Intuit: The Invisible AI Company

Why Intuit built one of the most powerful AI platforms in the world without talking about it.

Hi, I’m Kyle Kelly. Each week, Line of Sight breaks down how AI, strategy, and growth architecture turn complexity into leverage.

This week, I analyzed Intuit’s recent Investor Day presentation. While companies announce new AI releases every week, I’ve been thinking about what separates announcements from execution. Everyone talks about copilots and features, but the real advantage is infrastructure, data, and compounding capabilities.

I break down the invisible AI company, how to spot one before the market does, and why infrastructure always beats announcements.

The Great AI Disconnect

For the last two years, the technology world has been obsessed with a single narrative: the AI announcement. Companies raced to launch copilots, integrate generative AI features, and issue press releases declaring their AI-powered future. This created a wave of market noise, but it also created a massive disconnect between perception and reality.

While everyone was watching the show, a 40-year-old software company was quietly building one of the most powerful and deeply integrated AI platforms in the world. You probably did not notice. And that is the entire point.

Intuit is what it looks like when AI stops being a product and becomes the operating system. While everyone else was selling copilots and demo videos, Intuit built a self-improving machine that quietly runs the financial lives of 100 million people. It makes 60 billion predictions a day, processes two trillion dollars in invoices a year, and learns from every transaction across tax, payroll, and payments.

No press tour. No AI hype cycle. Just execution.

This is what the next generation of software looks like: invisible, autonomous, and obsessed with outcomes, not interfaces.

Inside the Machine

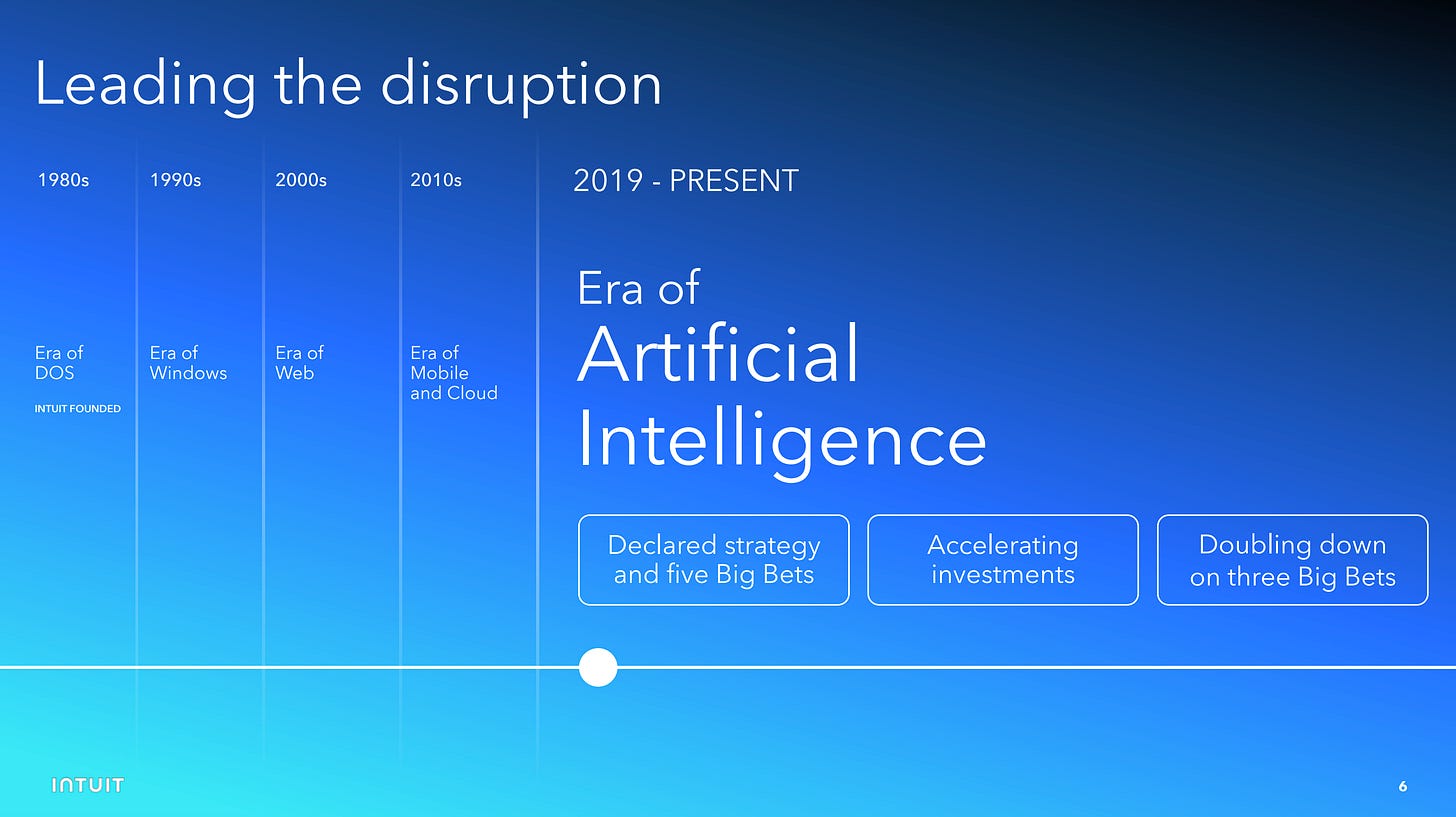

The difference between an AI feature and an AI platform is measured in infrastructure. While many companies were rebranding existing products with .AI domains and labels, Intuit was building the engine. The company declared its AI strategy back in 2019, and the results presented in 2025 are not just promises. They are proof of a deep, systemic transformation.

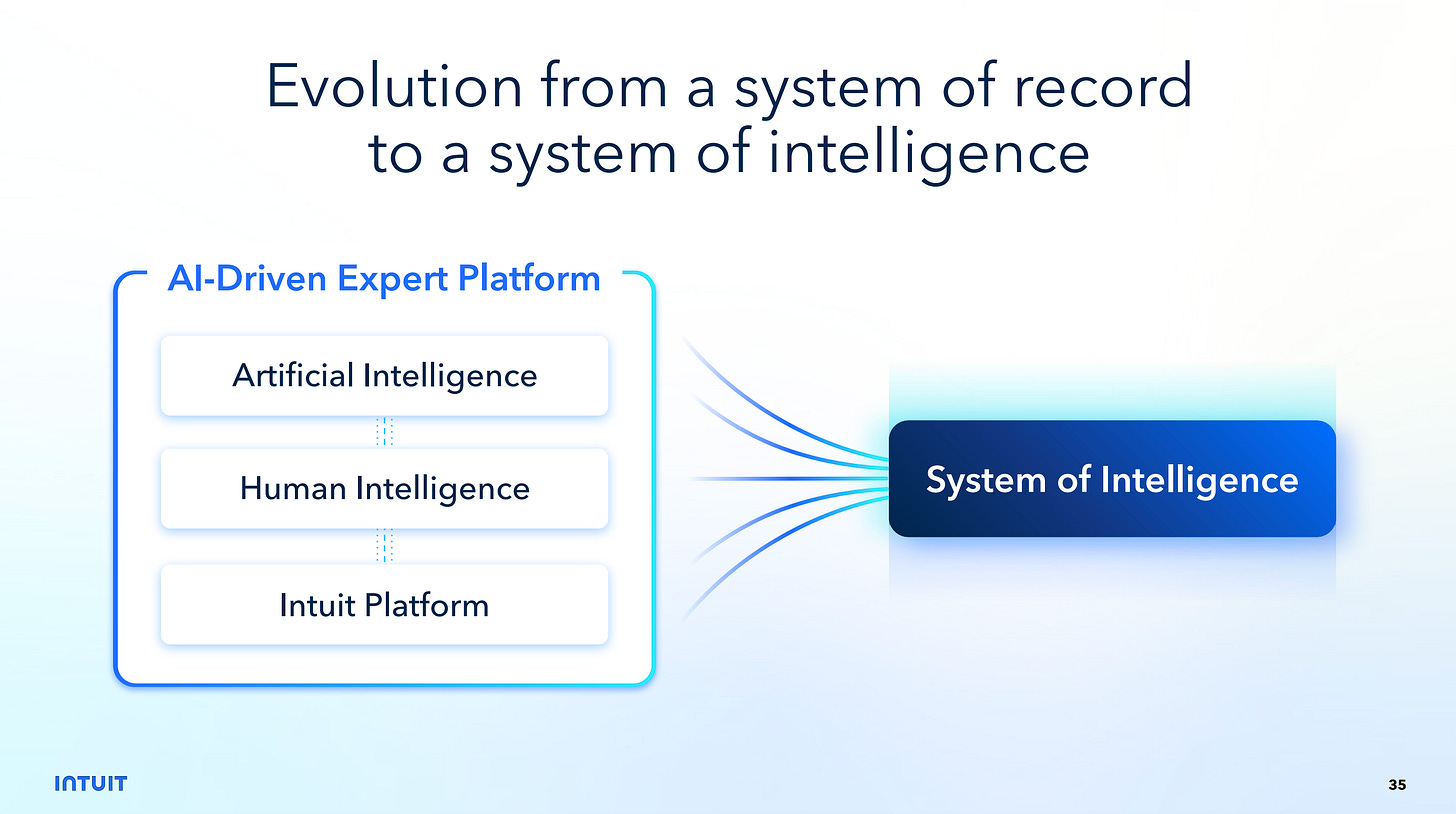

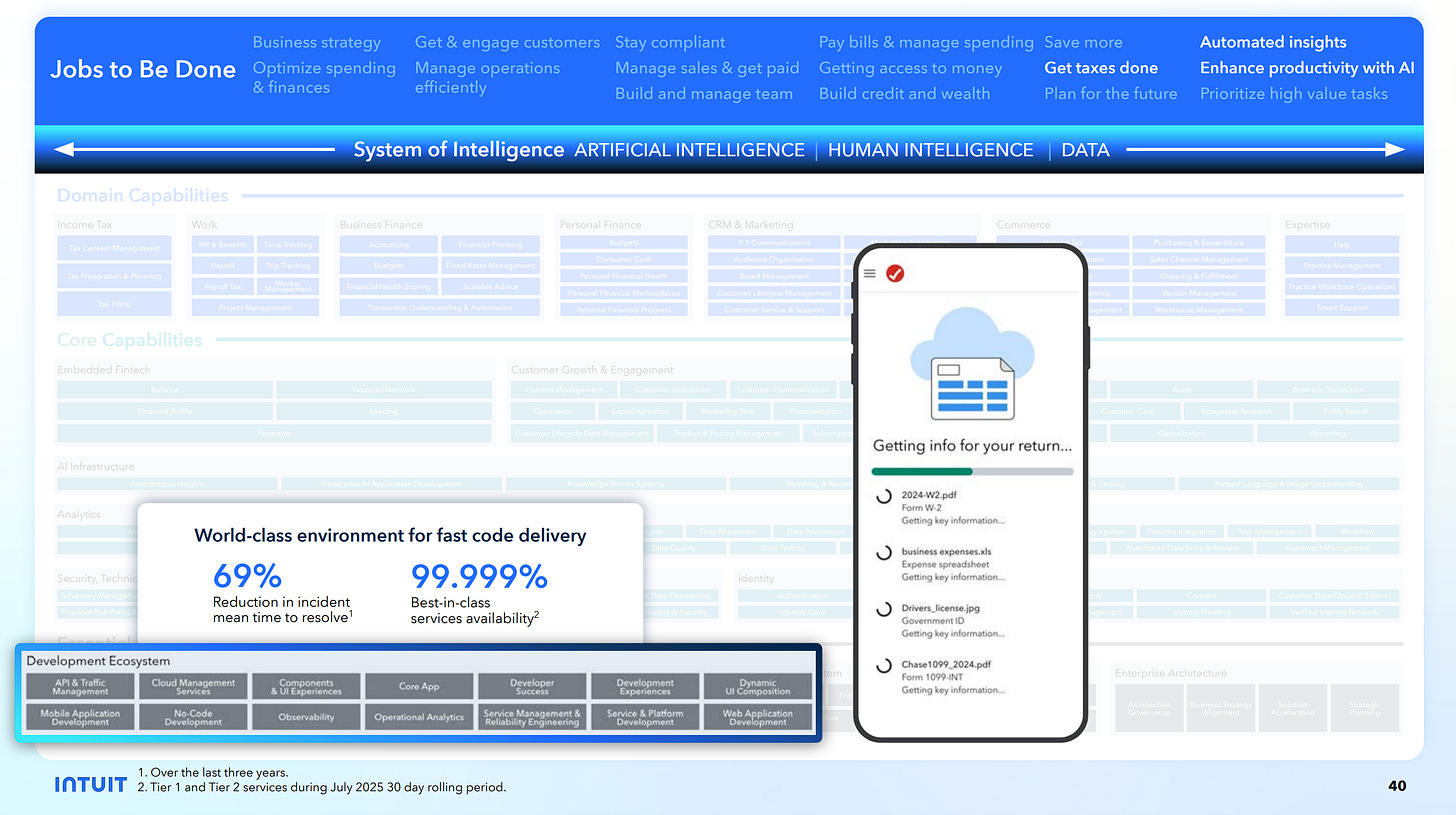

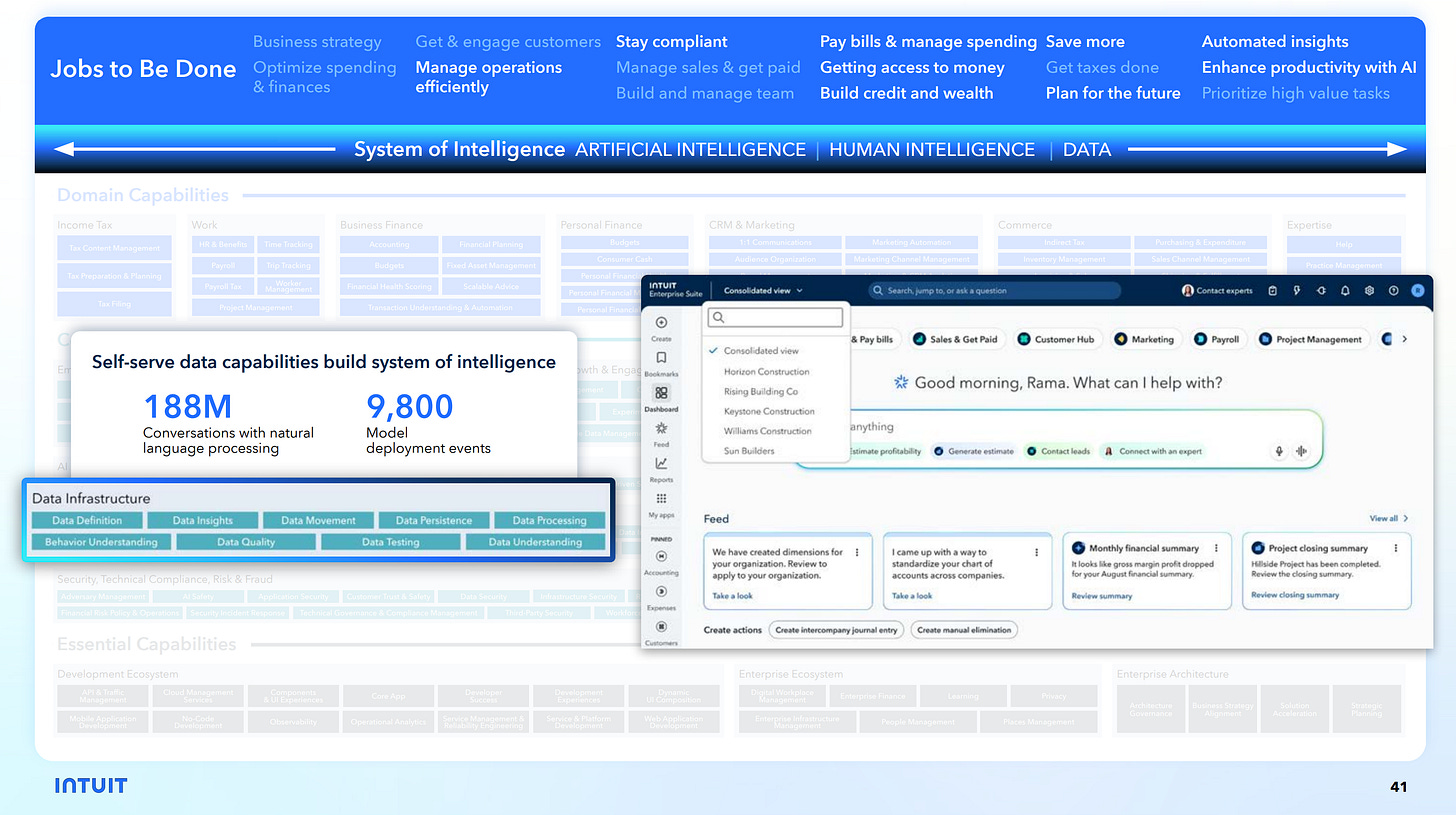

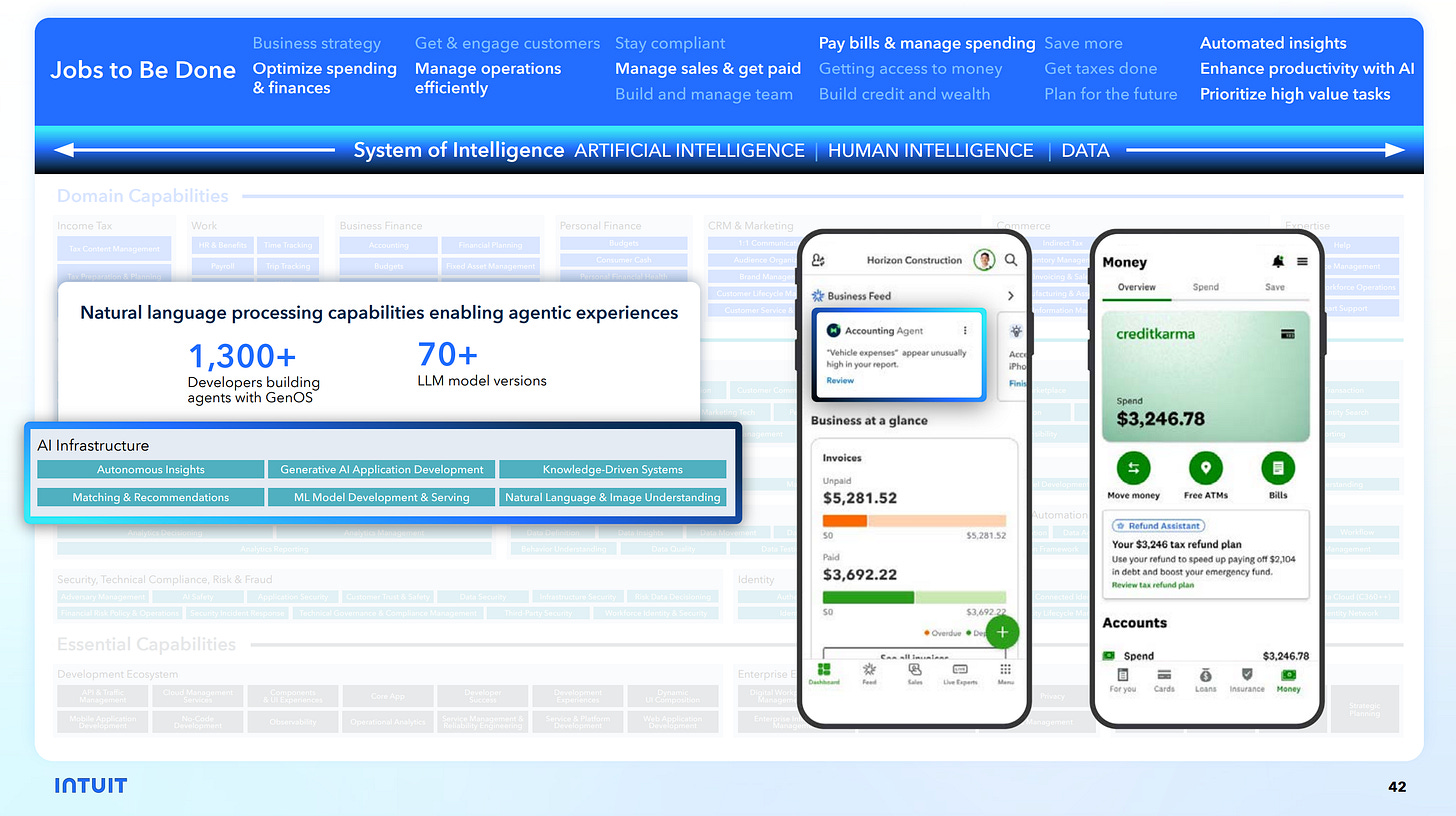

Intuit’s core strategy is to become a “System of Intelligence.” This is not a marketing slogan. It is an architectural framework that combines artificial intelligence, human intelligence (from their network of experts), and a massive, proprietary data asset. This system is designed to solve a core problem for its customers: the over-digitization of their lives. The average small business uses between 7 and 25 different applications, creating data silos and operational friction. Intuit’s goal is to solve this with a single, integrated platform that automates work and provides predictive insights.

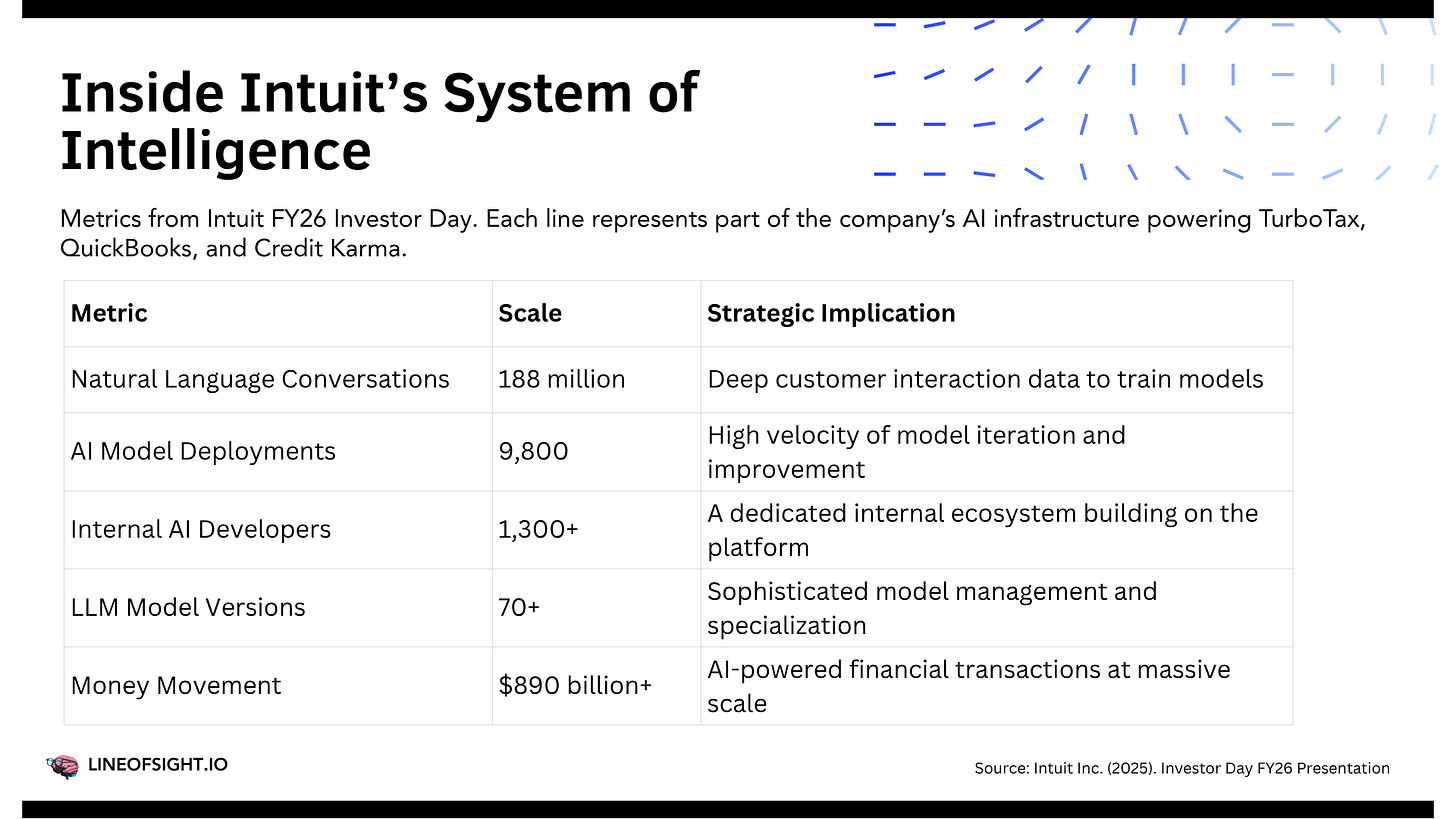

Let’s look at the numbers that prove this is not just a story. These are the metrics of a true AI platform, not a company with a few AI features.

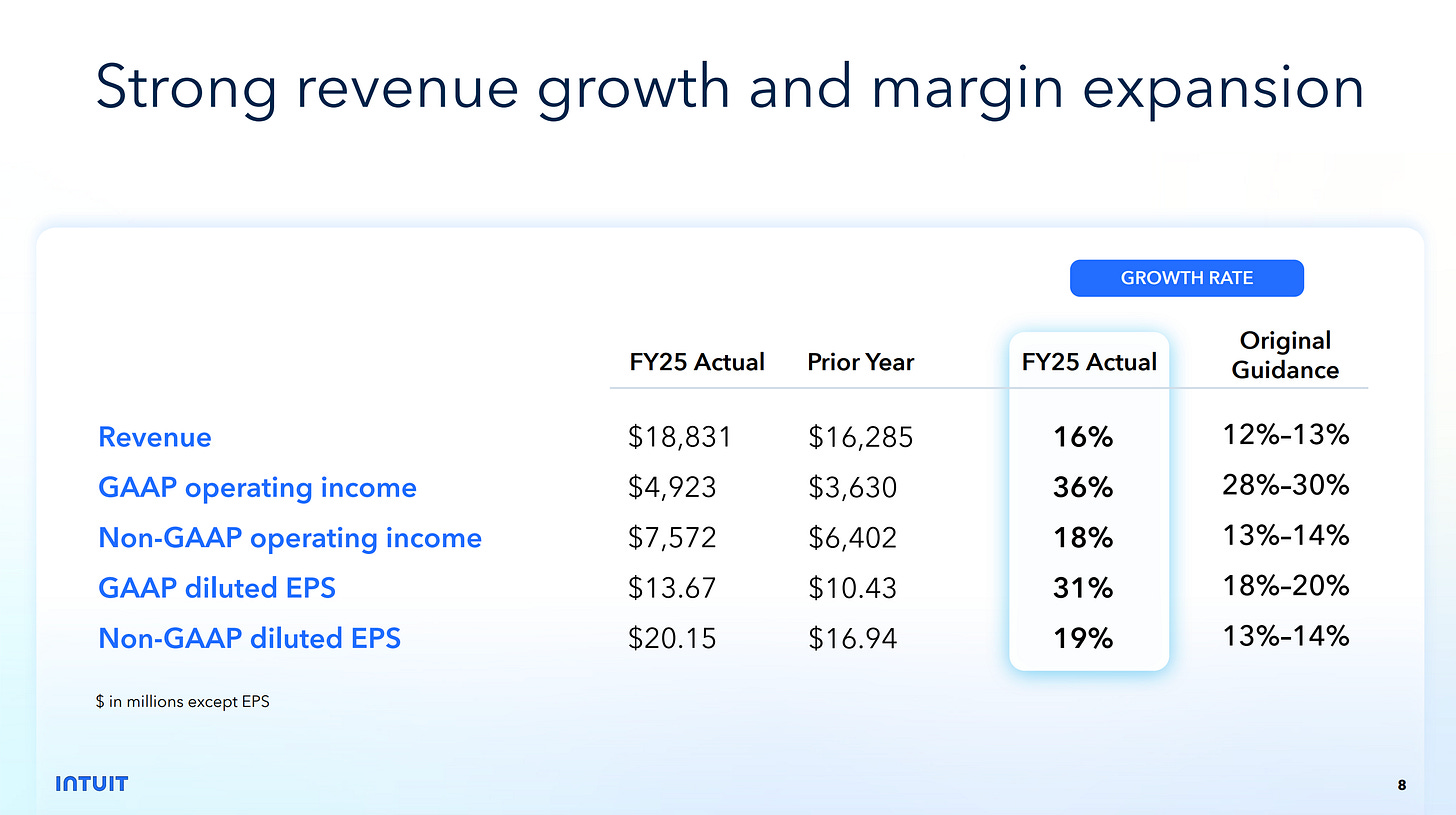

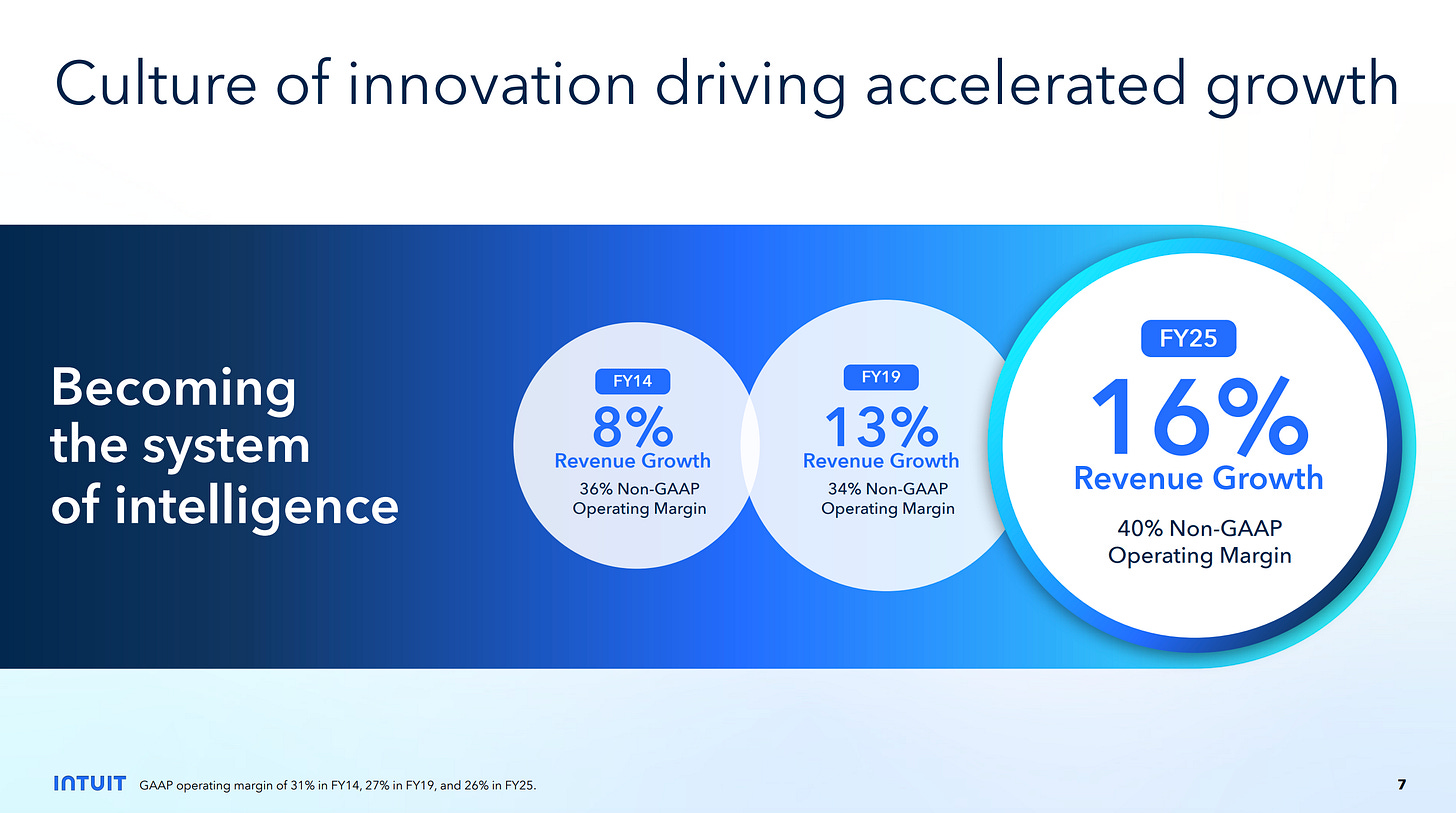

The results of this infrastructure are not just technical. They are financial. Intuit has accelerated its revenue growth from 8% in fiscal year 2014 to 16% in fiscal year 2025, while expanding its non-GAAP operating margin to a remarkable 40%. This is what happens when AI is your operating system, not just a feature.

Infrastructure Wins

The repeatable insight from Intuit’s quiet reinvention is simple but powerful: the most durable advantage in the AI era is infrastructure, not announcements.

Companies that win the next decade will not be the ones that make the most noise. They will be the ones that build the deepest, most integrated platforms. These platforms become a compounding advantage. More data leads to better models. Better models lead to better products. Better products attract more users, who generate more data. This is the flywheel that separates the AI haves from the have-nots.

Intuit’s strategy reveals a critical distinction. Many companies treat AI as a feature to be bolted on. Intuit treats AI as the foundation upon which everything is built. Their internal development platform, GenOS, allows over 1,300 developers to build AI agents and experiences. They are not just using AI. They are enabling their entire organization to build with it.

This leads to a second principle: real AI companies focus on capabilities, not just copilots. While a copilot is a user-facing feature, a capability is a deep, systemic strength. Intuit has built capabilities across a wide range of domains, from income tax and payroll to marketing and commerce. This allows them to deliver automated, personalized, and predictive experiences that solve real customer problems, not just provide a conversational interface.

P.S. I’ve built similar frameworks to the one above to identify platform opportunities, evaluate M&A targets, and assess partnership integrations. This is how you separate companies building infrastructure from those building features.

How to Spot an Invisible AI Company

As an operator, investor, or strategist, your most valuable skill is separating signal from noise. The market is flooded with AI announcements, but the real opportunities are often hidden in plain sight. Here is a playbook for identifying the next invisible AI company, using Intuit as a model.

1. Look for Infrastructure Metrics, Not Product Announcements

Forget the press releases. Dig into investor presentations, technical blogs, and conference talks. Look for metrics that reveal the scale of the underlying platform.

•How many models are in production?

•How many developers are building on the platform?

•What is the volume of API calls or data processed?

2. Follow the Data, Not the Hype

Proprietary data is the fuel for any AI engine. Identify companies that have a unique, compounding data asset that is difficult to replicate. Intuit’s decades of financial data from millions of customers is a moat that no startup can easily cross.

3. Analyze the Business Model, Not Just the Technology

Real AI companies show the impact of their platform on the bottom line. Look for evidence of accelerating revenue growth, expanding margins, and increasing customer retention. AI should not just be a cost center. It should be a growth engine.

4. Find the Flywheel

Map out the company’s data flywheel.

•How does the product generate data?

•How is that data used to improve the product?

•How does that improvement attract more users?

If you cannot clearly articulate this loop, there is no compounding advantage.

Who Is Next?

Intuit provides a powerful case study in how to build a durable AI advantage through quiet, relentless execution. They focused on building the engine while everyone else was polishing the paint job. Their success is a reminder that in the AI era, what you do is more important than what you say.

The critical question for every operator and strategist now is: who is next? What other established companies are quietly transforming their infrastructure to become invisible AI powerhouses? The winners of the next decade will be the ones who can answer that question before the rest of the market catches on.

If you are a founder or operator, study this playbook:

Data is the new distribution. Trust-based data loops drive compounding insight.

Automation is the new UX. The less your user does, the higher your product value.

Trust is the new moat. If you own the user’s confidence, you own the stack.

The best AI companies will not need to announce their intelligence.

They will simply run the world quietly, one automated workflow at a time.

The invisible AI company wins because it builds while everyone else talks.

References

[1] Intuit Inc. (Sep 18, 2025). Investor Day FY26 Presentation

Subscribe to Line of Sight for insights built for operators like us.