Turning Partnerships Into a P&L System

Hi, I’m Kyle Kelly. Each week Line of Sight breaks down how AI, strategy, and revenue growth architecture turn complexity into leverage.

You all know I’m obsessed with how partnerships actually create value.

Not the logos, co-marketing, or handshakes, but the systems that turn collaboration into compounding revenue.

I’ve led teams that built partner ecosystems from zero to scale, and the pattern is clear. Partnerships consume capital like cost centers, but the best teams treat them like investment portfolios.

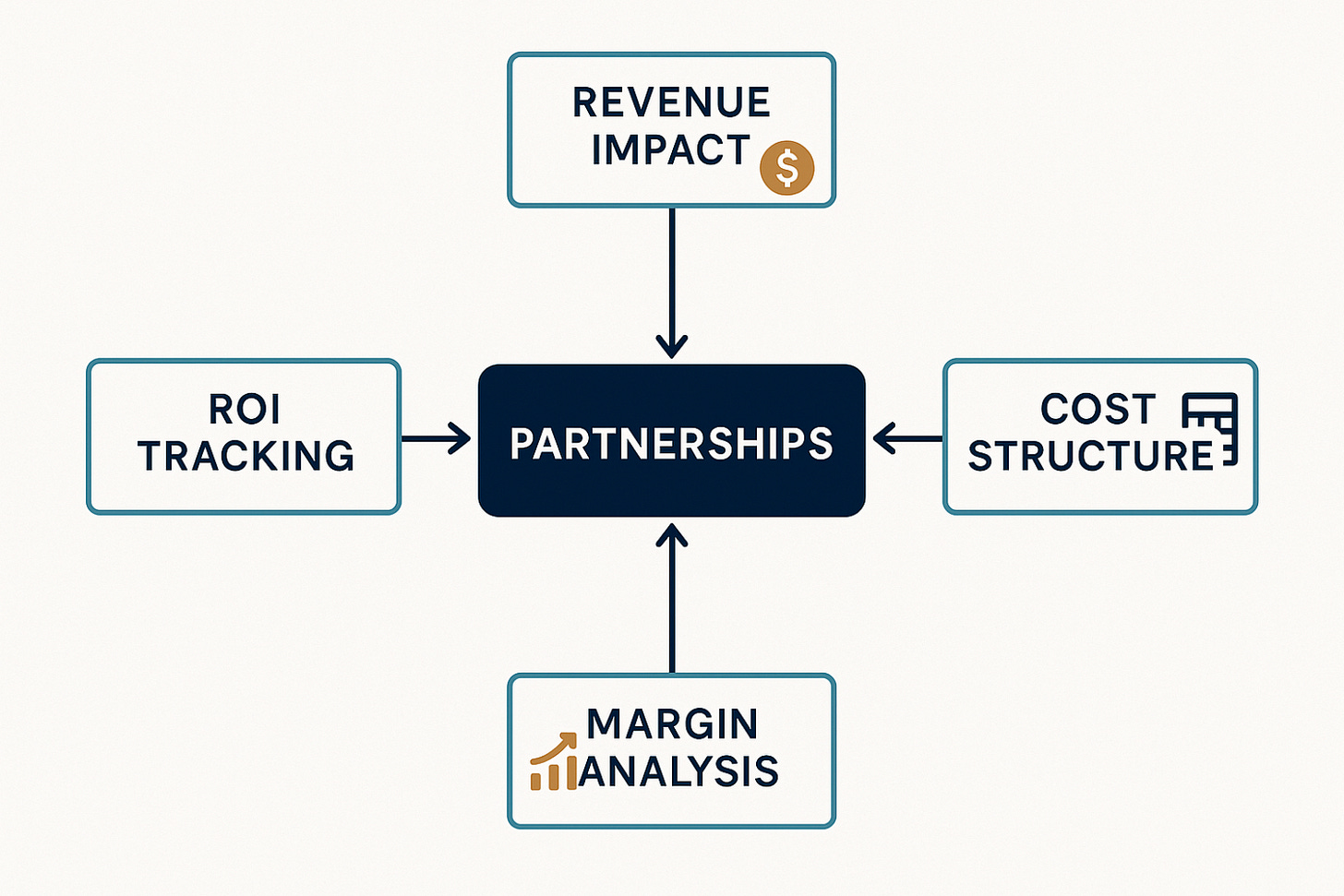

This week, I break down how to quantify that difference and use the Partner Leverage Ratio to turn partnerships into a true P&L system.

Most partnership teams track activity. Few measure leverage.

The difference determines whether partnerships scale like marketing channels or investment portfolios.

Activity metrics count logos, signed agreements, and quarterly partner adds. Leverage metrics measure output per unit of input. The first approach treats partnerships as a marketing function. The second treats them as a capital allocation problem.

The best partnership organizations operate like investment portfolios. They deploy resources (product, design, engineering, spend, and people) against measurable returns and optimize for efficiency at scale.

The Capital Efficiency Problem

Partnerships consume significant resources. According to benchmark data from Partnership Leaders and PartnerHacker’s State of PartnerOps Report, mature SaaS companies typically allocate between 8 to 12 percent of revenue to partner operations, including headcount, MDF, enablement, and technology.

Yet most partnership leaders cannot answer a basic question: What is the ROI per dollar invested in the partner channel?

This is not a measurement gap. It is a systems gap.

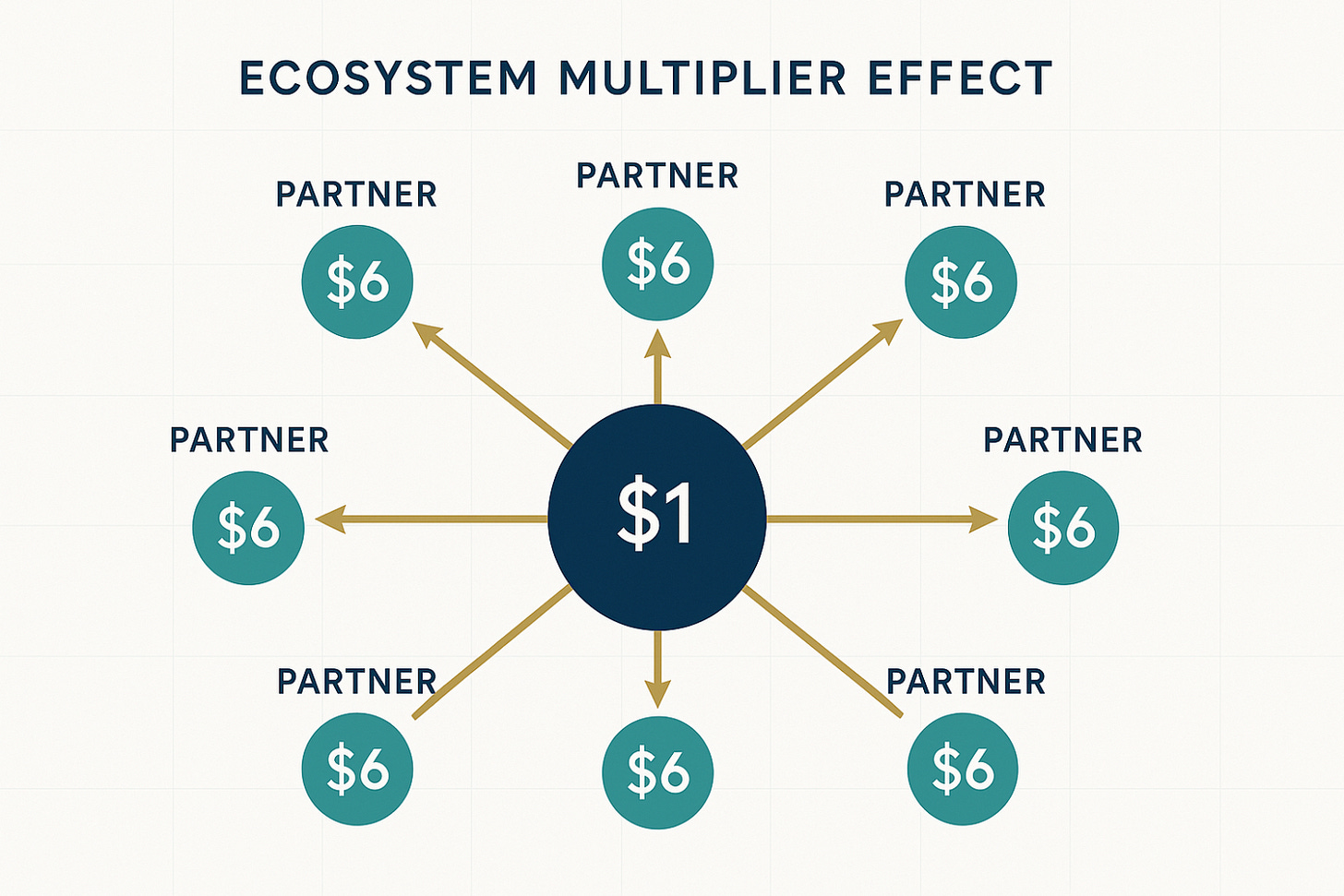

The best ecosystems generate asymmetric returns. Salesforce’s partner network produces $6.19 in partner revenue for every $1 Salesforce earns [1]. Aurora Solar has built a platform where financing, design, and equipment partners are embedded directly into the workflow, creating switching costs that drive retention.

ServiceTitan, Snowflake, Databricks, and Shopify demonstrate the same pattern. ServiceTitan reports net dollar retention above 110 percent and significant engagement across its integration ecosystem, suggesting strong partner influence on retention. Snowflake’s Data Cloud network has expanded from roughly 600 partners in 2022 to more than 12,000 worldwide, highlighting the pace of marketplace growth. Databricks’ Partner Connect program enables customers to integrate dozens of technology providers, reinforcing how usage-based revenue models benefit from ecosystem adoption. Shopify’s App Store now features over 8,000 apps that drive billions in merchant revenue, showing how platform extensibility compounds partner-led growth.

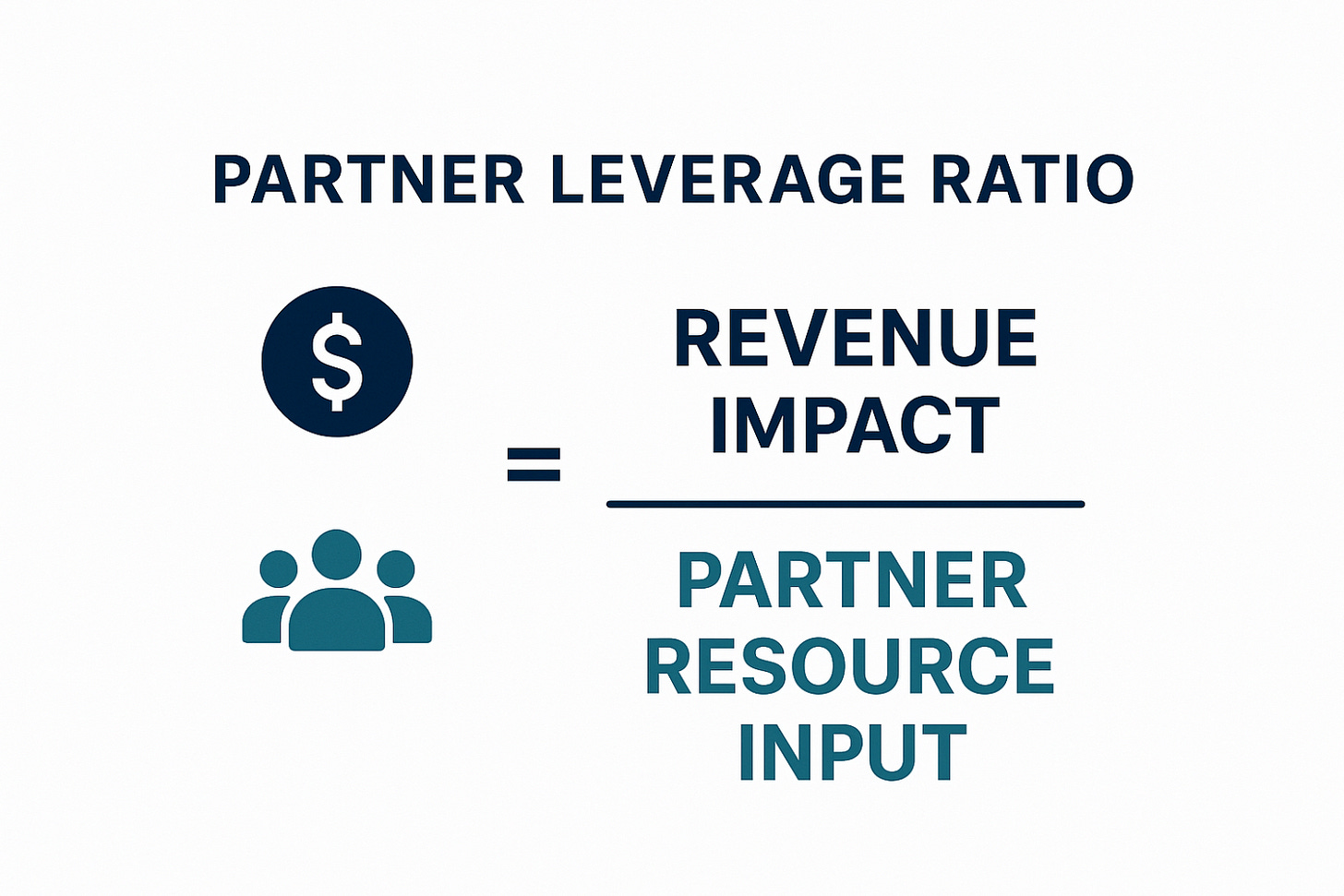

Defining the Partner Leverage Ratio

Partnerships Run on Relationships, but They Scale Through Systems

To manage partnerships like a financial system, you need a core efficiency metric. I call this the Partner Leverage Ratio. The Partner Leverage Ratio connects both, measuring trust’s financial output.

The formula is straightforward:

Partner Leverage Ratio = Total Revenue Impact ÷ Total Partner Resource Input

Revenue impact includes all revenue sourced, influenced, or driven by partners. Resource input includes fully loaded costs: salaries, MDF, technology, and overhead.

A ratio of 3:1 means every dollar invested in partnerships generates three dollars in revenue impact.

A ratio of 10:1 suggests a highly efficient system.

A ratio below 2:1 indicates structural inefficiency.

The math is simple. The discipline isn’t. Measuring leverage requires consistent attribution and a shared definition of “partner impact.”

This metric does three things:

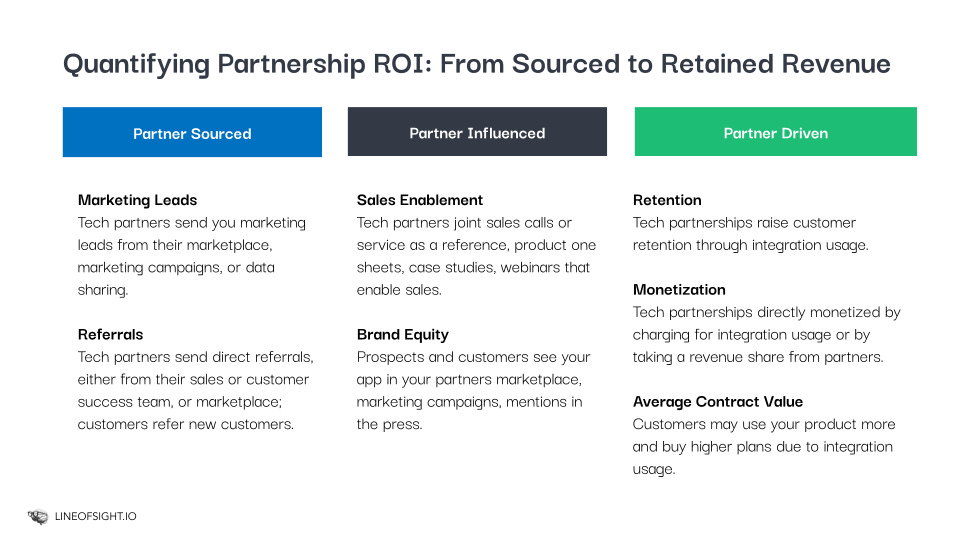

It forces clarity on attribution. You must define what counts as partner-sourced, partner-influenced, and partner-driven revenue.

It exposes cost structure. Most teams underestimate the true cost of partner operations.

It enables optimization. You can compare leverage across partner types and reallocate resources accordingly.

Early-Stage Partnerships Behave Differently

Early-stage partnerships behave like venture investments, inefficient by design. The goal is not short-term ROI but compounding returns over time. The aim should be to arrive at this level. You will not see this efficiency bias if you are in a 0 to 1 build out of team and systems. If you are reading this and that is your stage, everything from here on is aspirational of what can be.

Three Types of Partner Revenue

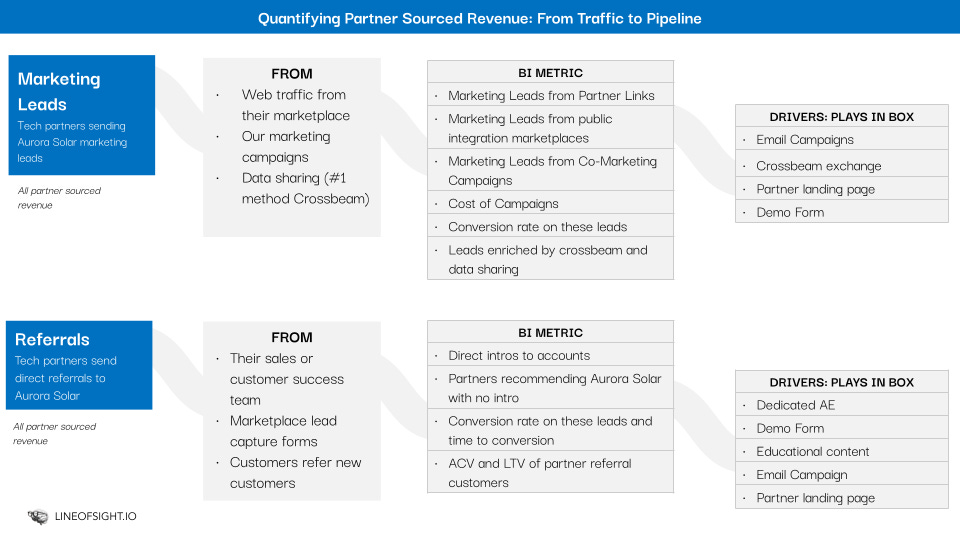

Partner Sourced: Direct referrals and marketing leads.

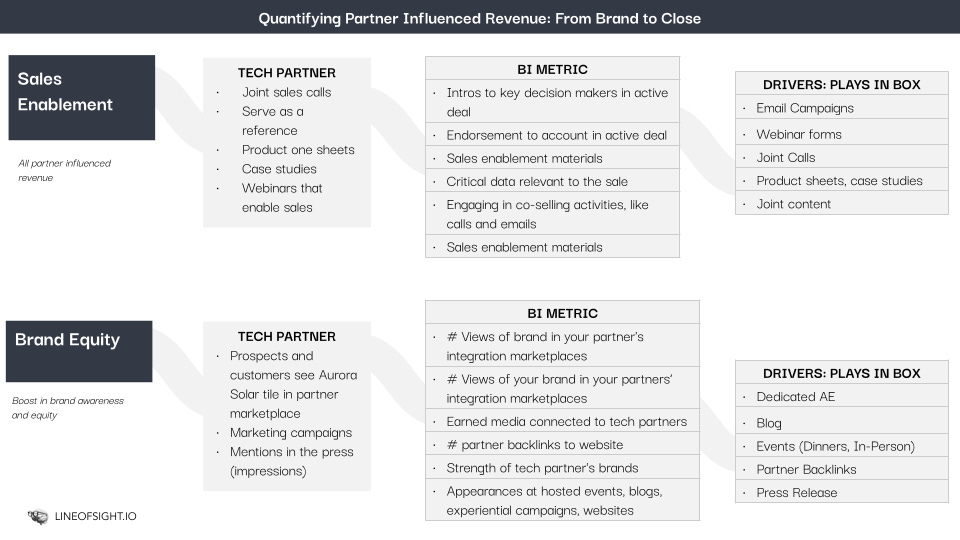

Partner Influenced: Sales enablement, co-selling, and brand equity.

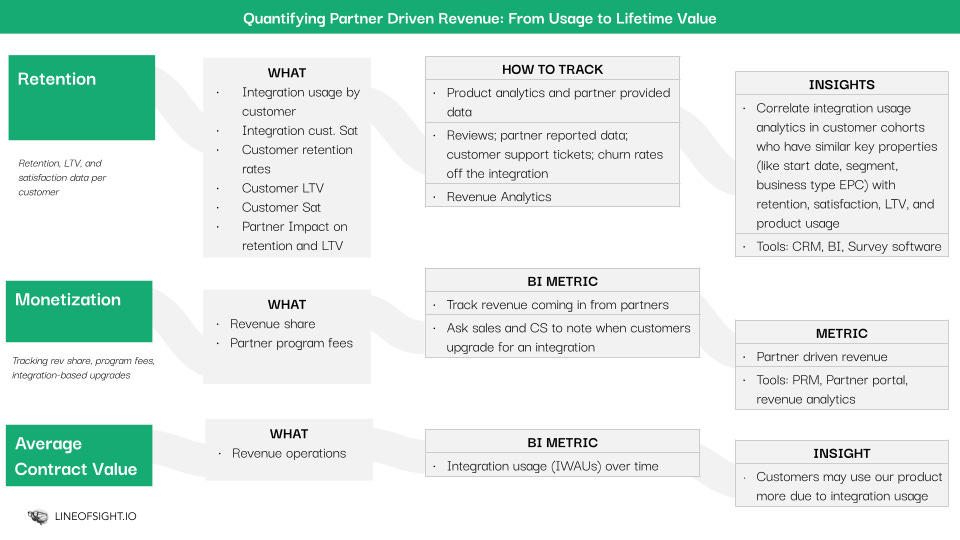

Partner Driven: Integration usage, retention lift, and ACV expansion.

Three Methods to Measure Leverage

1. Calculate ROI by Partner Type

Not all partners deliver the same return. Segment your ecosystem into three categories: referral partners, integration partners, and reseller partners. Track revenue and cost for each.

In most SaaS companies, integration partners deliver the highest leverage. They drive retention and expansion with minimal ongoing cost. Referral partners generate pipeline but require continuous enablement. Resellers scale reach but compress margins.

Knowing this allows you to allocate resources like a portfolio manager.

Partner Sourced: Direct referrals and marketing leads.

Partner Influenced: Sales enablement, co-selling, and brand equity.

Partner Driven: Integration usage, retention lift, and ACV expansion.

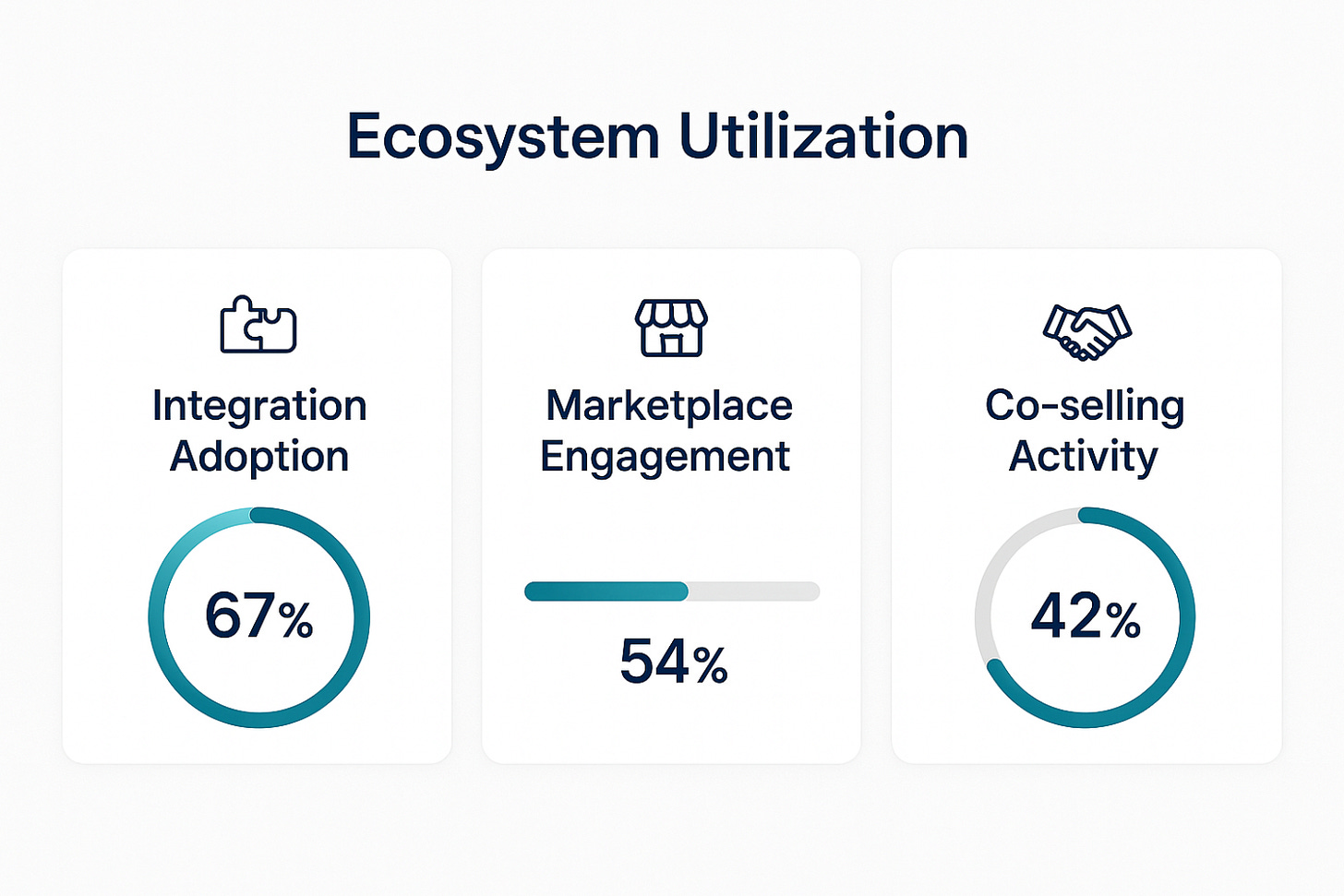

2. Track Ecosystem Utilization Rate

A partner ecosystem only creates value if customers use it. Utilization rate measures engagement across three dimensions:

Integration Adoption: Percentage of customers with at least one active integration.

Marketplace Engagement: Traffic, installs, and conversion from your app marketplace.

Co-selling Activity: Number of joint sales calls, deal registrations, and partner-assisted wins.

Low utilization indicates a discoverability problem or a value mismatch. High utilization correlates with retention and net dollar retention expansion. Ecosystem utilization connects directly to retention and is the clearest signal of partner value creation.

3. Use Predictive Models to Allocate Resources

The most advanced partnership teams use historical performance data to forecast partner productivity. Machine learning models can predict which partners will scale, which will plateau, and which require intervention.

This allows you to:

Prioritize recruitment based on partner archetype fit.

Identify at-risk partners before they churn.

Allocate enablement resources to the highest-yield opportunities.

Predictive allocation turns partnerships from a reactive function into a proactive growth engine. Few teams are here yet, but the path is clear. Data visibility and partner telemetry are the precursors to predictive allocation.

Implications

Partnerships are not a marketing function. They are a capital efficiency system.

When you measure leverage instead of activity, three things change:

First, you gain executive credibility. CFOs and boards understand ROI. They do not understand “strategic relationships.” Speaking in terms of leverage ratios and capital efficiency aligns partnerships with how the business is actually managed.

Second, you optimize resource allocation. You stop spreading resources evenly across all partners and start concentrating investment where returns are highest.

Third, you build a compounding system. High-leverage partnerships create network effects. Integration partners drive retention. Retention increases LTV. Higher LTV justifies more investment in the ecosystem. The flywheel accelerates.

The companies with the strongest ecosystems treat partnerships as a measurable business system, not a relationship-building exercise.

Leverage is the new ROI.

The next evolution of partnerships will be quantified, not guessed. The question is: who inside your company will build the first real Partner P&L?

References

[1] Salesforce. (2025). Salesforce’s Ecosystem: The Driving Force Behind Its Unprecedented Success.

Subscribe to Line of Sight for insights built for operators like us.