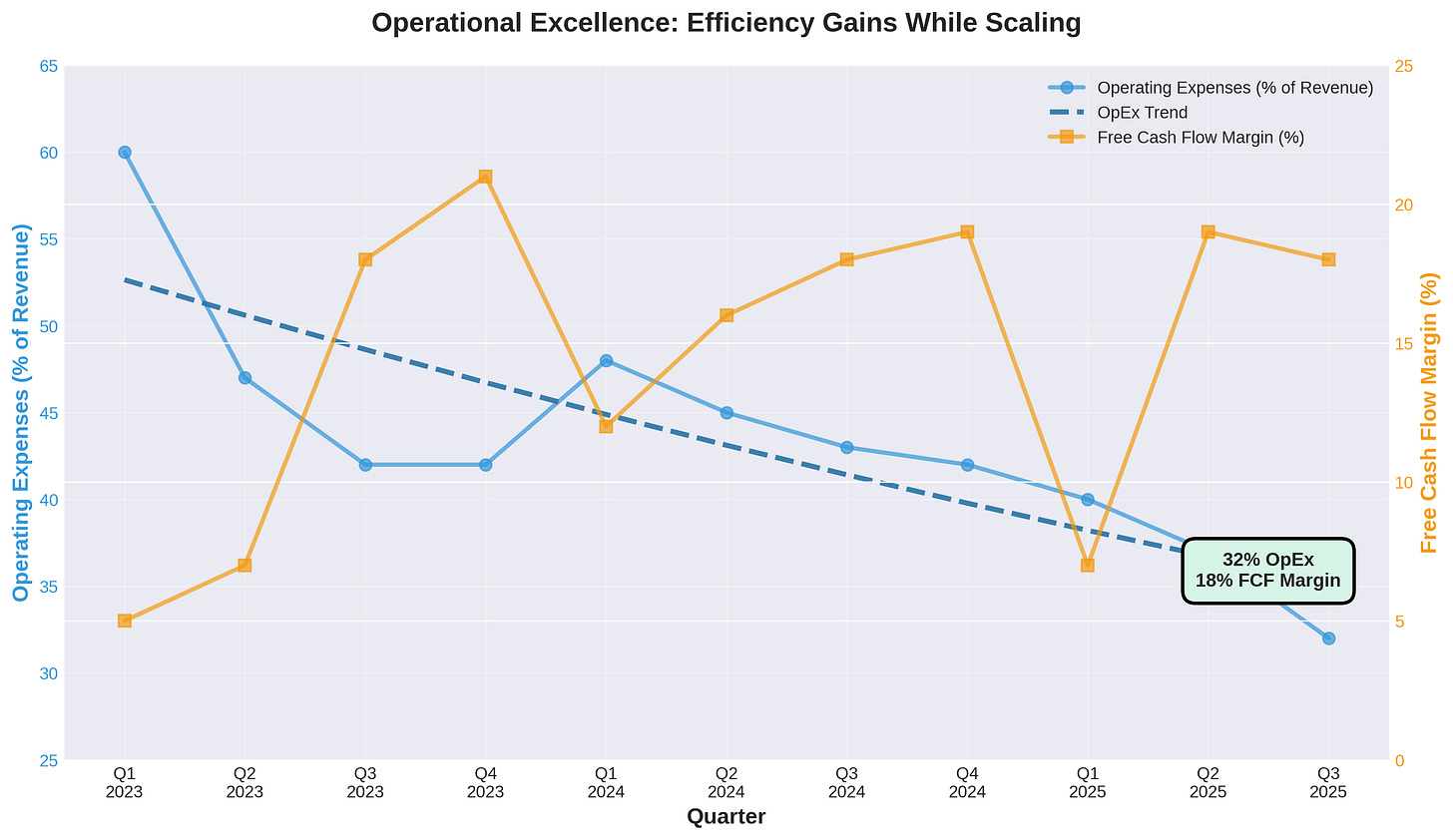

A New Era of Disciplined Growth

Underpinning this strategic execution is a newfound operational discipline. After a period of heavy investment and the painful decision to exit logistics, Shopify has demonstrated significant operating leverage.

Adjusted operating expenses as a percentage of revenue have fallen from 60% in early 2023 to just 32% in Q3 2025. This efficiency has unlocked consistent and growing profitability, with the company posting nine consecutive quarters of double-digit free cash flow margins.

This chart shows the inverse correlation between operating expenses as a percentage of revenue (a falling line is good) and the free cash flow margin (a rising line is good). This is the hallmark of a mature, scalable platform that can grow efficiently while still investing in future opportunities.

The company is guiding to Q4 operating expenses of 30-31% of revenue, suggesting this discipline will continue.

The Efficiency Story

The breakdown of operating expenses tells an important story:

Sales and marketing has fallen from 16% of revenue in Q3 2023 to 14% in Q3 2025

R&D has dropped from 14% to 10%

This isn’t cost-cutting; it’s operating leverage. The platform is becoming more efficient at acquiring and serving merchants, which allows Shopify to invest more in absolute dollar terms while spending less as a percentage of revenue.

Why This Matters

Shopify’s Q3 2025 performance is more than just a strong earnings report; it’s a blueprint for the next generation of platform companies. It demonstrates that it’s possible to achieve venture-scale growth, expand into new markets, and invest in future-defining technologies like AI, all while maintaining financial discipline and generating significant free cash flow.

The company has successfully navigated the transition from a simple tool for entrepreneurs to a complex, multi-product, global infrastructure for commerce.

The three flywheels (TAM expansion, payments penetration, and the AI commerce layer) are not independent; they are deeply interconnected and self-reinforcing.

More products attract more merchants, who bring more GMV, which increases payments volume and generates the data needed to build a world-class AI commerce engine. This is the powerful, compounding loop that will define Shopify’s next decade of growth.

The Timing is Everything

What makes this particularly compelling is the timing:

E-commerce still represents only 15-21% of total retail sales globally

The shift to unified commerce (online + offline) is just beginning

Agentic commerce is in its infancy

Shopify is positioned at the intersection of all three trends, with the infrastructure, merchant relationships, and financial resources to capitalize on each.

The Playbook

For investors, operators, and anyone building in the commerce space, Shopify’s playbook offers critical lessons:

Align incentives with your customers - Make customer success metrics your primary KPIs

Expand your market through product innovation rather than acquisition - Focus on adjacencies that leverage existing infrastructure

Build network effects through payments and data - Own the transaction layer to capture data and improve unit economics

Invest early in platform shifts like AI - Build infrastructure before the use cases are obvious

Execute on all four, and you might just build the operating system for an entire industry.

References

Shopify Inc. (2025, November 4). Shopify Beats Across the Board: Q3 Shows Growth, Efficiency, Brand Wins. Shopify News.

Shopify Inc. (2025, November 4 ). Investor Overview Deck - Q3 2025.

Perez, S. (2025, November 4 ). Shopify says AI traffic is up 7x since January, AI-driven orders are up 11x. TechCrunch.

Kinsta. (2022, June). Shopify Market Share and Usage Statistics.

Statista. (2025, September ). U.S. e-commerce platforms market share 2025.

Disclaimer

This article presents analysis and opinion, not investment advice. All data is sourced from publicly available materials and believed to be accurate, but readers should conduct their own due diligence before making any investment decisions. The views expressed are those of the author and do not constitute recommendations to buy or sell any securities.