Motive’s IPO Blueprint: S-1 Teardown

How AI is Finally Industrializing the $50T Physical Economy

Hi, I’m Kyle Kelly. Each week Line of Sight breaks down how AI, strategy, and revenue growth architecture turn complexity into leverage.

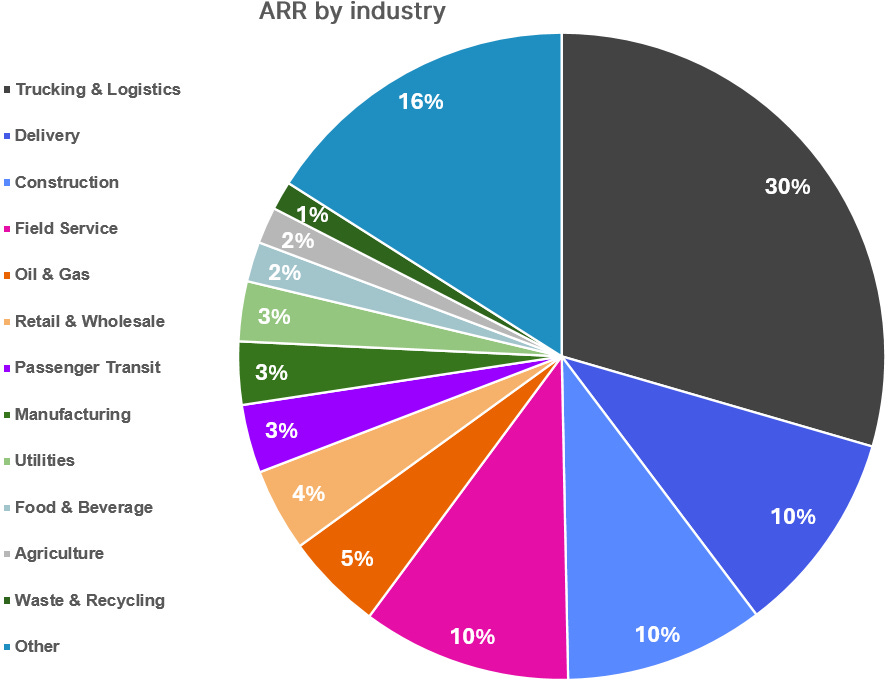

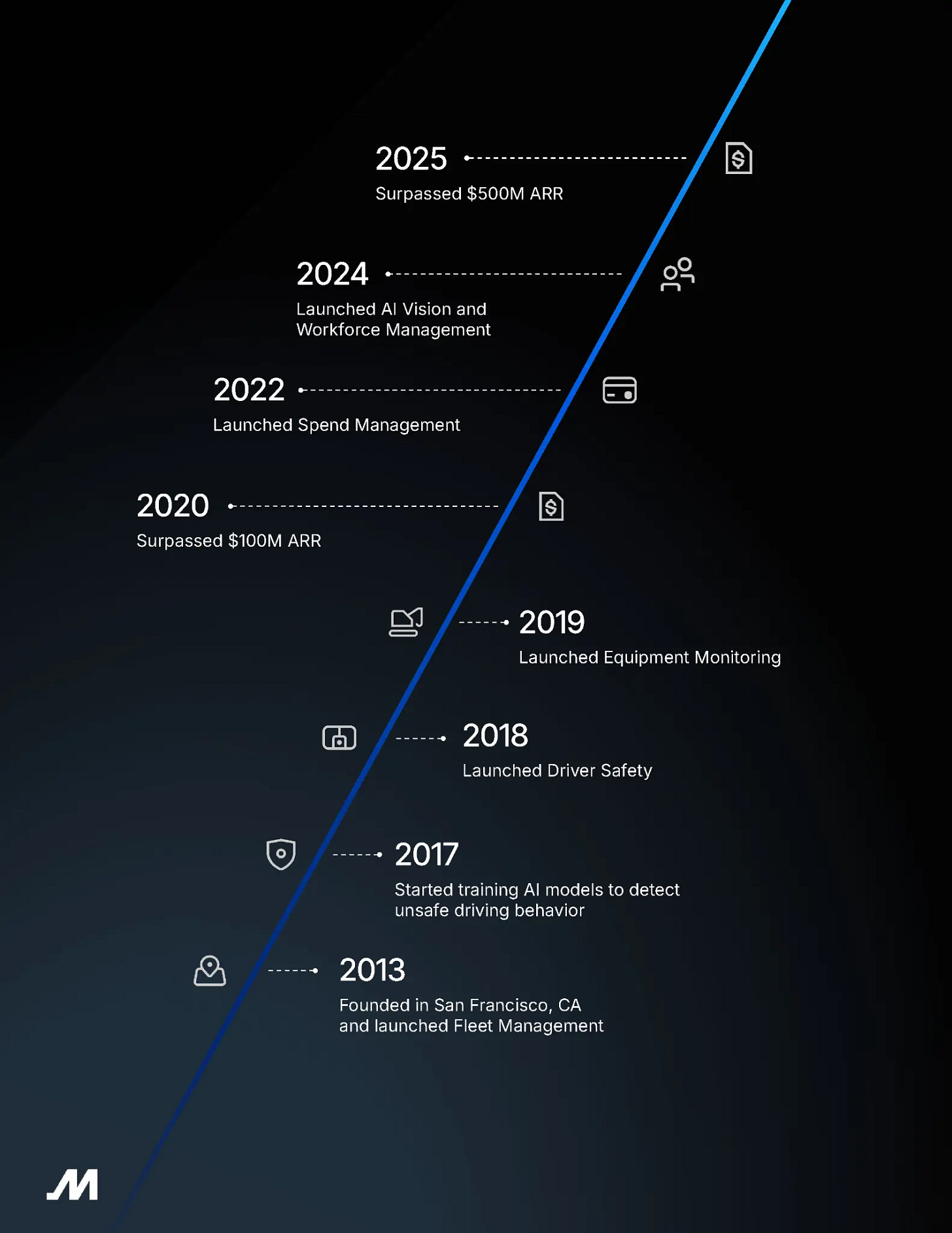

For the last two decades, software has been eating the world, but it has mostly been consuming the same meal: the knowledge economy. The physical economy (the industries that build, move, and power our world) has been left with the scraps. This massive half of global GDP, representing over $50 trillion in annual output, remains a frontier of operational complexity, held together by fragmented point solutions and manual processes. Motive Technologies’ recent S-1 filing for its IPO provides a detailed blueprint for how to build a category-defining company by systematically digitizing these foundational industries. It’s a case study in strategy, systems thinking, and the power of a full-stack approach to AI.

I wrote previously about why compliance is becoming one of the most durable moats in modern software. Motive is a live case study of that theory playing out at scale. This is a compliance moat that compounds across regulation, insurance economics, and data defensibility.

A System of Record for the Physical World

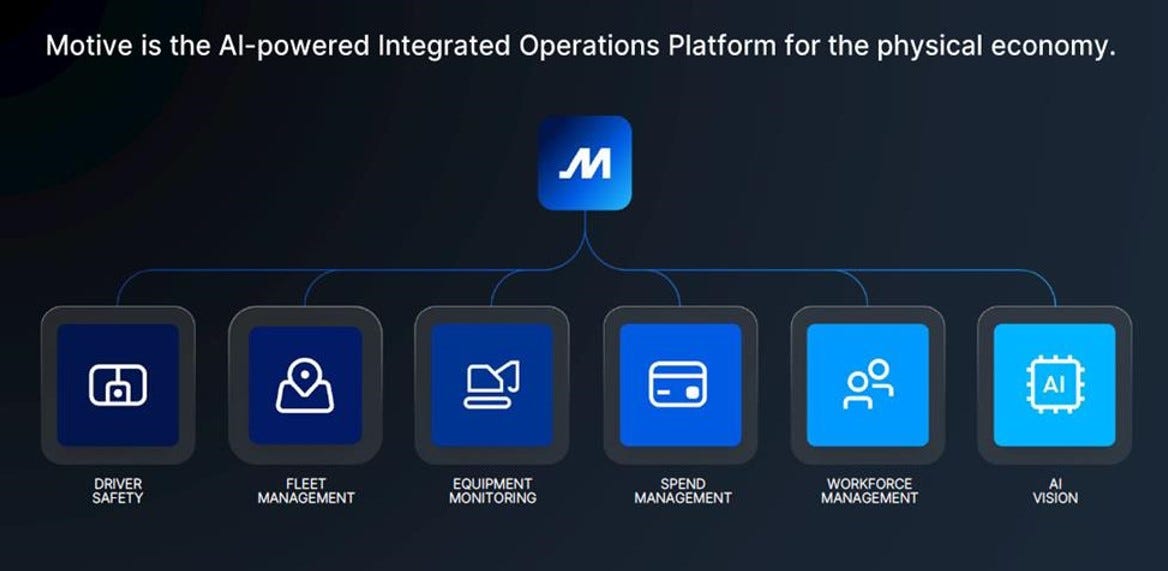

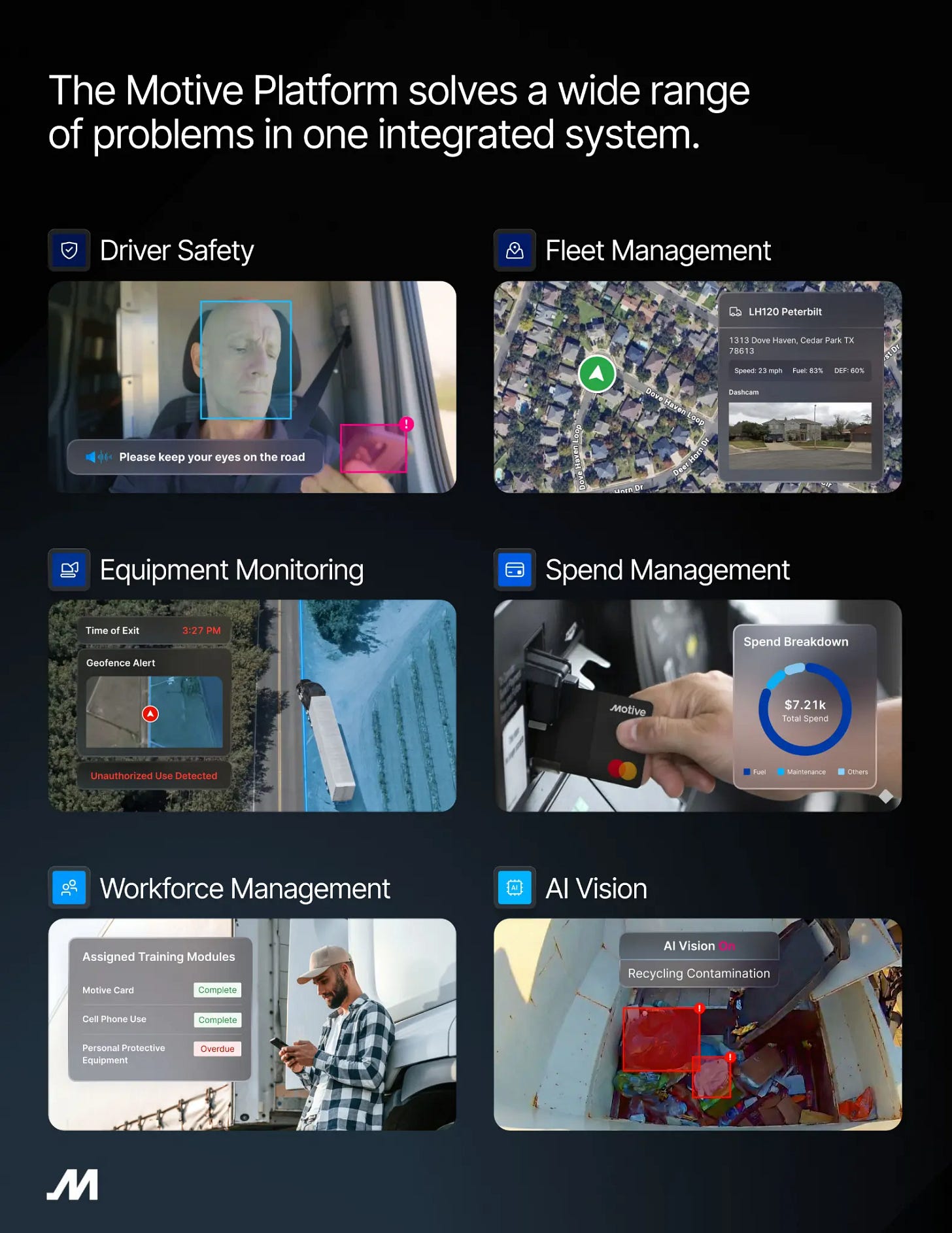

Motive’s core premise is that the physical economy is not just a large market, but a fundamentally different one that requires a new kind of platform. Unlike the natively connected knowledge economy, the physical world runs on disconnected assets: vehicles, equipment, and mobile workers. This creates immense challenges, from safety and labor shortages to rising costs and regulatory pressure. Motive’s strategy is to build the Integrated Operations Platform, a unified system of record that connects and automates a customer’s entire physical footprint (workers, vehicles, equipment, and spend).

The platform architecture is deceptively simple: six interconnected modules (Driver Safety, Fleet Management, Equipment Monitoring, Spend Management, Workforce Management, and AI Vision) that share a common data foundation. This integration is the key differentiator. Rather than forcing customers to stitch together point solutions from multiple vendors, Motive provides a single pane of glass for physical operations.

Data from the S-1 Filing

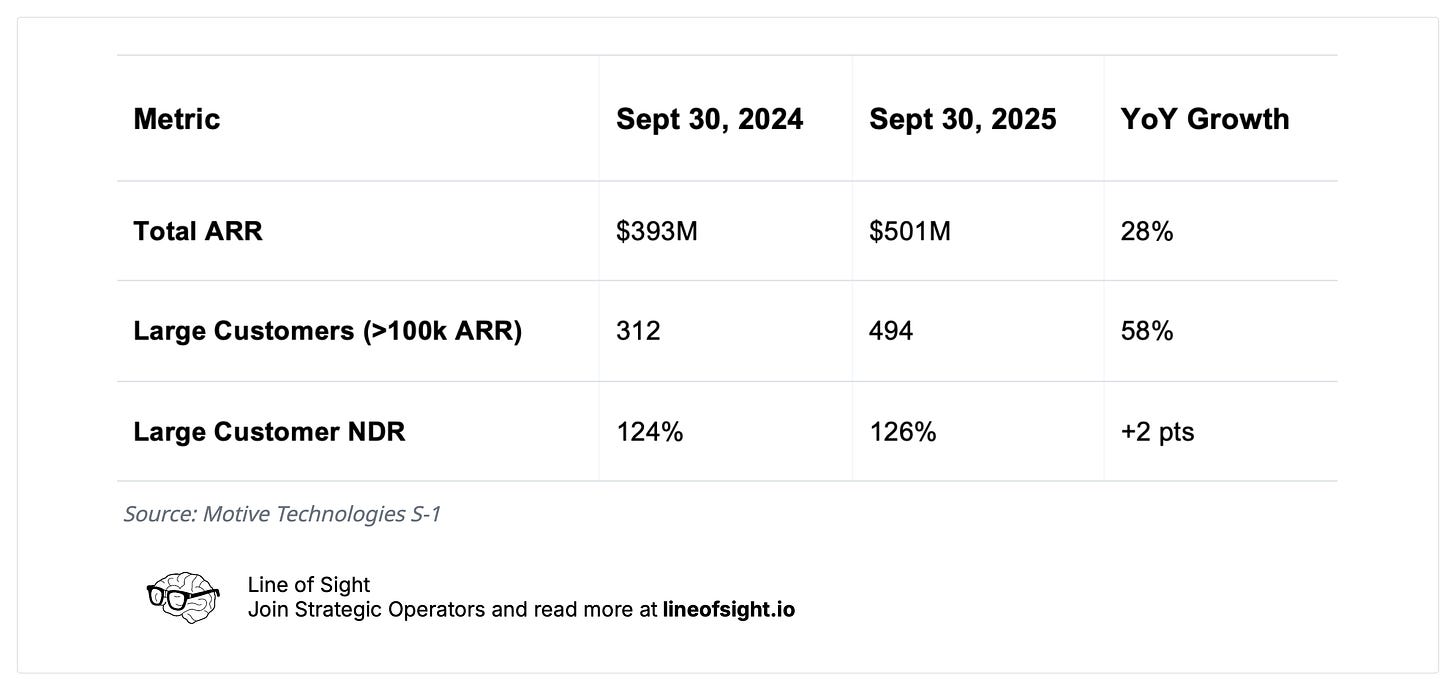

Motive’s S-1 is a testament to the scale of the opportunity and the effectiveness of their strategy. The company is not just growing; it is accelerating its hold on the most valuable customer segments. The filing shows a clear pattern of moving upmarket and increasing customer dependency on the platform.

As of September 30, 2025, Motive serves nearly 100,000 customers. The growth in high-value cohorts is particularly telling. Large Customers, those with an Annual Recurring Revenue (ARR) over $100,000, grew by 58% year-over-year, and their contribution to total ARR jumped from 28% to 37%. This demonstrates a successful land-and-expand model that deepens wallet share over time.

This growth is built on solving acute, expensive problems. The physical economy is grappling with systemic risks that directly impact profitability. For instance, fatal crashes involving large trucks surged 43% from 2014 to 2023, and commercial trucking insurance premiums have risen approximately 40% over the past decade. Simultaneously, organizations face a complex and ever-changing regulatory landscape. Navigating this environment is not just an operational burden; it is a strategic imperative where building an ELD compliance moat can become a significant competitive advantage. Motive’s platform directly addresses these issues, turning compliance from a cost center into a streamlined, data-driven function.

The AI-Powered Flywheel

Motive’s competitive moat is not just its software, but its full-stack, AI-powered system. The company has engineered a powerful, recursive flywheel that creates compounding value and raises barriers to entry.

This system is built on four pillars:

Proprietary Hardware: Devices like the AI Dashcam and Vehicle Gateway are purpose-built to capture high-fidelity, multimodal data (video, telematics, diagnostics) in harsh operating environments.

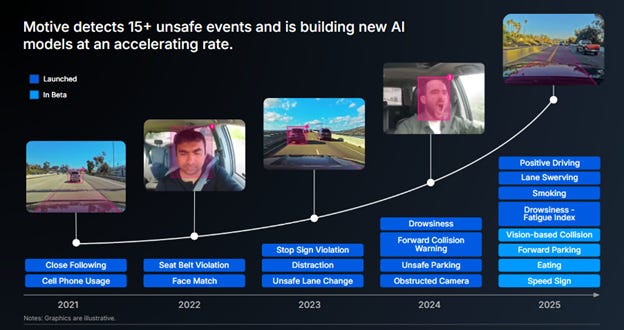

Massive, Labeled Data Corpus: Over one million connected vehicles and assets feed a continuously growing data set. A team of 400 full-time annotators labels tens of millions of events annually, creating a rich, structured foundation for model training.

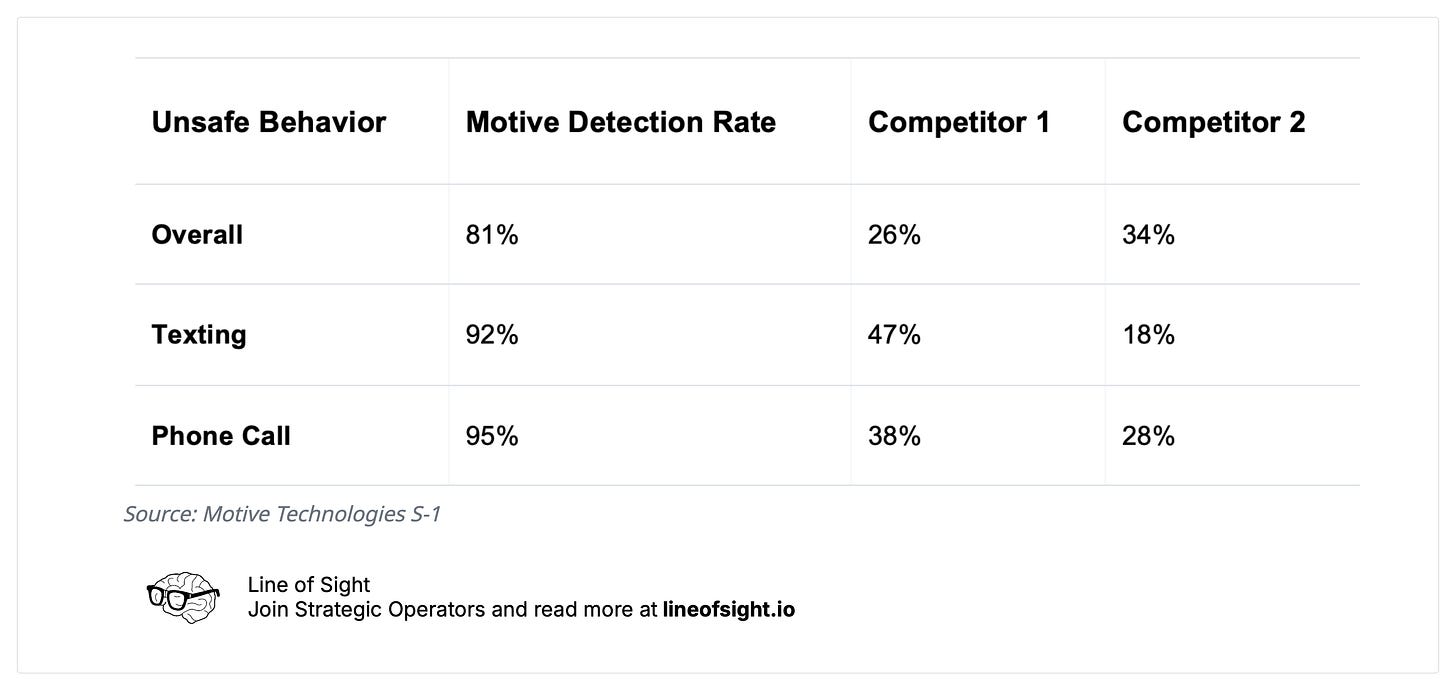

Purpose-Built AI Models: This data is used to train highly accurate, domain-specific AI models. A 2023 study by the Virginia Tech Transportation Institute found Motive’s AI Dashcam was 2-4x more effective at detecting unsafe driving behaviors than its competitors.

Low-Latency Validation: A tight feedback loop allows for rapid validation of model outputs, eliminating false positives and ensuring the high degree of accuracy required for mission-critical operations.

The risk in this model is not competition, but execution drag. Hardware margins compress, annotation costs scale non-linearly, and regulatory regimes evolve faster than product cycles. A full-stack moat only compounds if the company continues to translate model accuracy into auditable, insurer-grade outcomes. Lose that translation layer and the flywheel degrades into an expensive data operation. This is why compliance is not a feature, but the control plane.

This flywheel (where more customers lead to more data, which leads to better AI models, which in turn attracts more customers) is the engine of Motive’s defensibility. It’s a classic data network effect applied to the physical world.

How to Build for the Physical Economy

If your AI product can be removed without breaking a compliance workflow, you are not building a system of record.

Motive’s S-1 offers a clear playbook for founders and executives aiming to build enduring companies in industrial and vertical AI markets.

Target a Fragmented, High-Stakes Workflow: Identify a core operational process that is currently managed through a patchwork of disconnected point solutions. For Motive, this was fleet management and safety compliance.

Build the System of Record First: Before chasing sophisticated AI features, build the foundational data layer. Motive’s “Physical Operations Graph” unifies data from across a customer’s operations, creating a single source of truth and high switching costs.

Go Full-Stack to Control the Data Pipeline: In the physical world, data quality is paramount. Owning the hardware (the sensor layer) ensures the fidelity of the data feeding the AI models. This control over the end-to-end system is a powerful differentiator that pure software players cannot replicate.

Translate AI Accuracy into Economic Value: Don’t just sell AI; sell outcomes. Motive quantifies its impact in terms of accident reduction (80% average for AI Dashcam users), insurance savings (~25% for top quartile customers), and fuel and fraud savings ($175M+ in 2024). This makes the ROI tangible and the purchasing decision straightforward.

The Industrialization of AI

Motive’s IPO is more than a financial event; it’s a signal that the next wave of enterprise software will be built on the bedrock of the physical economy. The playbook is shifting from pure-play SaaS to integrated systems that combine hardware, software, and purpose-built AI. These are not just software companies, but systems companies. They are building the digital infrastructure that will automate and optimize the industries that form the backbone of our civilization.

Motive has provided the blueprint. Now, a generation of founders will execute on the same playbook.

I’m Kyle Kelly. Each week Line of Sight breaks down how AI, strategy, and revenue growth architecture turn complexity into leverage.

This is not investment advice.

References

Motive Technologies, Inc. (2025, December 23). Form S-1 Registration Statement. U.S. Securities and Exchange Commission.