The Compliance Moat: Build, Buy, or Partner

From Crypto taxes to ADA compliance, the companies that become the default infrastructure for navigating regulation win.

Hi, I’m Kyle Kelly. Each week Line of Sight breaks down how AI, strategy, and revenue growth architecture turn complexity into leverage.

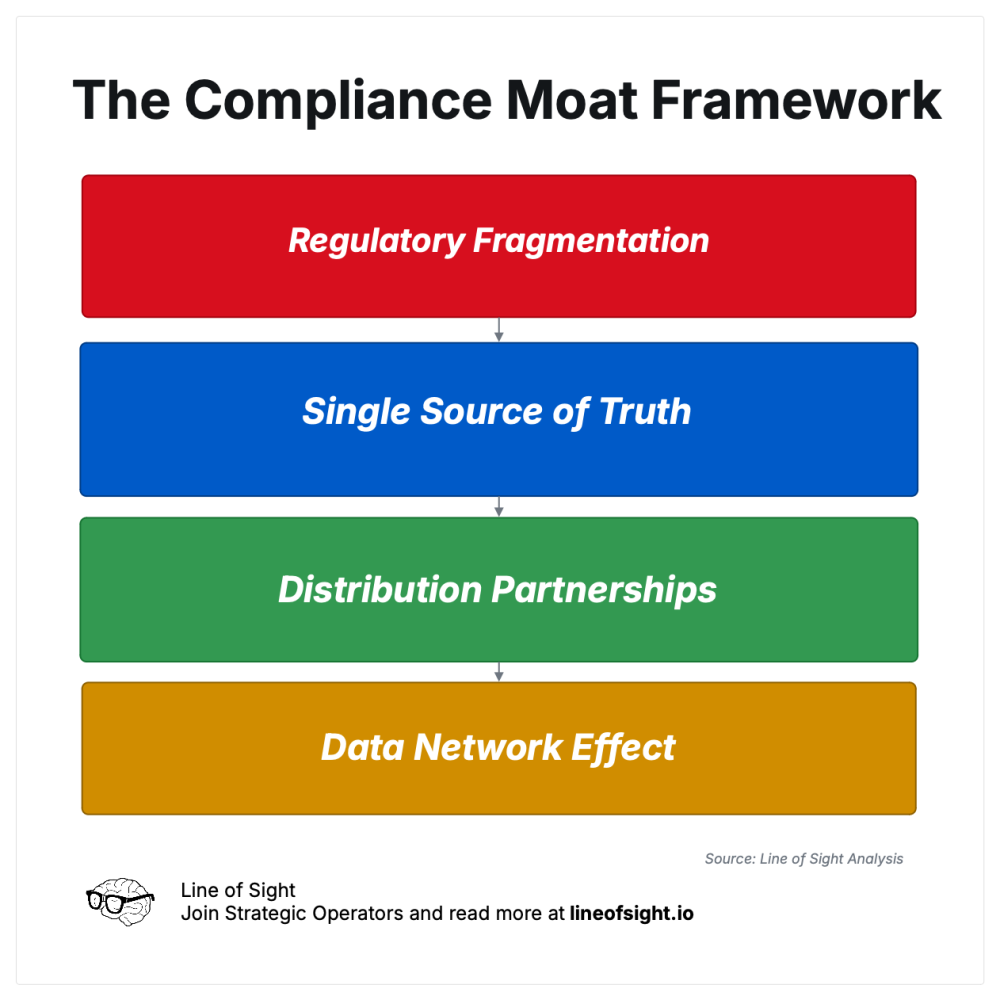

There is a class of billion-dollar startups that do not compete on features. They compete on becoming the invisible, indispensable infrastructure for navigating regulatory complexity. I call this strategy The Compliance Moat.

A compliance moat is a defensible competitive advantage built by embedding a product so deeply into a regulated workflow that it becomes the de facto standard. The moat is not the product itself; it is the network of integrations, the accumulated data, and the high switching costs created by solving a complex, fragmented, and mandatory compliance problem.

Compliance moats are not permanent monopolies. They are time-bound leverage windows created by regulatory fragmentation, and they only become durable if converted into data ownership, distribution control, or workflow lock-in before standards stabilize.

This pattern is visible across four key industries. By examining them, we can uncover a repeatable playbook for building a compliance-driven business.

Four Verticals: Proving the Pattern

1. Crypto Tax Compliance: The Race to Become the System of Record

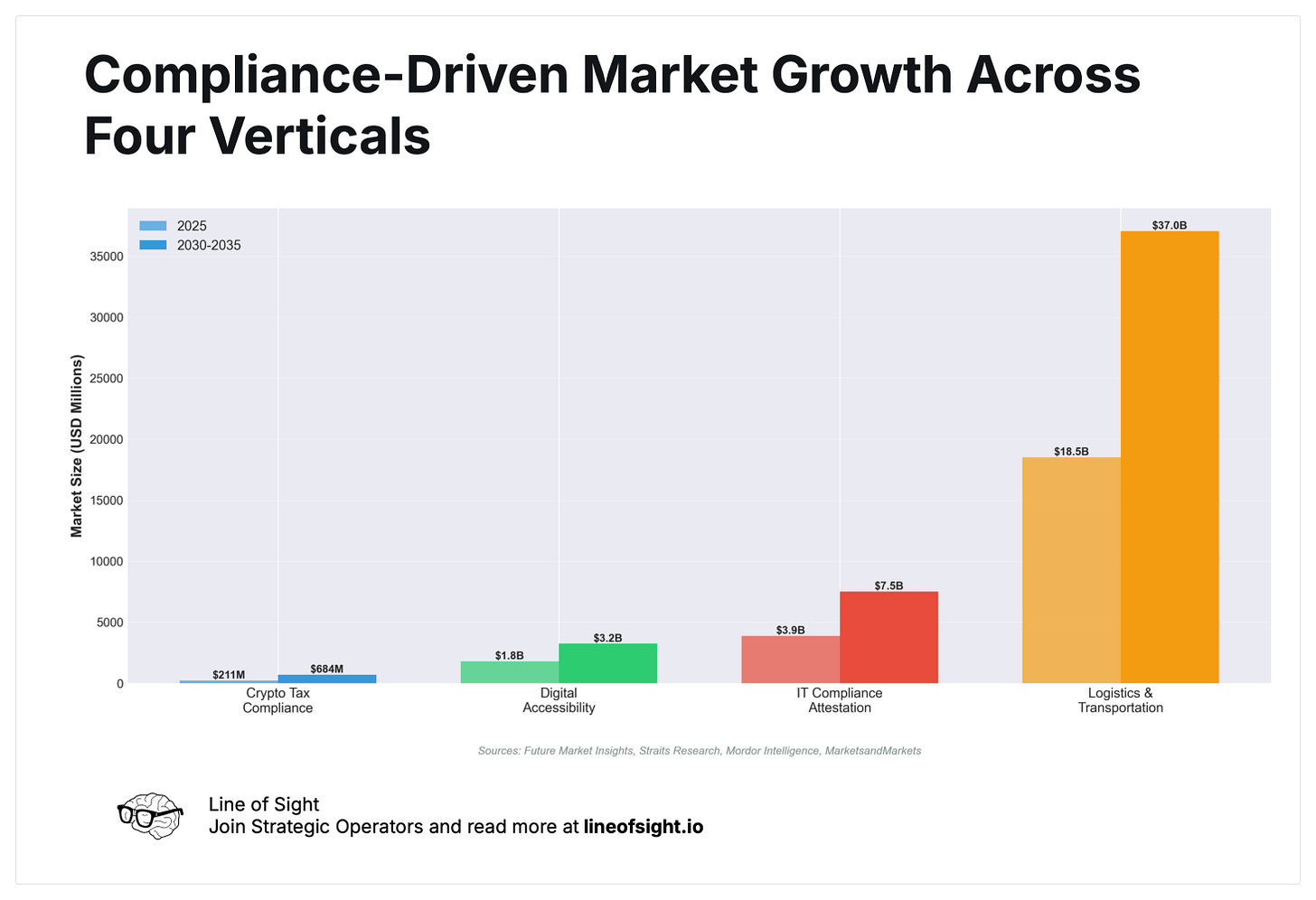

The average crypto user has assets across 10-20 different exchanges and wallets, creating a data aggregation nightmare for tax reporting [1]. This fragmentation fuels the crypto tax software market, projected to grow from $210.6 million in 2025 to $683.9 million by 2035 at a 12.5% CAGR [2].

Companies like CoinTracker, Taxbit, and Koinly are racing to become the single source of truth. CoinTracker’s partnership with Intuit TurboTax is a brilliant moat-building move, making it the default infrastructure for the largest tax software provider. As the IRS introduces Form 1099-DA for digital asset brokers in 2025, the company with the most comprehensive data network will become the undisputed system of record [3].

The USA, UK, Canada, Germany, Australia, France, and India already treat crypto like property or income (as of Dec 2025). This is a CAGR to keep an eye on as many countries clear up, evolve, or begin to enforce tax policies.

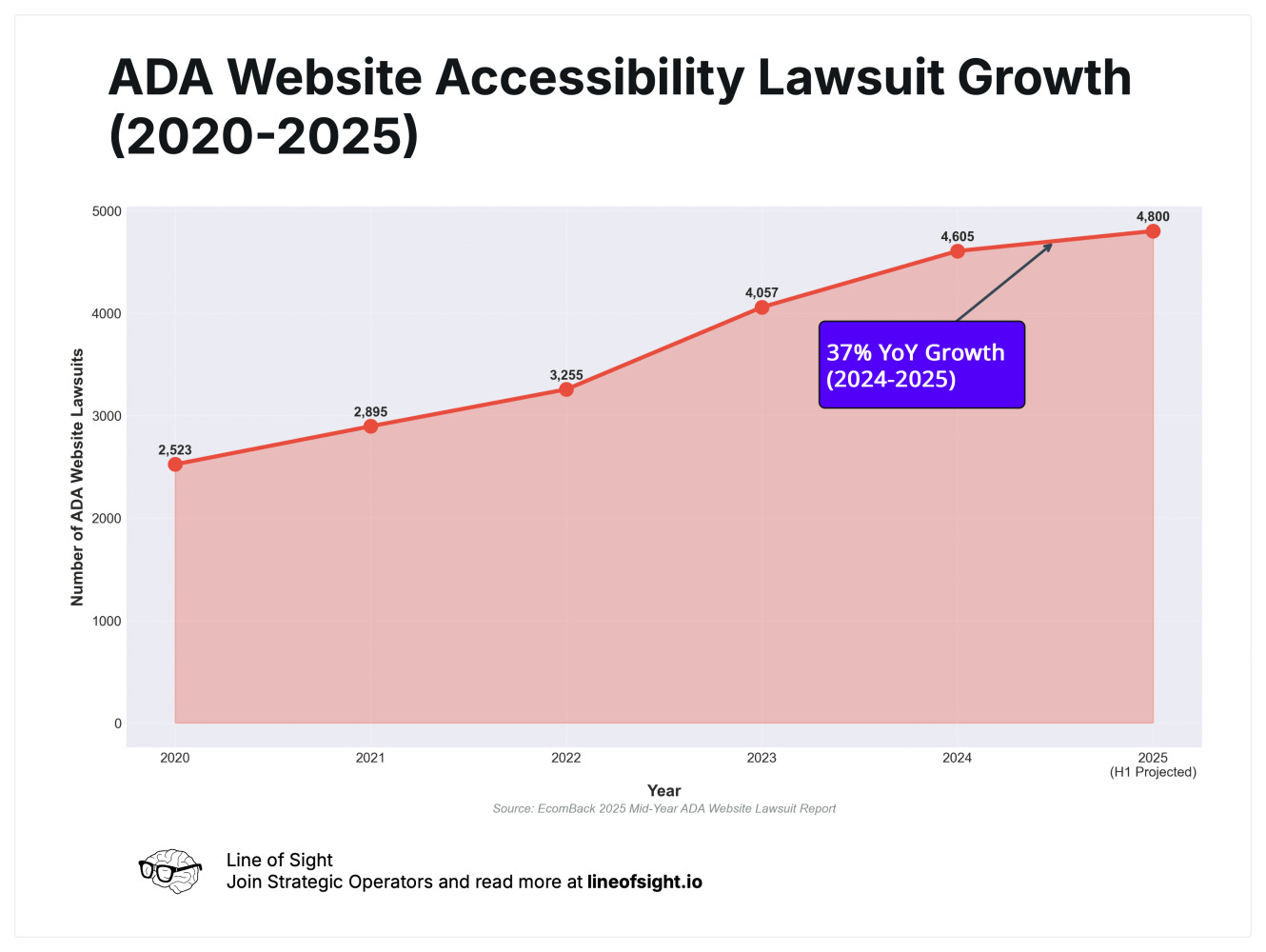

2. ADA Website Accessibility: Turning Legal Risk into a Sticky Product

The Americans with Disabilities Act (ADA) has created a litigious compliance landscape. With over 4,000 ADA-related lawsuits filed annually and a 37% year-over-year increase in the first half of 2025, businesses are desperate for a simple solution [4]. This legal pressure fuels a digital accessibility market projected to reach $3.24 billion by 2034 [5].

Companies like AudioEye and accessiBe build moats by embedding their tools into website builders like WordPress and Shopify. Once installed, the legal risk of removing the tool creates high switching costs, making the product a form of insurance against lawsuits.

The moat is not the regulation itself. It is the speed at which a company exploits regulatory complexity before it collapses into standardization.

3. IT Compliance Attestation: The Enterprise Sales Gatekeeper

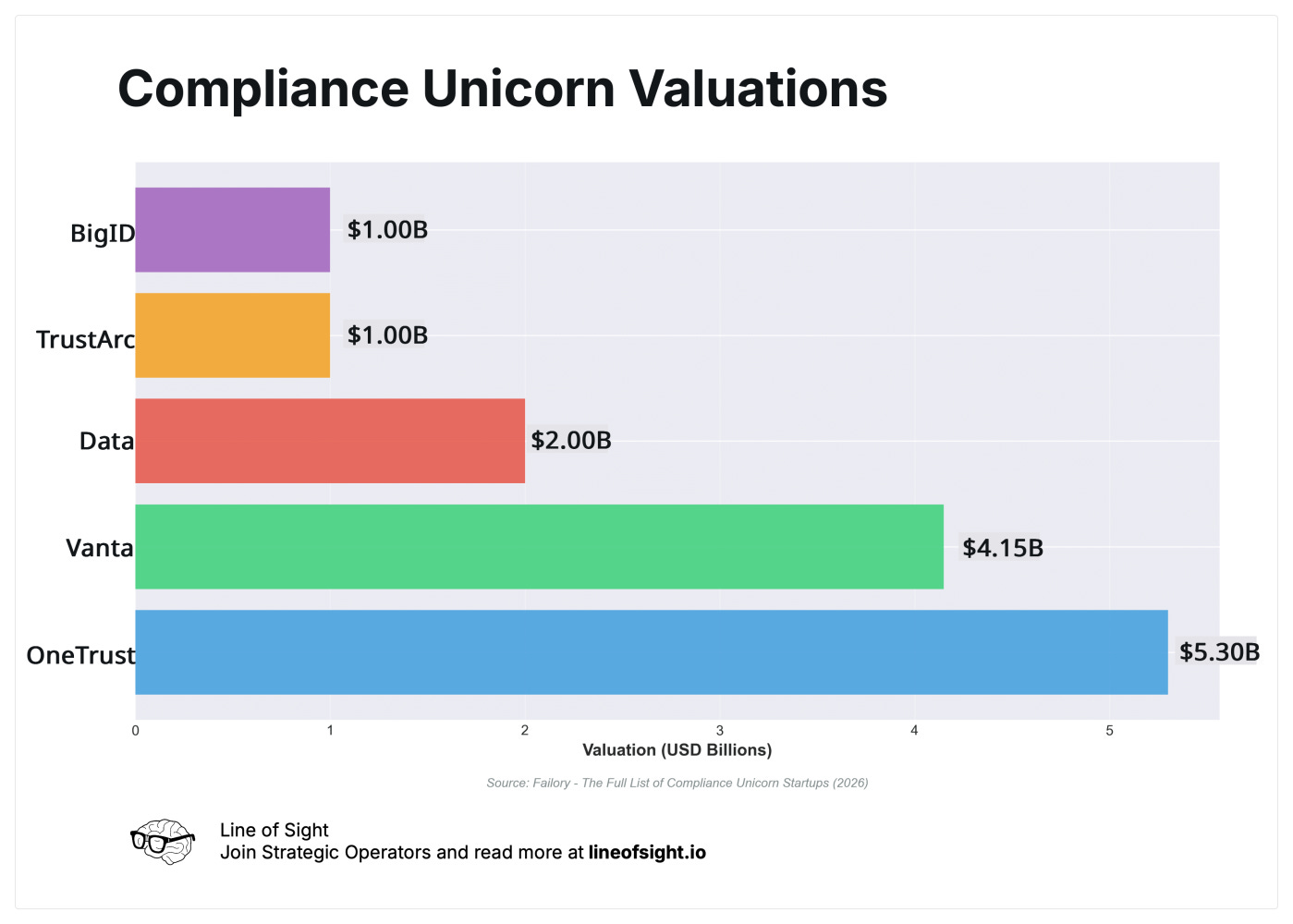

In B2B SaaS, SOC 2 and ISO 27001 compliance are mandatory for selling to enterprise customers. This has created a cybersecurity certification market projected to grow from $3.88 billion in 2025 to $7.50 billion by 2030 [6].

Unicorns like Vanta ($4.15B valuation) and Drata ($2B valuation) have built moats by integrating with cloud providers like Amazon Web Services (AWS) and source code repositories like GitHub [7]. They become the system of record for a company’s security posture, making it incredibly painful to switch to a competitor for the next annual audit. The compliance certificate is the ticket to the enterprise sales game, and these platforms are the gatekeepers.

4. Logistics and Transportation: The Mandate-Driven Moat

The $14.5 trillion logistics industry is a prime example of a mandate-driven moat. The Electronic Logging Device (ELD) mandate requires commercial drivers to use electronic logs to track hours of service, creating an ELD market projected to grow from $15.1 billion in 2025 to $22.4 billion by 2035 [12].

Companies like Geotab and Samsara build moats by providing ELD solutions deeply integrated into trucking workflows. Switching costs are high, requiring hardware reinstallation and data migration. Similarly, freight brokers must maintain a $75,000 surety bond, fueling a transportation management system (TMS) market projected to reach $37.04 billion by 2030 [13] [14].

The Operator’s Dilemma: Build, Buy, or Partner?

I’ve made this decision from the inside, using this lens in live Build, Buy, and Partner decisions, including M&A transactions where compliance architecture materially affected deal outcomes.

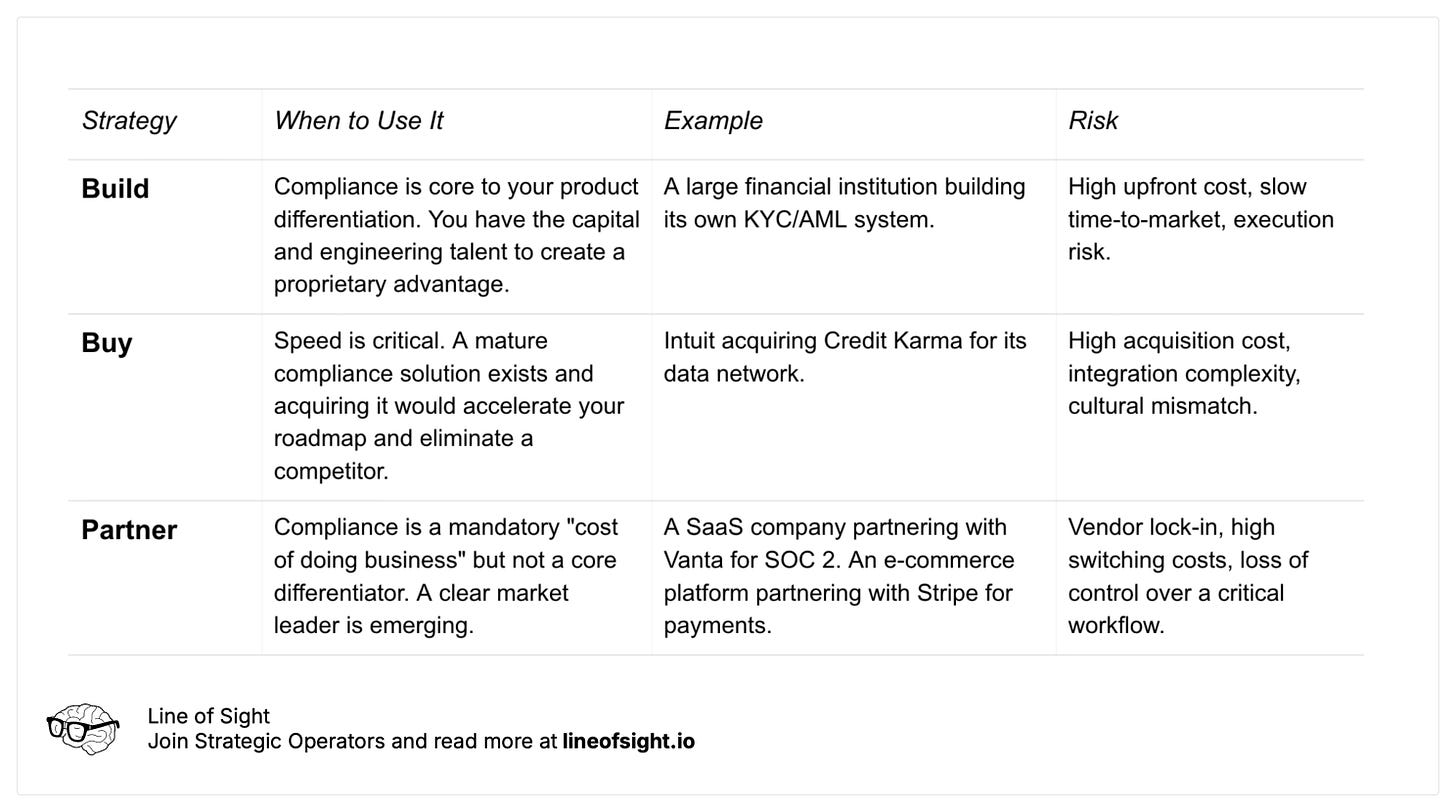

Every new regulation forces a capital allocation decision. For example, when the EU AI Act lands, when crypto tax reporting becomes mandatory, when SOC 2 becomes table stakes for enterprise deals, operators face the same question: do we build this capability, buy a company that has solved it, or partner with infrastructure?

The decision hinges on two factors: whether compliance creates competitive differentiation, and whether a clear market leader has emerged.

Most companies partner. It is faster and cheaper than building, less risky than buying. But partnering creates dependency. Operators who partner without negotiating data rights, exit clauses, or migration paths trade short-term speed for long-term strategic exposure.

The exception: companies where compliance data itself becomes a competitive moat. Plaid owns bank connection infrastructure. Stripe owns payments compliance. For them, building was not optional. When compliance shapes product roadmap, pricing power, or platform trust, building is the only way to avoid ceding strategic control.

Buying is a high-risk, capital-intensive move reserved for strategic market consolidation or reclaiming control after a partnership proves too constraining.

AI: The Moat Builder & The Moat Breaker

The EU’s AI Act will create a $9.5B AI governance market by 2035, a 15.8% CAGR . Penalties up to 7% of global turnover will drive adoption. This creates a new generation of compliance moats around AI model auditing and validation.

But AI is also a moat breaker. It automates the complexity that sustains existing moats. AI can classify crypto transactions. It can audit websites for ADA compliance in real-time. It can monitor cloud infrastructure for SOC 2. Startups using AI will offer faster and cheaper solutions. The moats built on manual data aggregation are the most vulnerable.

Most incumbents will not be disrupted by better competitors. They will be disrupted when weeks of compliance work collapse into minutes and their accumulated friction evaporates.

The compliance moats that survive AI are not those built on process complexity, but those anchored in trust, audit authority, and irreversible workflow adoption.

The Question for the Next Decade

Compliance moats are not permanent. They require continuous reinvestment and adaptation. The tension is this: companies profit from complexity, but customers want simplicity. The best operators navigate this paradox. They make compliance easier for customers while building deeper moats. The question for the next decade of founders: are you building a new compliance moat, or are you the AI-powered startup that will tear the old one down?

For operators, the real advantage is not building better software. It is becoming the standard every other participant is forced to route through before regulation simplifies the game again.

Line of Sight delivers frameworks on AI, strategy, and growth systems for VP and C-suite operators. Written by Kyle Kelly. No theory. No hype. Just repeatable models that scale. Subscribe at lineofsight.io

References

CoinTracker. “2024 Crypto Tax Report”.

Future Market Insights. “Crypto Tax Software Market”.

Internal Revenue Service. “Digital Assets”.

EcomBack. “2025 Mid-Year ADA Website Lawsuit Report”.

Straits Research. “Digital Accessibility Software Market”.

Mordor Intelligence. “Cybersecurity Certification Market”.

Failory. “The Full List of 18 Compliance Unicorn Startups (2026)”.

European Commission. “Artificial Intelligence Act”.

European Commission. “Article 99: Penalties”.

Future Market Insights. “Enterprise AI Governance and Compliance Market”.

European Commission. “Article 16: Obligations of Providers of High-Risk AI Systems”.

Future Market Insights. “Electronic Logging Device Market”.

Federal Motor Carrier Safety Administration. “Broker and Freight Forwarder Financial Responsibility Rule Overview and Compliance”.

MarketsandMarkets. “Transportation Management System Market”.